GambleFi Portfolio | RLB Finally Pumping!

It was another interesting week in the GambleFi space with some updates and development in the WINR ecosystem while RLB finally is seeing a pump.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

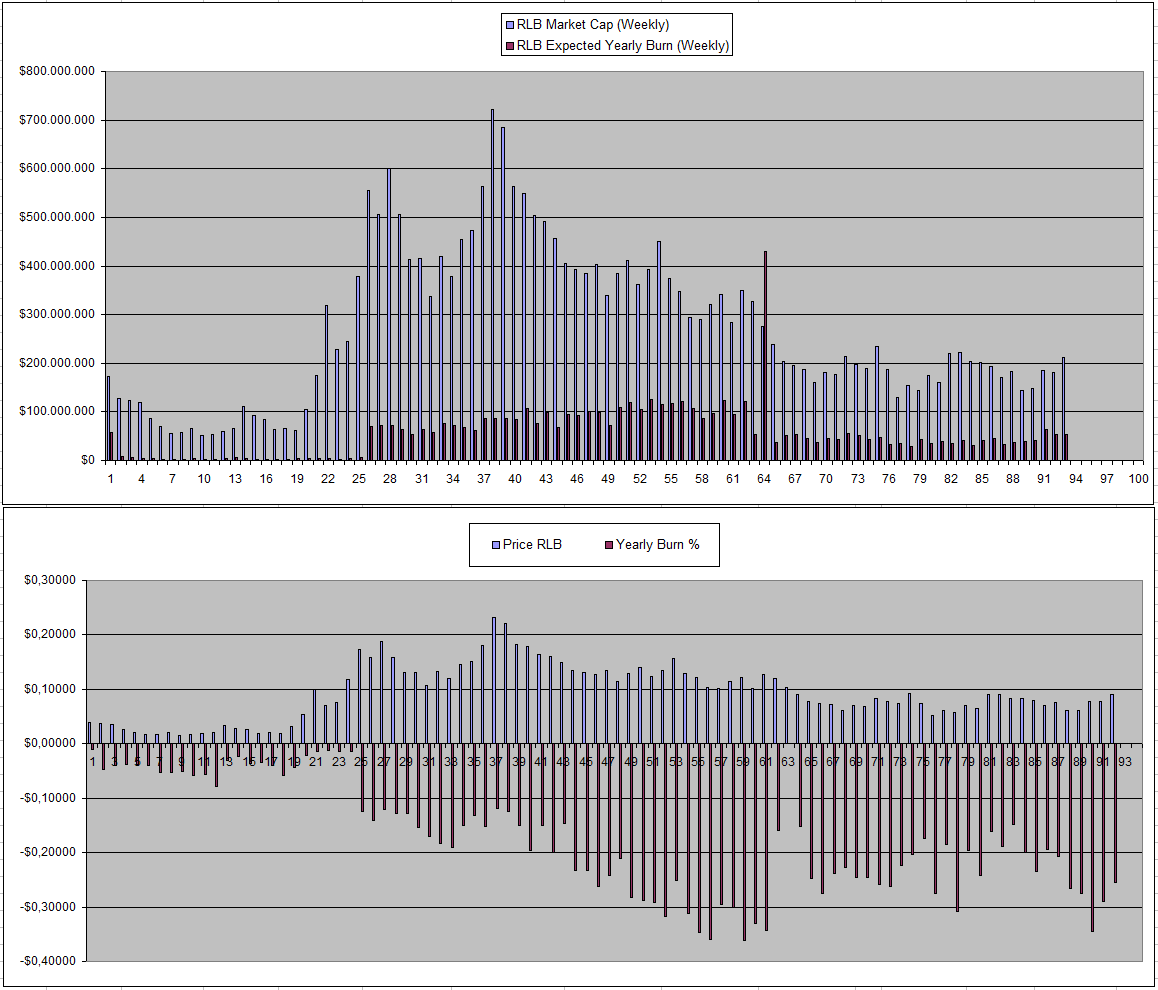

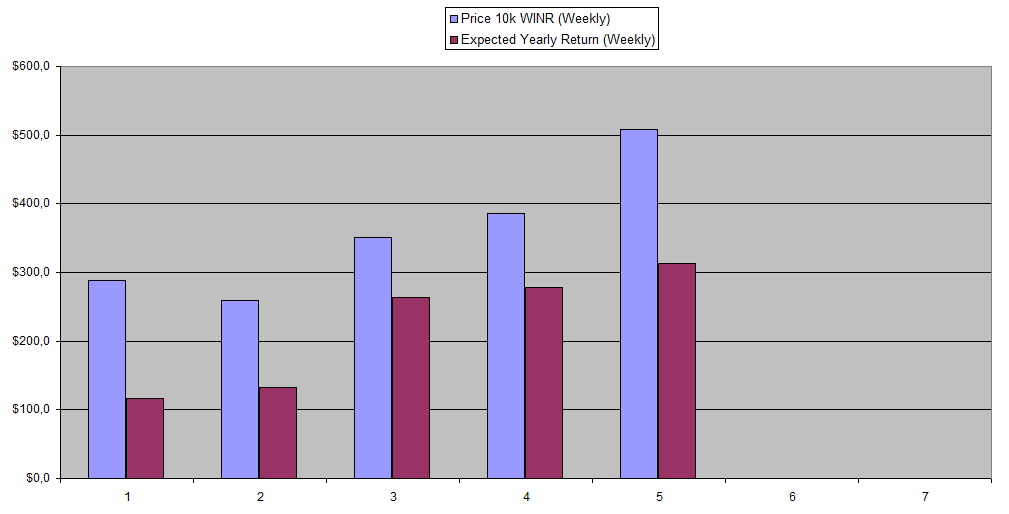

For Rollbit, there were always 2 options which were that either they were faking their numbers and scamming everyone making it a matter of time for there to be an FTX scenario, or there was going to be a pump as their tokenomics are by far the best out of any crypto token out there. All tokens are 'in circulation' (knowing Rollbit themselves likely hold more than half of the supply) while the yearly burn rate averages somewhere between 20% and 35% of the supply.

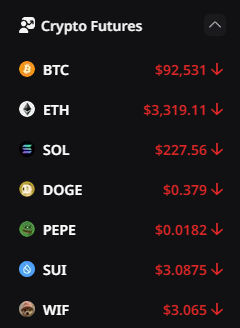

It now looks like either a big seller is done or more people are just willing to take the gamble. Looking at the Revenue numbers it can be seens that the Leverage trading revenue has gone up of which 30% gets burned.

As the price of RLB increases, the burn naturally will slow down and I expect something of a more permanent repricing from 20% yearly burn expectation to somewhere around 15% on average which is still high.

I managed to do quite well to buy RLB with the money I got from selling my NFTs and the moment the burn reaches below 15% I will likely start taking some profit.

I mainly am using the Rollbit Platform now to take some small crypto leverage trading positions which is plenty of fun. They also have a very big selection of coins to gamble on.

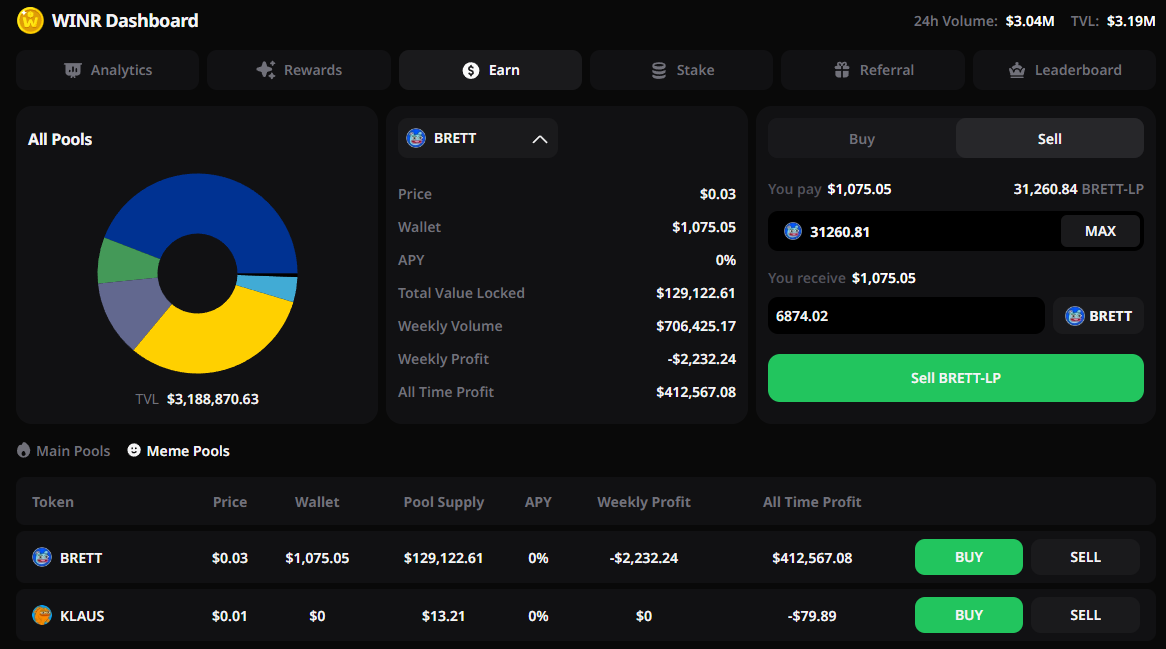

The BRETT liquidity pool is still broken as my position of 10k Brett that I put in should be well worth over 12k while it shows just 6874. The devs are aware of the issue and for weeks now have claimed that 'it will be fixed soon'. They are also looking to list more memecoin liquidity pools with the aim to give those coins a direct use case while feeding on the communities to possibly get an inflow of gamblers to the platform. I did find it quite weird that the 2nd Memecoin they listed is KLAUS as from the info I gathered around that is that it has most of the supply held by insiders probably waiting to dump. There also isn't really a supply in the pool and I kind of fear this will quickly become a dead weight. I hope they will over time remove some of the pools that don't get any traction.

Next up will be a Solana integration while they will be used from what I understand by Sx.bet who will launch a casino on their chain.

| Date | Brett Pool | Brett Staked | Brett Now | Earnings |

|---|---|---|---|---|

| 12/11/2024 | 186582$ | 10000 BRETT | 11604 BRETT | +1604 BRETT |

| 19/11/2024 | 159763$ | 10000 BRETT | 6878 BRETT | -3122 BRETT *** |

| 26/11/2024 | 129122$ | 10000 BRETT | 6874 BRETT | -3126 BRETT *** |

(*** Caused by bug which should be fixed)

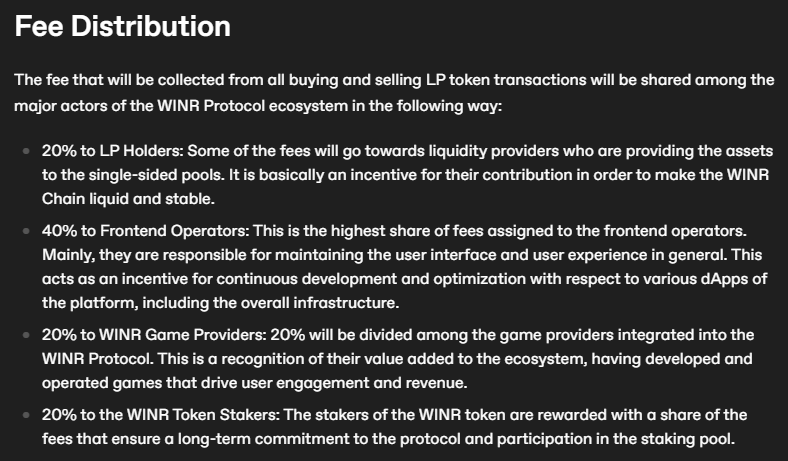

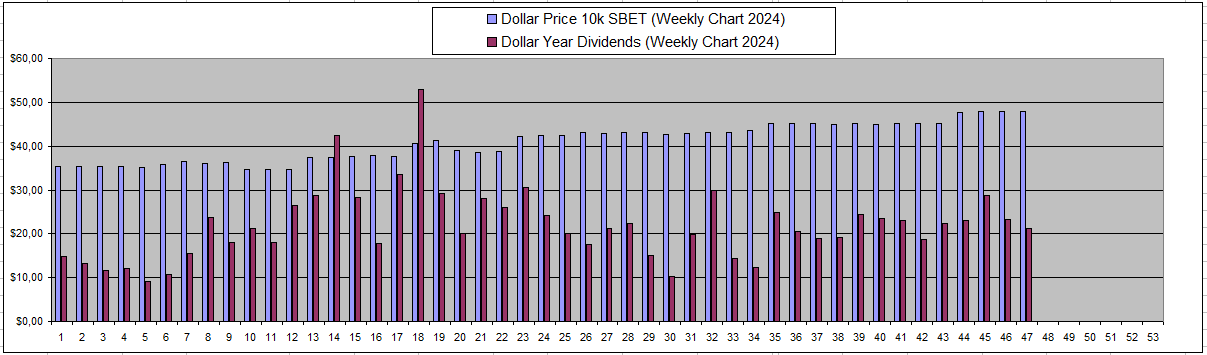

I also learned that the previous revenue share payout percentages no longer count and that now only 20% goes to WINR Stakers and only 20% to Liquidity providers which both feel like on the low end. At the same time, if game providers get a big share that much more encourages them wanting to promote and advertise. So it might be one of those cases where WINR Stakers get a smaller piece (20% instead of 45%) or a larger cake.

The vWINR integration also continues to take a lot of time and it sucks that those who took most risk on the old platform kind of get screwed over as they didn't get a share of the early revenue made on he WINR Chain.

Overall I'm quite happy that I managed to position myself by closely following and tracking WINR the past 40 weeks with a considerable investment of 150k WINR at an average price of 0.032$. However, with only 14.3% of WINR Staked, the vWINR yet to be bridged over and only 20% of revenue going to WINR stakers, I don't see it as crazy undervalued now. A fair value I would say would be somewhere around 10%-20% APY given that there is always a smart contract and regulatory risk. Last week the APY was 61.58% but I do expect that this will continue to go down especially if case the WINR Price continues to go up.

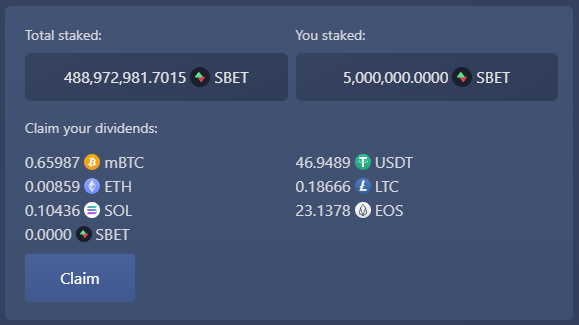

Sportbet.one (SBET)

I did manage to succesfully withdraw the pBTC / pLTC / pETH that I had build up over time. Now I won't claim my tokens until they are switched to the new non-ptoken format. The dividends once again were ok without real growth and it's nice to also earn SOL now.

vBookie (NFTs)

Still no real updates on vBookie but the floor price of NFTs seems to have gone up quite a bit. There is still nothing really that I can claim and the hope is that next month the bookie actually shows some profit.

NFT Floor Price Last Week

NFT Floor Price Now

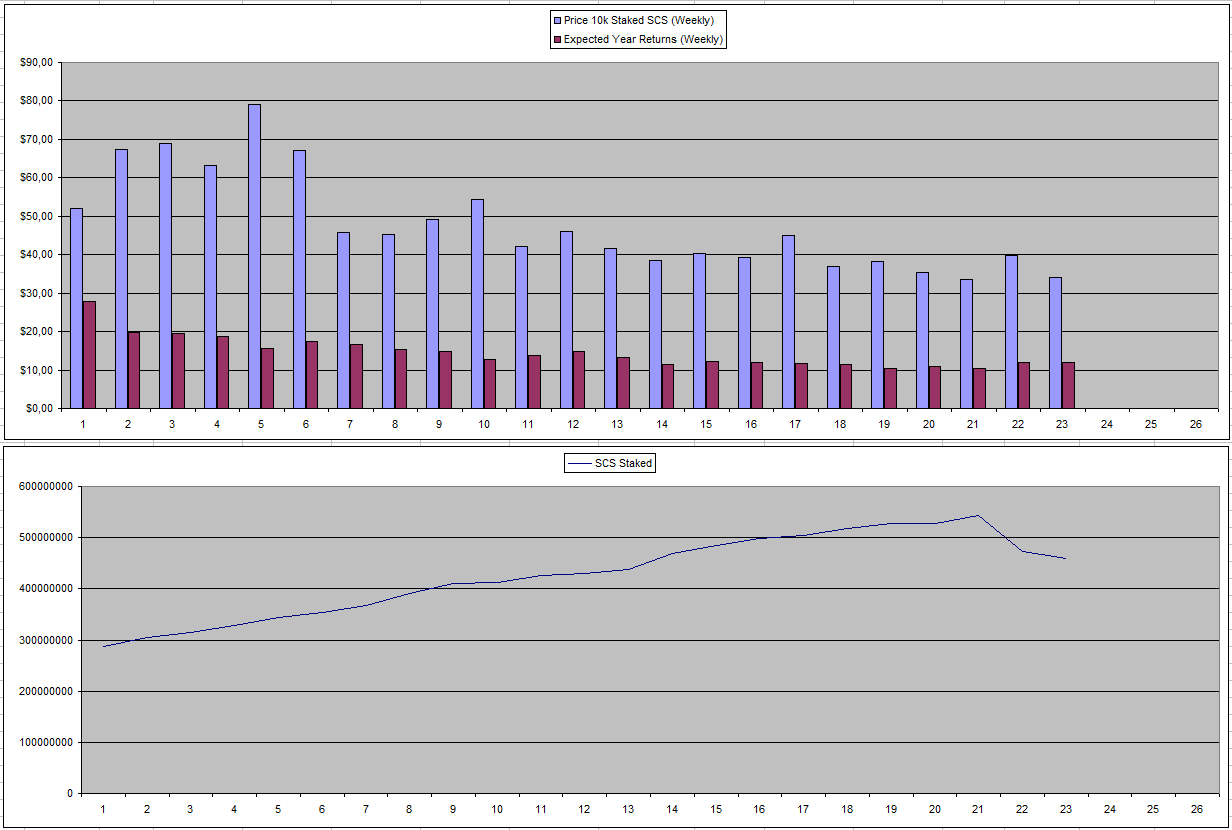

Solcasino.io (SCS)

The SCS price continued to go down and I guess the only real way to get it going up is if they increased the USDC pool which so far hasn't really happenend. I must say that it is getting in a range where I'm starting to get tempted to add a bit to my bag as it is getting below a 20 Million Market cap. The good things is that the team looks valid wanting to make SCS work while it's the most known casino on Solana. At the same time, the NFT's are taking away part of the SCS value and solcasino from what I understand runs on OWL Dao which I don't trust as much.

60k SCS now is worth around 170$ and weekly gives 1.38$ worth of weekly dividends. I'm going to try to get that up to 5$ in case the price of SCS drops a bit more. It looks like quite some got unstaked while at the same time only 7% of the max supply is staked currently.

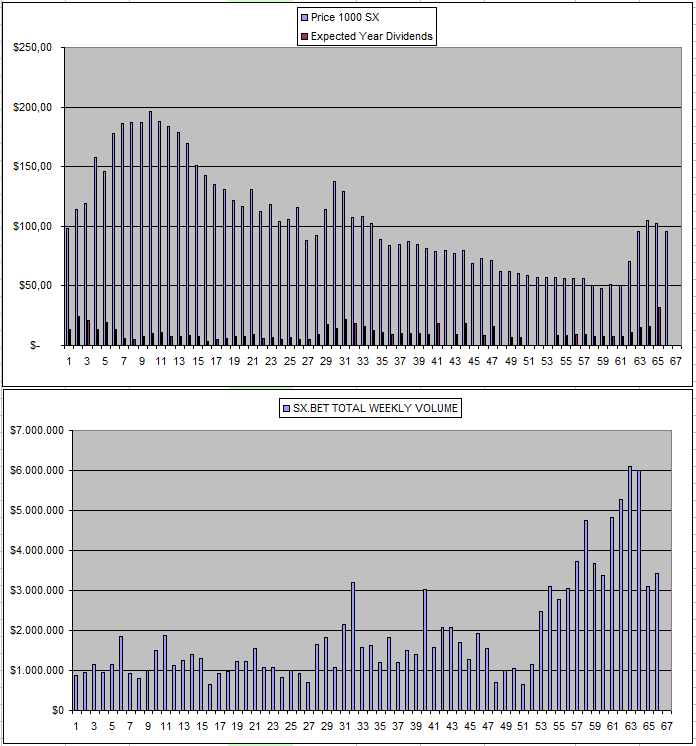

Sx.Bet (SX)

I got double dividends last week so none cam now as expected. The price of SX is coming down a bit again and I don't really see an instant change why there all of a sudden would ge good profit shared from the platform. It still feels like everything is in the early adoption stage while I do like what they offer as a product.

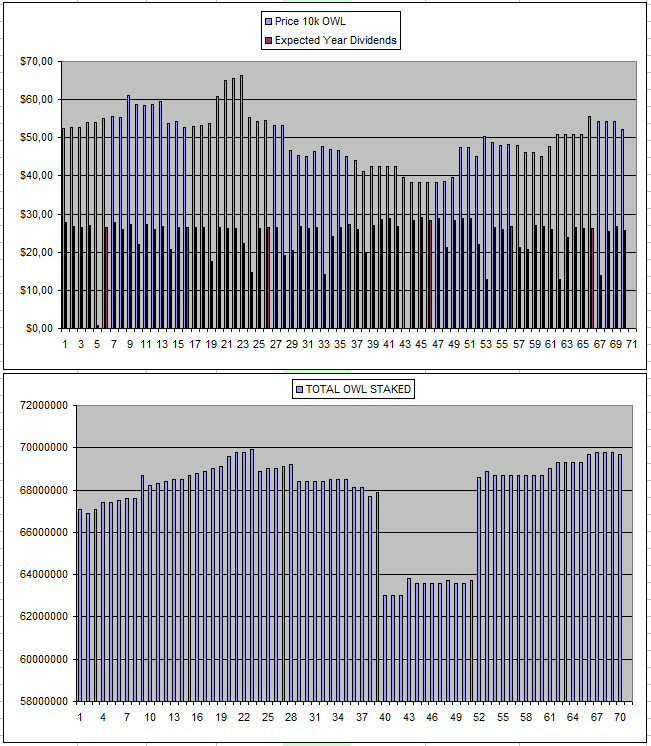

Owl.Games (OWL)

As usual nothing really happened for Owl and the dividends continue to come at a reliable pace. I amost have enough funds build up to do another cashout which derisks the initial investmet that I made 70 weeks ago which has been paid back for 57%+ by now.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 12/11/2024 | 600k | 3179$ | 2879$ | 29.35$ | 1778.34$ | 55.94% | +1478$ |

| 19/11/2024 | 600k | 3179$ | 2879$ | 30.86$ | 1809.20$ | 56.91% | +1509$ |

| 26/11/2024 | 600k | 3179$ | 2766$ | 29.66$ | 1838.86$ | 57.84% | +1425$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

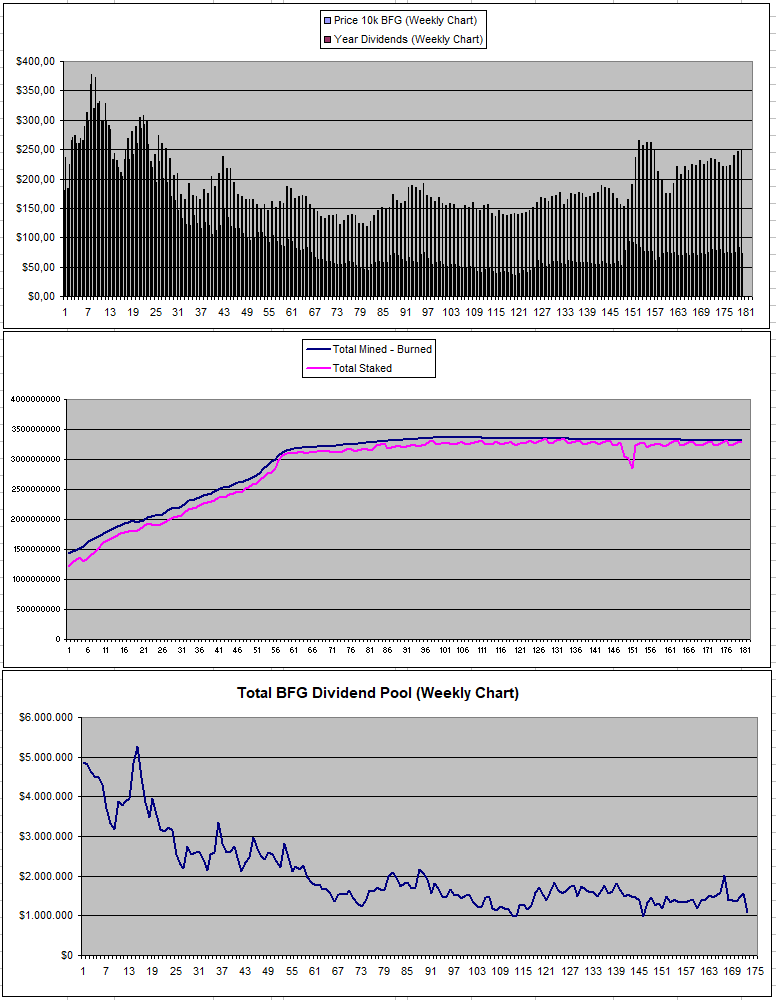

Betfury.io (BFG)

It was a dissapointing week for BFG as the revenue went back to 70$ and the reward pool is getting closer to below 1 Million.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +44% APY |

| Betfury.io (BFG) | +30% APY |

| Owl.Games (OWL) | +49% APY |

| Sx.Bet (SX) | +17% APY |

| WINR Protocol (WINR) | +61% APY |

| Solcasino (SCS) | +35% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

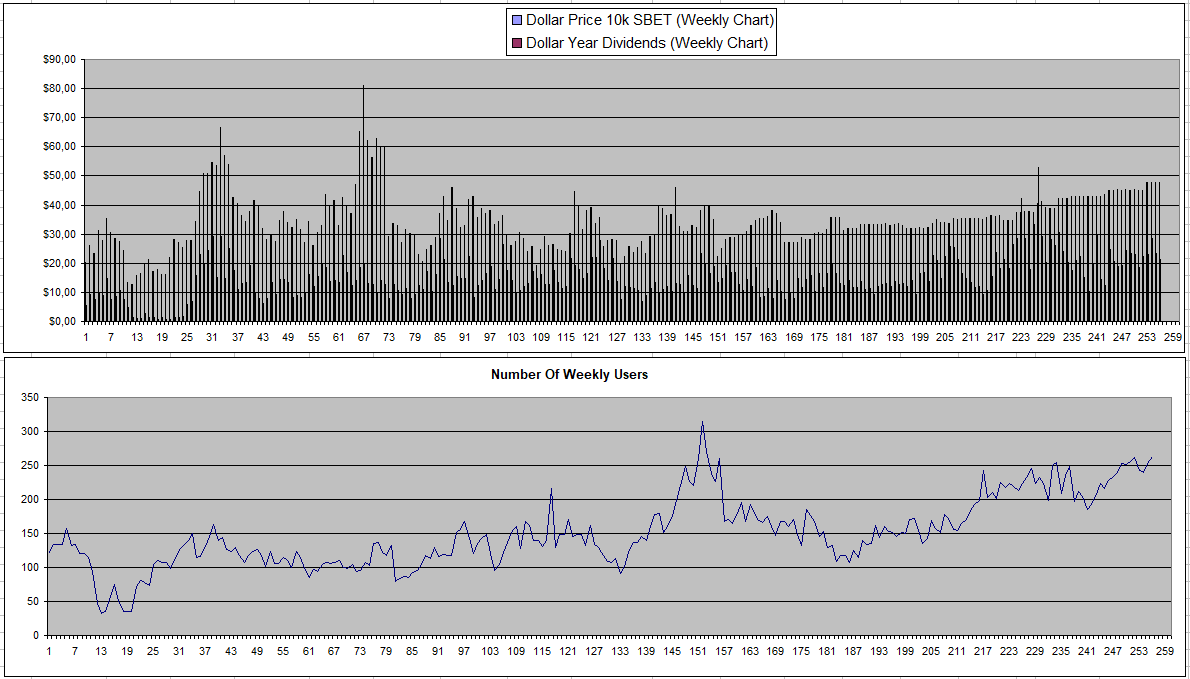

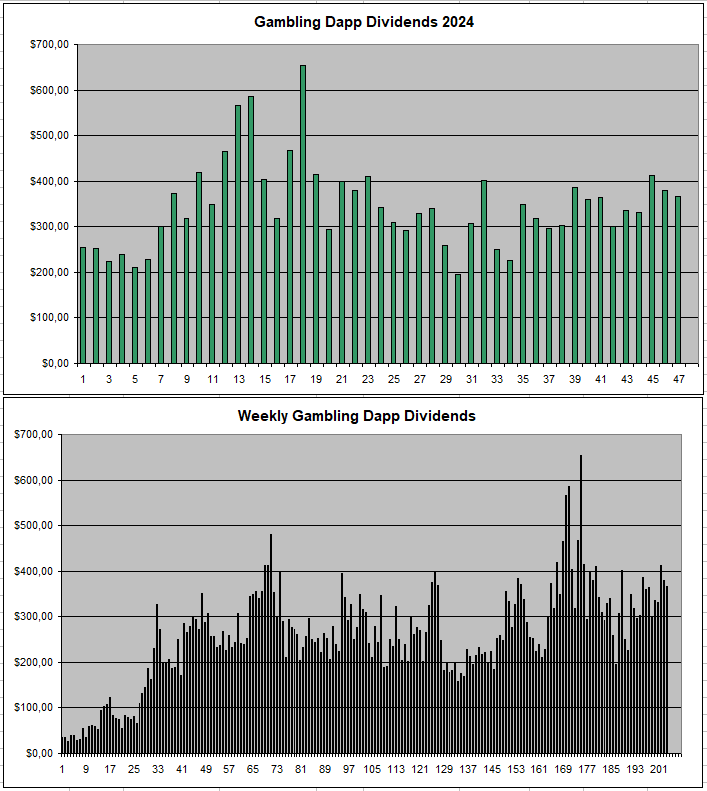

Personal Gambling Dapp Portfolio

Last week I managed to earn 365$ in passive earnings for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha

See a some people on X are super hyped about Winr lately.

The price going up always helps to create hype. The reality though is that WINR looks like a legit Project and could become the backbone of on-chain crypto Gambling. I'm glad that I did an initial test buy (paying too much) early on to study and ramp up the investment near the lows.

It's going to be interesting to see where it goes, should be fun!

Yeah watched Jesse Eckel vid about it on Youtube and see why people say it has potential.

How do you see RLB? I know not everything is on chain there so its hard to verify all data right?

If RLB has no shady business going on, I would say it's the buy of the century. Right now you just feel that not everything is 100% legit. The price action kind of feels manipulated. The previous pump got them a ton of attention and possibly new users. I assume they used that to dump some of their bags. Now it feels like the same scenario where a big pump would help to get more attention again bringing in more users. The big question is how high they will pump it this time. I'm mainly just looking at the RLB yearly burn % as a reference to buy or sell.

Will be interesting to see what happens with them this bull.

It's crazy to me how these gambling sites have managed to create crypto ecosystems like that.

I would argue it's actually one of the use cases that is most suited for Crypto. GambleFi feels heavily underrated in the crypto space and few are actually talking about it while it's one of the only sector with recurring customers and real revenue that adds up.

!BEER

View or trade

BEER.Hey @costanza, here is a little bit of

BEERfrom @thehockeyfan-at for you. Enjoy it!Learn how to earn FREE BEER each day by staking your

BEER.I noticed the Betfury reward pool showed BTC as a negative - any idea why that be as it's reduced the daily reward from staking I think.

I went to check just now and it indeed shows negative. I guess some gamblers who used BTC managed to win an it will count as 0 toward the dividend claim until it's back in the green. That also shows when I would claim right now. Let's hope it can get back in the green sooner than later.

Thanks for the response. I figured it might be something like that.