Ethereum or Solana: Who Has the Most Potential?

We are living in a historic moment in the crypto market: Bitcoin is already 30% above its historic high of 2021, while Ethereum has not yet reached the same expected movement.

On the other hand, Solana is attracting attention with a significant appreciation, driven by its memecoin narrative.

But will this difference be sustainable in the long term? Is Ethereum dead? Let's analyze.

Use Cases

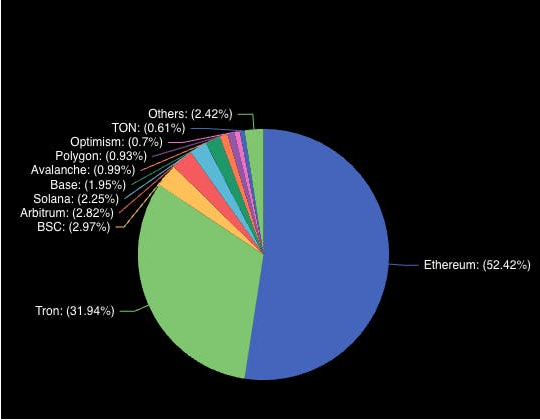

Ethereum continues to be a clear leader in real-world use cases. It is the largest smart contract platform, dominating sectors such as stablecoins, DeFi, and asset tokenization.

- Example: Would you trust Aave on Ethereum or an emerging solution on Solana more for borrowing or liquidity pooling?

- Stablecoins (market killer app): The overwhelming majority of them are mined on Ethereum, while Solana represents only 2% of this market. Did you know that in terms of the number of active users, stablecoins even surpass Bitcoin? This is because many countries use them as a direct substitute for the dollar - easier, faster and cheaper than doing a SWIFT.

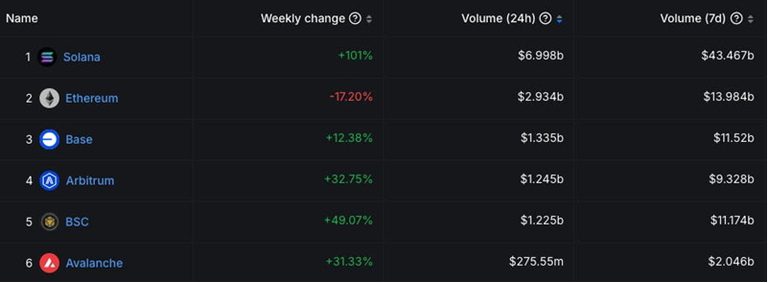

Solana is booming significantly, but much of that growth comes from high demand for memecoins. It has had an impressive volume of over $6 billion in the last 7 days, more than double that of Ethereum, Arbitrum and Base combined. But is this growth sustainable?

Sustainable Growth

Solana performs well in the short term, reaching close to its all-time high (ATH). But the question that remains is: is the use based on memecoins sustainable in the long term?

Meanwhile, Ethereum remains the basis for more robust innovations, such as tokenization of real assets (Real World Assets) and consolidated DeFi projects.

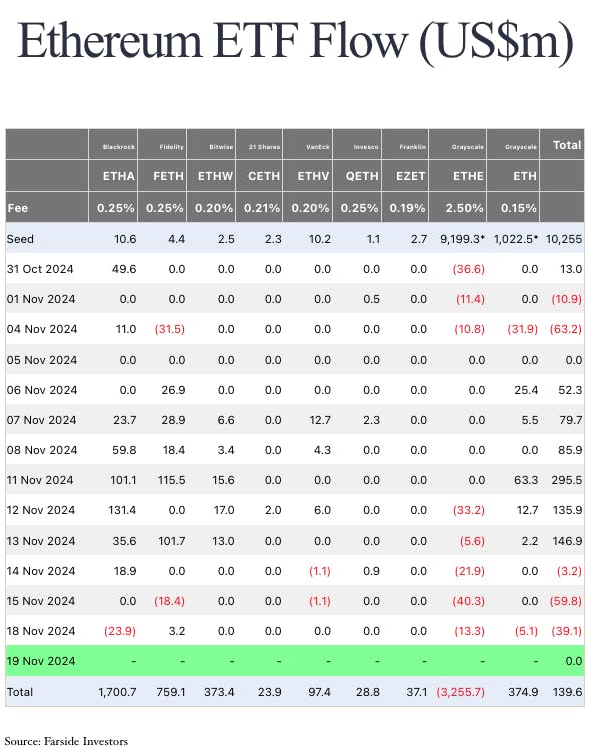

Furthermore, Ethereum ETFs have a positive capitalization, which shows the market's interest, especially institutional ones, in investing in them. BlackRock alone has a positive inflow of US$1.7 billion. Do they really not know what they are doing?

The Gas of Blockchain

On both Ethereum and Solana, the native token works as a kind of "oil" for the networks. When more people use the network, more tokens are purchased to transact and pay fees. Basically, $ETH and $SOL drive the economy of their respective blockchains.Today, Solana usage is on the rise, but Ethereum has more diverse and solid use cases, as we have seen in past cycles.

Why hasn't Ethereum caught up with $BTC and $SOL yet?

The ETHBTC chart below shows not the price of ETH or BTC in dollars, but the performance of one in relation to the other. When the candle is green, it means that ETH performed better than BTC, and when it is red, ETH is "losing" to BTC.

Historically, Ethereum tends to recover in post-halving Januarys. This happened in 2017 and 2021 when ETH outperformed BTC.

Even now, the ETHBTC chart shows that although BTC has led this start of the cycle, Ethereum is expected to gain traction soon. History points to a favorable movement, and ETH's recovery could be a matter of time.

Posted Using InLeo Alpha