GambleFi Portfolio | Weekly WINR Buy!

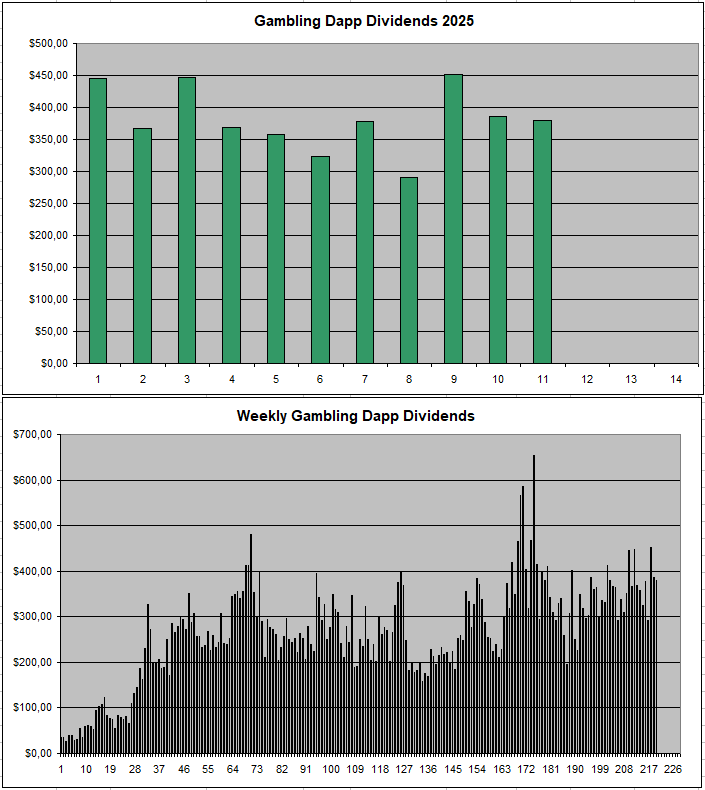

It was another good week for the GambleFi Portfolio raking in a passive 379$ in Dividends which equals an overall 42% APY on the portfolio value mainly thanks to SBET which remains my biggest holding. I still see a lot of potential in WINR Protocol which made me cost-average some more this week with an eye to increase my stake along the way to at least 400k WINR while I now hold 275k after the latest buy.

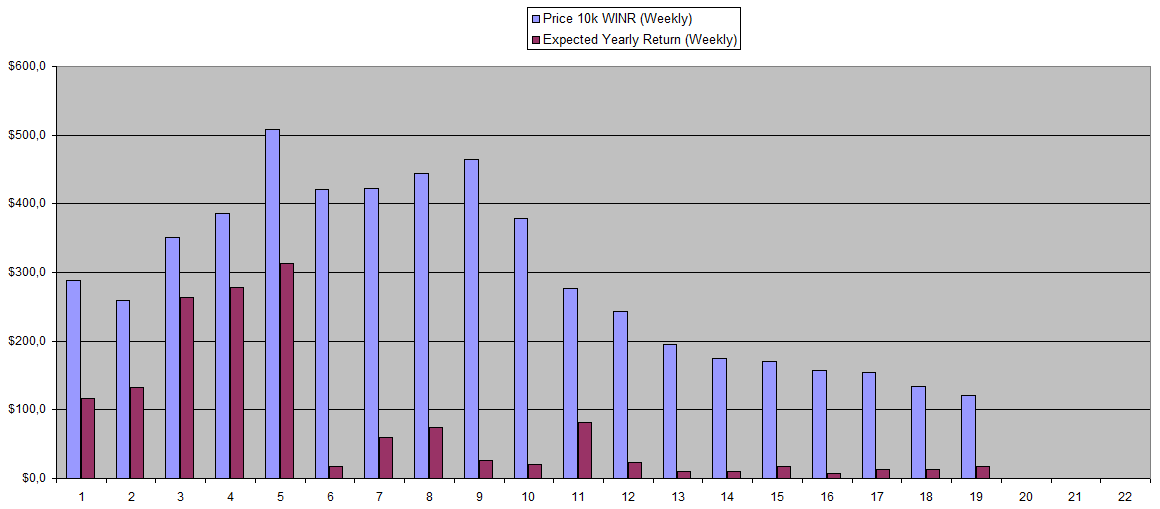

WINR Protocol

WINR is kind of struggling right now to acquire more users and volume but I really like what they build see the actual use-case especially if crypto would become mainstream. So at current depressed price levels, I can only really accumulate more with an eye to hold it for the long run, have it stakes and earn dividends which hopefully will go up if they start doing some proper marketing.

I bought 70k WINR extra still having around 5k sitting in my wallet from last week payig 820$ for it and I do plan to get it staked before Thursday. The dividends despite the low volume last week added up to 14.54% APY so it's not to hard to see them go up in an absolute way. However, currently only 18.57% of the total supply is staked.

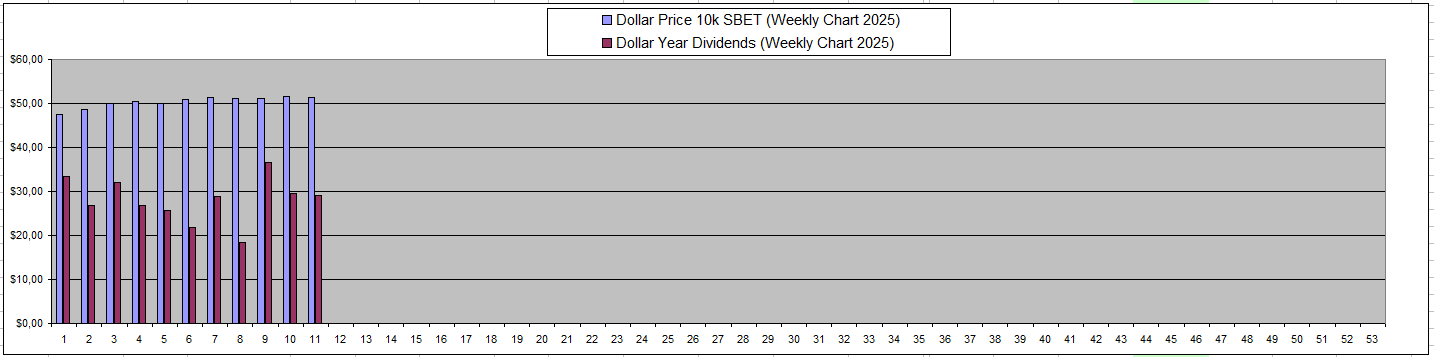

Sportbet.one (SBET)

In the last week, the APY was well over 50% which shows that the token price is undervalued and cheap. At the same time I understand that nobody is buying as it's a rather complicated undertaking having to buy from coinstore and needing your own EOS Wallet to have it staked. So I expect pretty much more of the same from SBET as this week things might be lower with less sports on the schedule due to the international break.

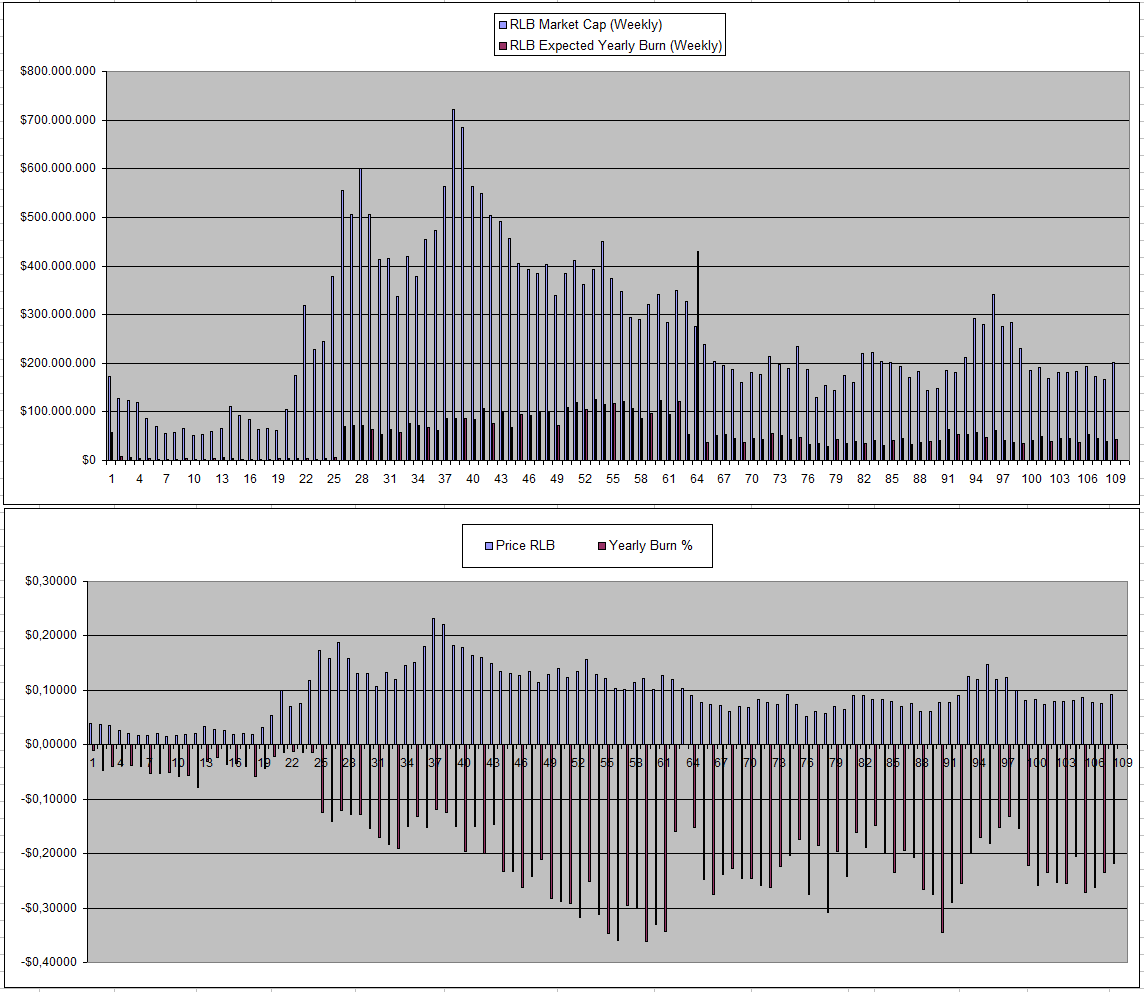

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB kind of pumped in price as in the end there is only so much to be burned. However with the price increase back to 0.09$ it's harder to burn RLB unless the revenue goes up which isn't happening yet. Last week, the burn was at 21.7% Yearly and if it would go down to 15% due to a further price increase I would likely start selling a bit.

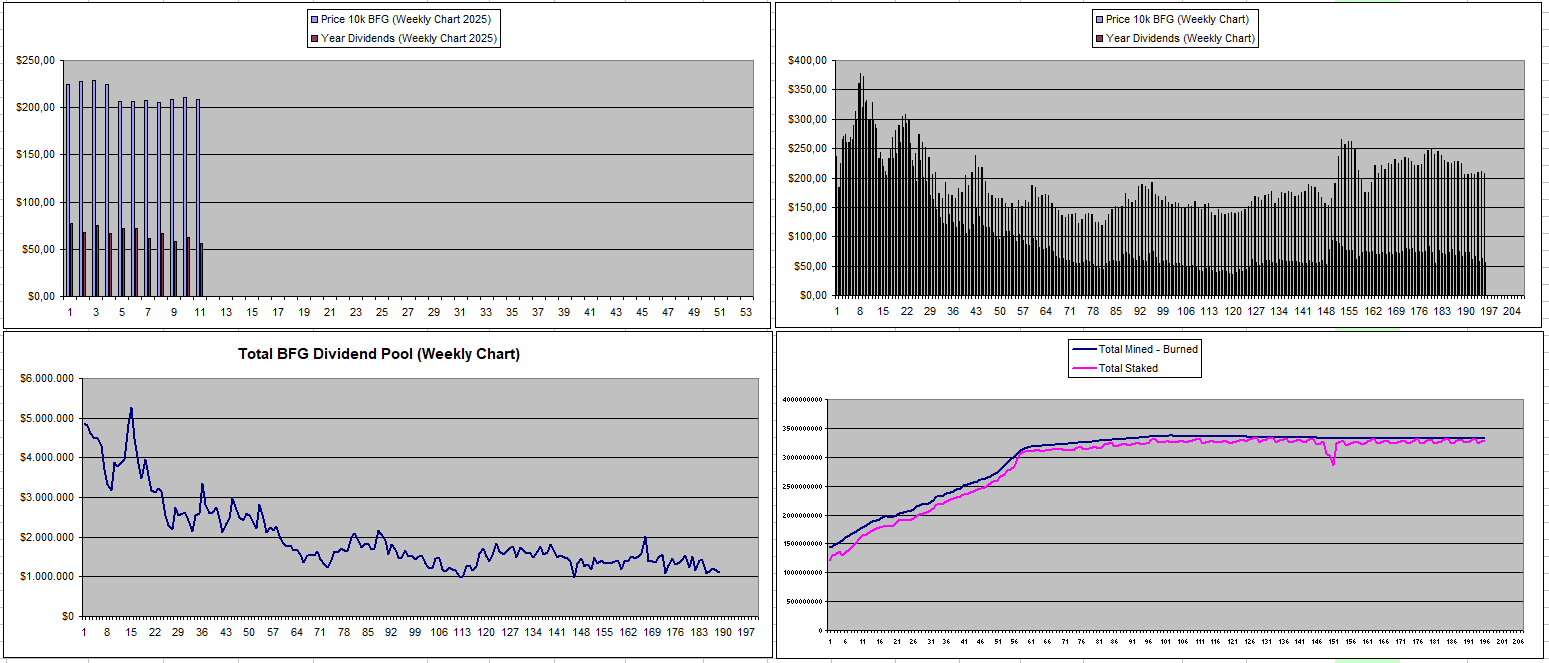

Betfury.io (BFG)

BFG ahead a rather disappointing week at 54.36$ in Dividends which equals 27.12% APY. This while it used to be a stable 70$ in the past. The price however continues to be quite stable but I would not be surprised to see it go down at some point if the dividend pool doesn't increase.

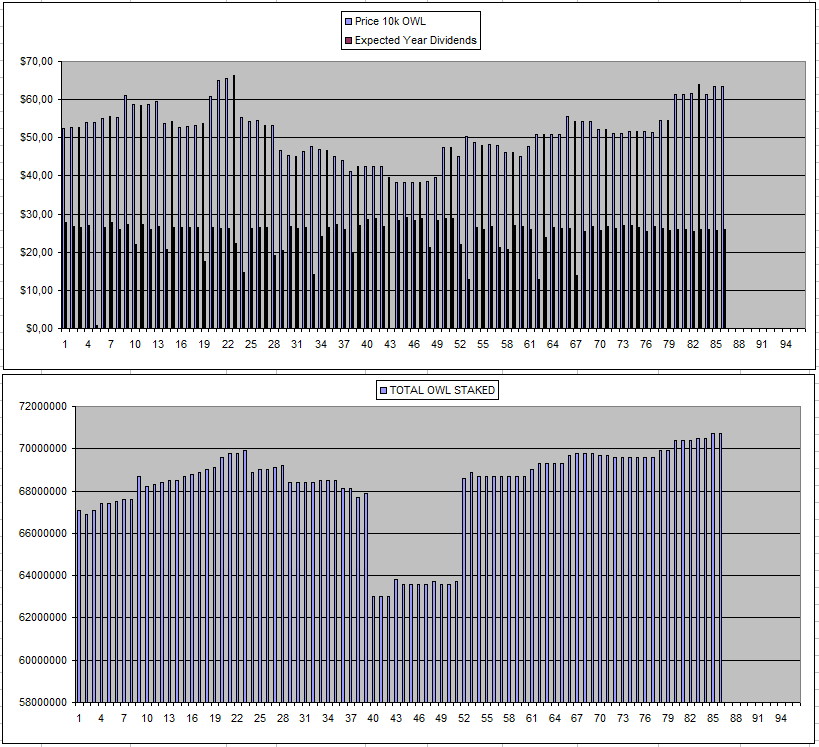

Owl.Games (OWL)

Once again I stayed jut under 30$ in Dividends for my OWL stake which is still very solid at 41% APY. It's been a good ride so far and I earned 73% of my original investment back after 86 weeks.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/01/2025 | 600k | 3179$ | 2731$ | 29.46$ | 2021.79$ | 63.59% | +1573$ |

| 14/01/2025 | 600k | 3179$ | 2729$ | 30.75$ | 2052.54$ | 64.56% | +1602$ |

| 21/01/2025 | 600k | 3179$ | 2889$ | 30.31$ | 2082.85$ | 65.52% | +1793$ |

| 28/01/2025 | 600k | 3179$ | 2887$ | 29.58$ | 2112.43 | 66.45% | +1820$ |

| 04/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2142.50$ | 67.39% | +2212$ |

| 11/02/2025 | 600k | 3179$ | 3249$ | 30.07$ | 2172.57^ | 68.34% | +2242$ |

| 18/02/2025 | 600k | 3179$ | 3271$ | 29.37$ | 2201.94$ | 69.26% | +2294$ |

| 25/02/2025 | 600k | 3179$ | 3387$ | 29.81$ | 2231.75$ | 70.20% | +2440$ |

| 04/03/2025 | 600k | 3179$ | 3247$ | 30.05$ | 2261.81$ | 71.14% | +2329$ |

| 12/03/2025 | 600k | 3179$ | 3361$ | 29.64$ | 2291.44$ | 72.08% | +2473$ |

| 18/03/2025 | 600k | 3179$ | 3357$ | 29.98$ | 2321.42$ | 73.02% | +2499$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

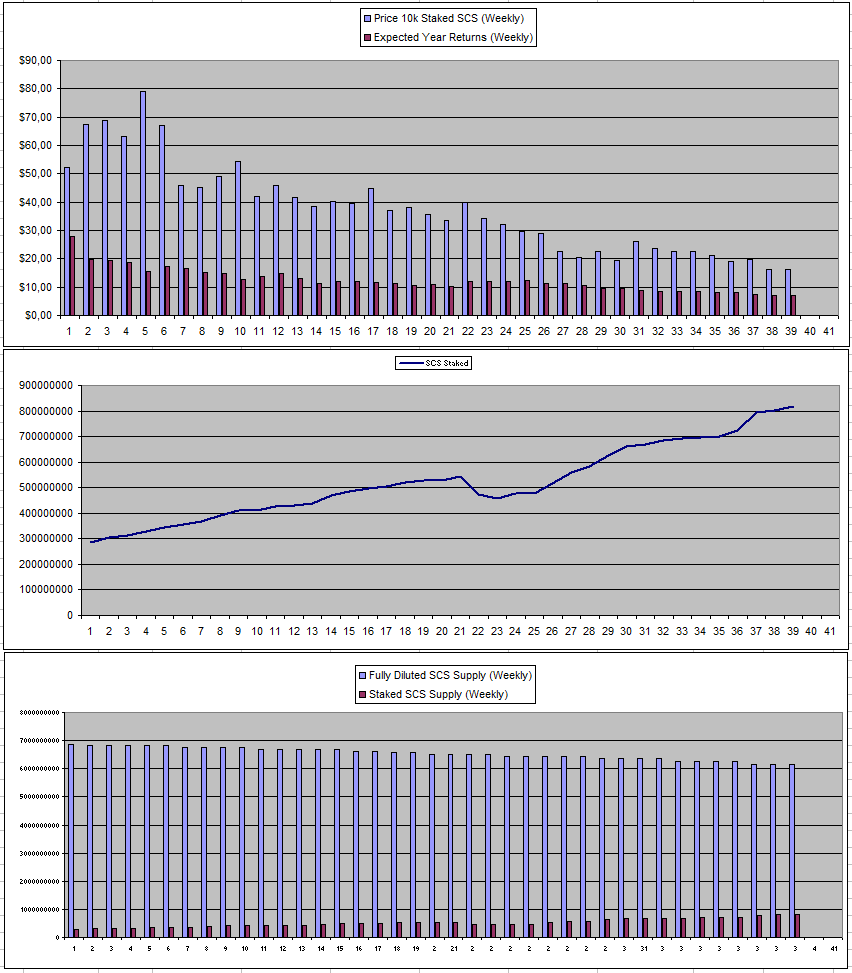

Solcasino.io (SCS)

I'm still waiting for the price of SCS to go lower before potentially buying more but at the same time I kind of fear a fundamental change where for example they would increase the USDC Pool which pumps the price and leaves me behind. At the same time only 13.26% of the supply is staked in the USDC Pool which is increasing making the earnings go down a but each week. So I kind of trust that the price will continue to go down bit by bit as more SCS is mined by NFT holders. At the same time, this price range with the eye on the longer term is starting to get really attractive and I'm also glad I kept my investment really small so far.

vBookie (NFTs)

There is still no update on the February earnings so I more and more consider this project as dead. There also haven't been any buys or sells in the last week.

| Last Week | This Week |

|---|---|

|  |

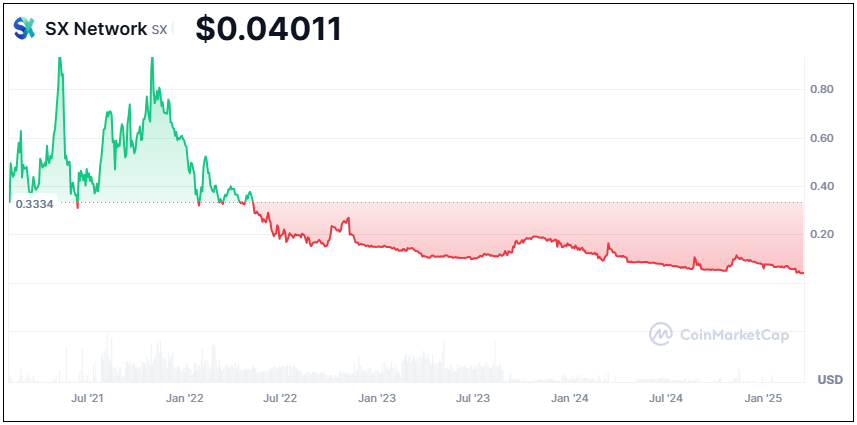

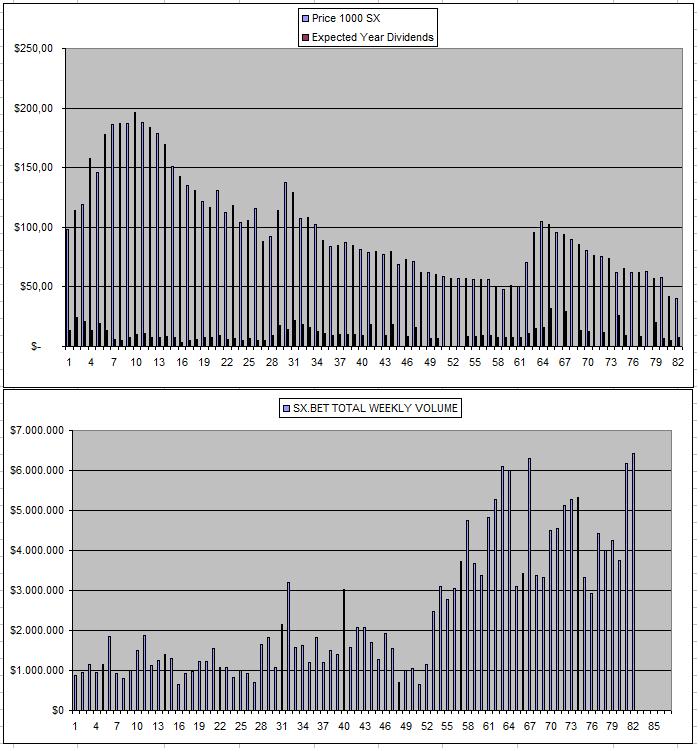

Sx.Bet (SX)

The Price of SX continues to drop week by week even though the volume is picking up.I also got a bit higher dividends but it might be a case of double divindes and no release next week which means they might have gone down. The long-term chart also just doesn't look pretty and at a 40 Million fully diluted valuation and no real revenue as the fees are turned off it feels like there is more downside on the horizon.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +56% APY |

| Betfury.io (BFG) | +27% APY |

| Owl.Games (OWL) | +41% APY |

| Sx.Bet (SX) | +18% APY |

| WINR Protocol (WINR) | +14% APY |

| Solcasino (SCS) | +44% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip.

Personal Gambling Dapp Portfolio

I earned 379$ in dividends last week for holding and staking 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 28.5k SX | 275k WINR | 500k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using INLEO

$379 in weekly dividends isn't a small amount. You've built a good portfolio.

Yeah, it's the result of a 220+ week grind starting low and slowly cost-averaging my way into these coins and re-investing some of the earnings. Given enough time, the ball really starts rolling and since the coin values are backed up by actual revenue there are lower swings which acts in a way that it balances my overall crypto portfolio. The weekly earnings also give some piece of mind.

Still hard for me to understand can u tell me out something about this ??

Gamblers Gamble, The House Always Wins in the long term, Owners of the casino (those who hold coins and stake them) get part of the revenue. It's basically as simple as that. I hope that explains it.