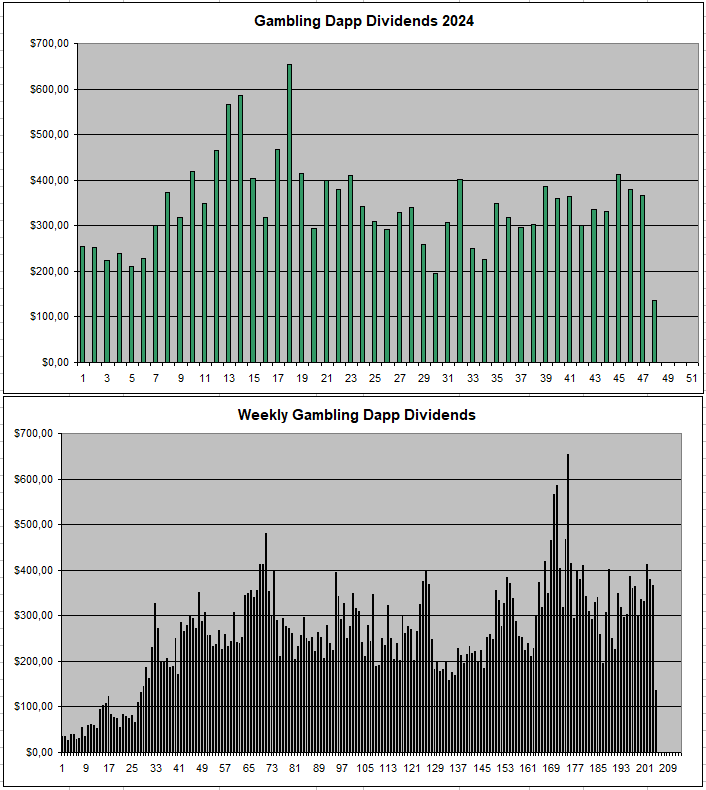

GambleFi Portfolio | Poor Dividend Week!

Due to circumstances, this turned out to be a rather poor dividend week only getting around 137$ but the missing dividends will still come so I expect an increase somewhere in the next weeks.

Sportbet.one (SBET)

There is a migration going on right now from pbtc / peth / pltc to native coins that are held by Sportbet. This removed previous earnings in those coins that I saved up as I didn't want to pay the transaction cost being forced to withdraw these small amounts. This week only SOL got paid out and I assume everything will be handled properly as they are migrating things. Al the expected dividends from last week also still show in the Dividends tab. With around 5 years of trust build up, I have no doubt it all will be handled properly.

I also took screenshots so in case anything goes wrong I can easily show and get support.

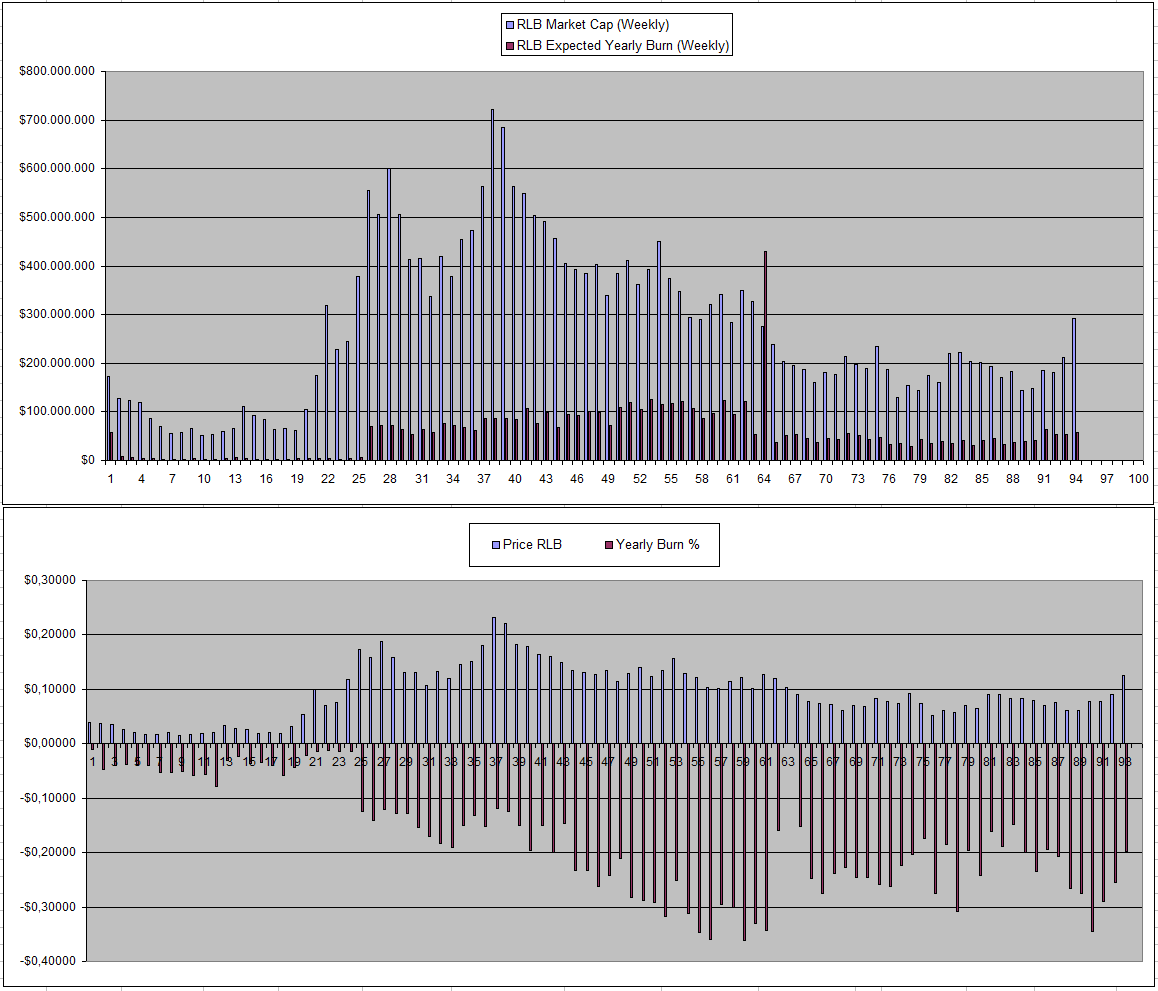

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

From here on out I'm mostly watching the Expected Yearly Burn % as that is my main metric toward buying and selling. With the increased RLB price it did come down from 25% to still around 20% so all still is good to hold at the moment. Once it goes below 15%, I will start looking to offload some of my RLB.

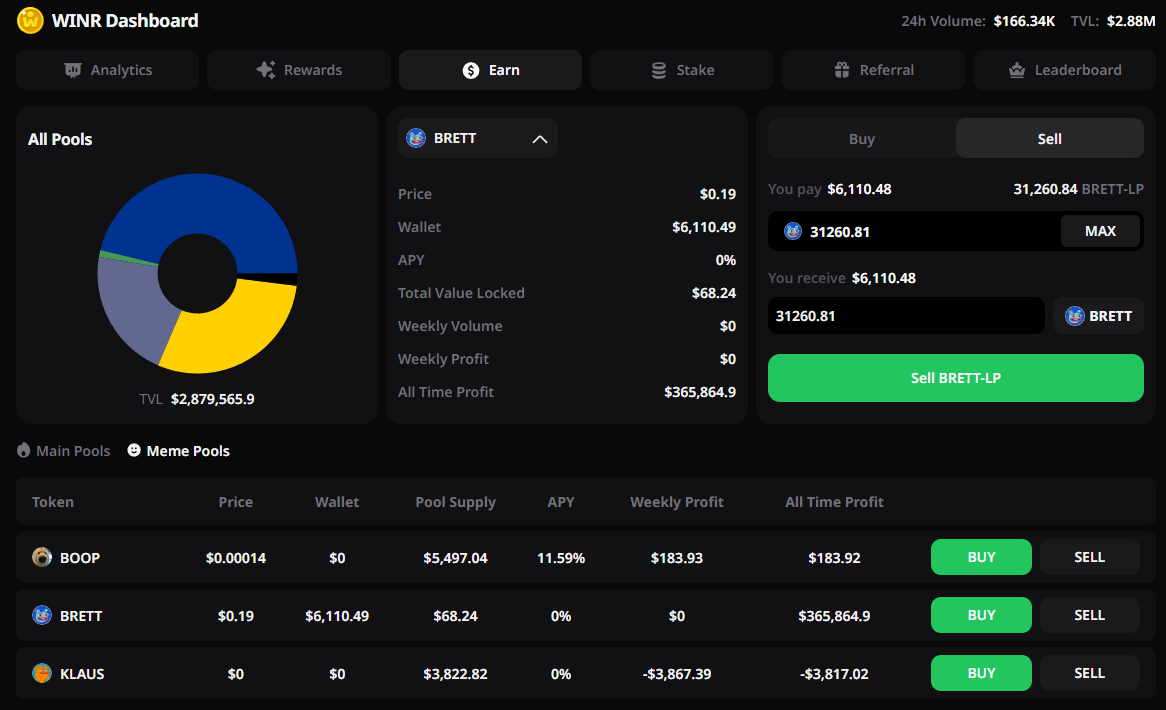

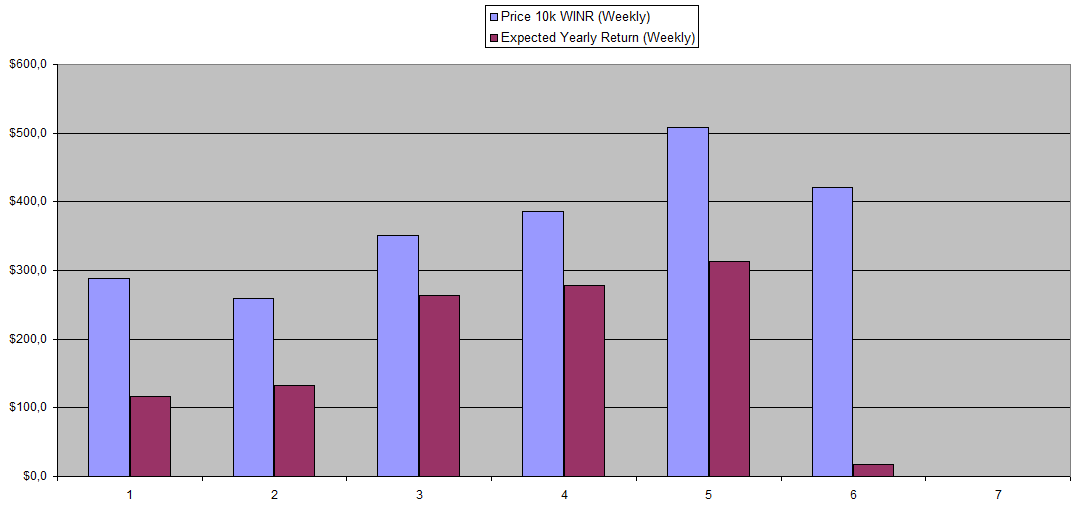

While I was very optimistic about WINR for the past month, last week kind of broke the trust bit since there once again seems to be a problem with the BRETT liquidity pool and it's very unclear what is actually going on or if the funds are lost or not. From what I understand there was some kind of 0% fees promo going on which I never saw mentioned anywhere before. At the end of the month the 'cashbacks' were done which totally butchered the liquidity pools and the profit expectation.

There was previously also an issue with the brett pool which got fixed but the new issue seems to be way worse now.

| Date | Brett Pool | Brett Staked | Brett Now | Earnings |

|---|---|---|---|---|

| 12/11/2024 | 186582$ | 10000 BRETT | 11604 BRETT | +1604 BRETT |

| 19/11/2024 | 159763$ | 10000 BRETT | 6878 BRETT | -3122 BRETT * |

| 26/11/2024 | 129122$ | 10000 BRETT | 6874 BRETT | -3126 BRETT * |

| 03/12/2024 | 68$ | 10000 BRETT | ???? BRETT | - *** |

(* Caused by bug which was fixed)

(** Another bug or Drain of the Liquidity Pool ?)

So with all the pools getting hit by this strange 0% fee cashback event which makes no sense as profit could be claimed in the previous weeks while it makes no sense to provide liquidity for 20% of a 0% fee. On the bright side, Degens leverage trading was introduced and the volume on the casino went up I guess as many players got the cashback. The entire situation is a real mess, there is very poor communication around it and I just hope that I didn't lose the 10k which ran up to 19k BRETT that I put in the pool.

So lots of growing pains for WINR

vBookie (NFTs)

The floor price went down again to 0.24 SOL and I assume next week there will be numbers of the previous month who hopefully will be positive this time around.

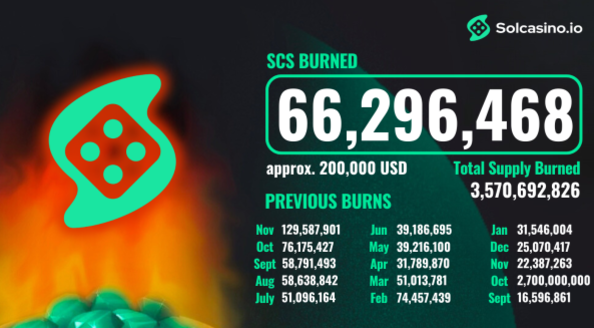

Solcasino.io (SCS)

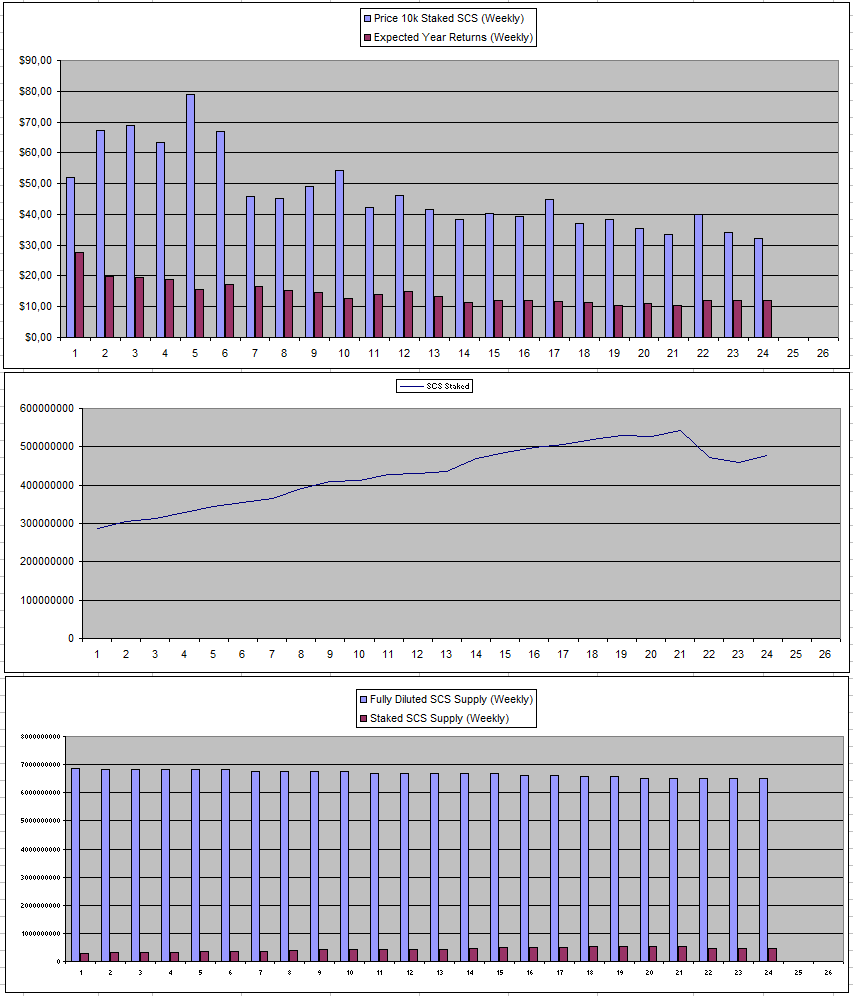

I pulled the trigger to buy 80k extra SCS and stake it along with the 60k I still had sitting on the side. This brings my total investment in this at just 907$ which equals 0.0045$ as the average price and the expectation now to be around 4.5$ in earnings each week. I might look to add a bit to my bag along the way around these prices or lower. There also was another monthly SCS brun from all the profit made by the casino from gamblers who choose to use SCS as their currency. This added up to 200k Dollars or around 66 Million SCS.

The dividends remain around 35% but with only 7.35% of the total supply staked in the USDC Pool. That is one of the main factors that is holding me back.

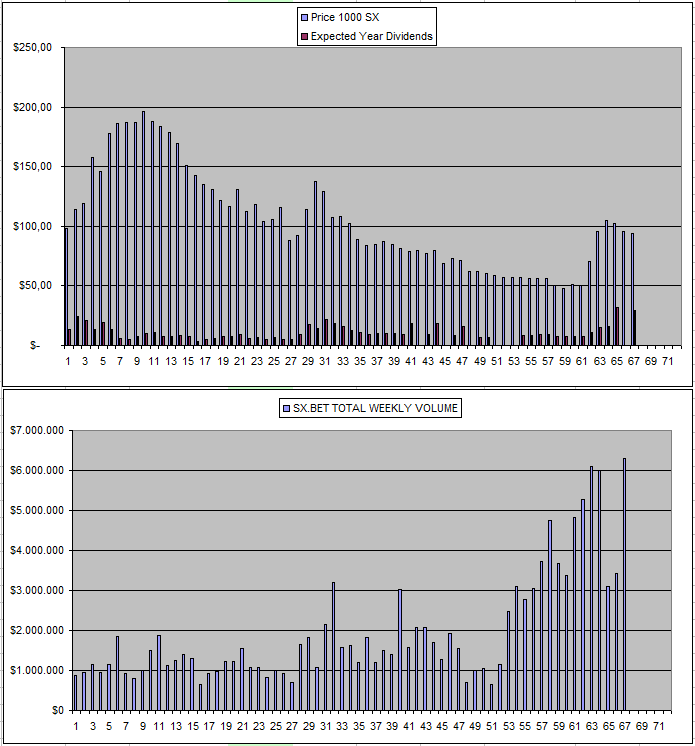

Sx.Bet (SX)

Looks like there was another double payout from SX and a record high volume over 6 million.

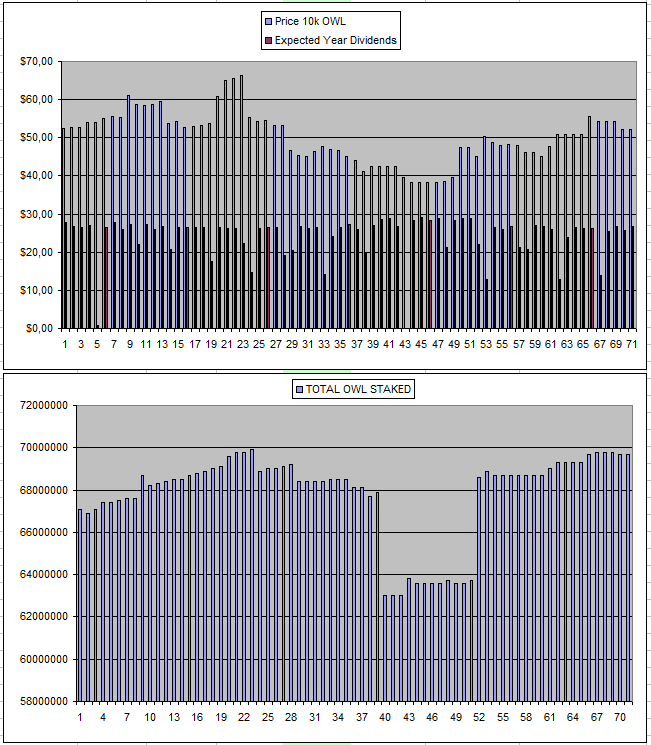

Owl.Games (OWL)

I kind of expected another dividend drop as usual when the pool needs to be replenished but it looks that either it was done instantly now or it yet has to be done so next week will suffer from that. OWL remains one of those projects that is kind of nice to have a bit in as the 30$ weekly is somewhat considerable for an investment that is not too big. At the same time, it's not something that I would be comfortable with having much more invested into.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

| 01/10/2024 | 600k | 3179 | 2696$ | 14.77$ | 1614.59$ | 50.79% | +1131$ |

| 05/11/2024 | 600k | 3179$ | 2879$ | 16.13 | 1748.99$ | 55.02% | +1449$ |

| 12/11/2024 | 600k | 3179$ | 2879$ | 29.35$ | 1778.34$ | 55.94% | +1478$ |

| 19/11/2024 | 600k | 3179$ | 2879$ | 30.86$ | 1809.20$ | 56.91% | +1509$ |

| 26/11/2024 | 600k | 3179$ | 2766$ | 29.66$ | 1838.86$ | 57.84% | +1425$ |

| 03/12/2024 | 600k | 3179$ | 2766$ | 30.72$ | 1869.58$ | 58.81% | +1456$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

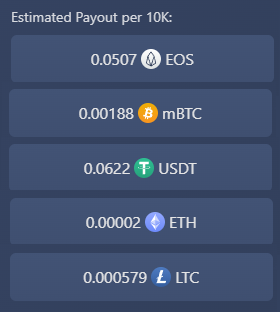

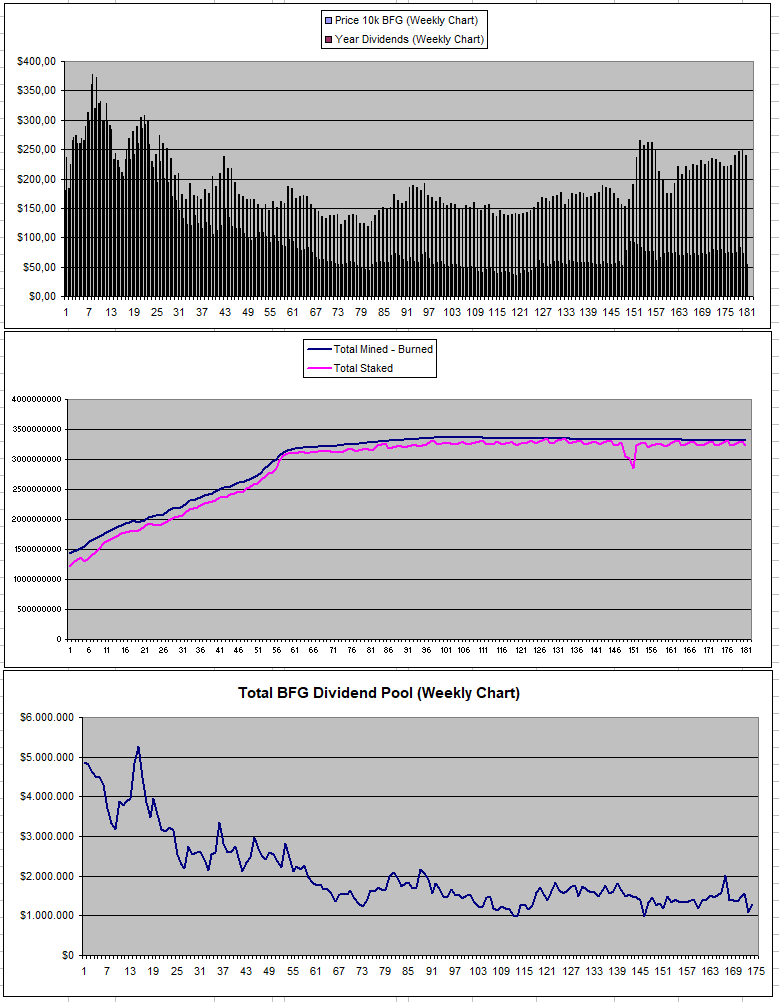

Betfury.io (BFG)

There was a negative outlook for BFG as the BTC pool was at a loss early last week but it still managed to recover a bit for a week were there were only 53$ in earnings. However, it looks like the dividend pool now is up a bit again so I expect for next week that it will be closer to 70$ again.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +7% APY |

| Betfury.io (BFG) | +23% APY |

| Owl.Games (OWL) | +51% APY |

| Sx.Bet (SX) | +16% APY |

| WINR Protocol (WINR) | +4% APY |

| Solcasino (SCS) | +36% APY |

| VBookieSports (NFTs) | +0% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

Only 136$ in earnings last week but I expect things to be back to normal nextweek. I'm now holding 5M SBET | 500k BFG | 30k RLB | 26 Defibookie NFTs | 600k OWL | 27.4k SX | 150k WINR | 200k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha

Dont fully understand the Winr situation but sounds messy.

Which would you say you have most conviction about of the projects mentioned in the article?

Yeah, I also don't fully understand it. I guess it are mostly just normal growing pains and hope they will clear everything out in the coming week. As for the one with most conviction it fully depends on what your main objective is. For reliable Dividends I would say SBET since it has proven itself for 5+ years now (which isn't a guarantee) at some point I can see them being on EOS which kind of is a ghost chain as a problem. RLB as a coin has the best tokenomics and should always appreciate in value over time but there is the issue that nobody really knows if they are fully legit. If it would end in an FTX scenario it would not surprise me. BFG, OWL, SCS, RLB are all fully centralized where users need to deposit money which increases the risk and why they need to have high APY to make it worth the risk. vBookie is the one that easily could do a x5 in a short term since it has a very low overall valuation but it also hasn't proven itself and I don't see it as a long term solution. WINR & SX both have the potential to be the Casino layer and Crypto betfair as on-chain platforms but something else could easily come along that does it better.

That's why I like to have a portfolio with multiple coins, having just 1 is quite high risk as you never really know in crypto.

If I had to take a long-term bet it likely would be WINR despite the recent liquidity pool problems. If they can pull it off and become the crypto gambling backbone it could become huge while right now the expected dividends are already nice.

I hope that helps

Never heard of this BRETT pool before. I am just hodling my coins. You put some of yours in there and they maybe got lost now? Didnt really got it.

The way it works in WINR is that there are 1-sided liquidity pools. If gamblers win they take from it but when they lose which is expected over time, the pool grows and those who provide liquidity earn part from it (only 20% apparently which is a bit too low). I was willing to put part of mu BRETT stack at risk to test it out but if feels like there are some issues either displaying the proper numbers or something else which isn't fully clear. I hope they give an update soon and if possible I would likely withdraw my stake there again. The rewards aren't worth the risk mainly because of the smart contract risk where trust is somewhat lost now.

These sound really esoteric :) I think I will stick to things I can actually understand :)

Actually I would say GambleFi is one of the easiest Cyrpto sectors to understand. People are stupid and want to gamble as there is a chance that they will win while the house in the grand scheme of things always has an edge. The overall profit or at least part of it based on the tokenomics is distributed to token holders giving quite big returns as often there is centralization risk, smart contract risk, or regulatory risk.

The fact is that this is something where there is continued demand with real customers and real revenue which can't be said about many things in crypto and the projects themselves are not overvalued based on these. If anything, GambleFi has been a crazy good way to get reliable income in Crypto and I would say there still is a lot of growth potential.

The charts and results in these posts that have been going for over 4+ years kind of prove it.