GambleFi Portfolio | Slow Dividend Week

With Wimbledon and the European Cup having come to an end while the European football season still has to kick off, this was a rather low dividend week for the portfolio.

Sportbet.one (SBET)

This remains my biggest bag and a lower volume week does cause the overall weekly returns to be down which was the case this week. The return on a weekly basis still was 0.677% so not that bad overall.

Returns and overall activity on WINR are still very low and I guess the next step will be to release the WINR chain and I'm honestly not sure what to expect from it.

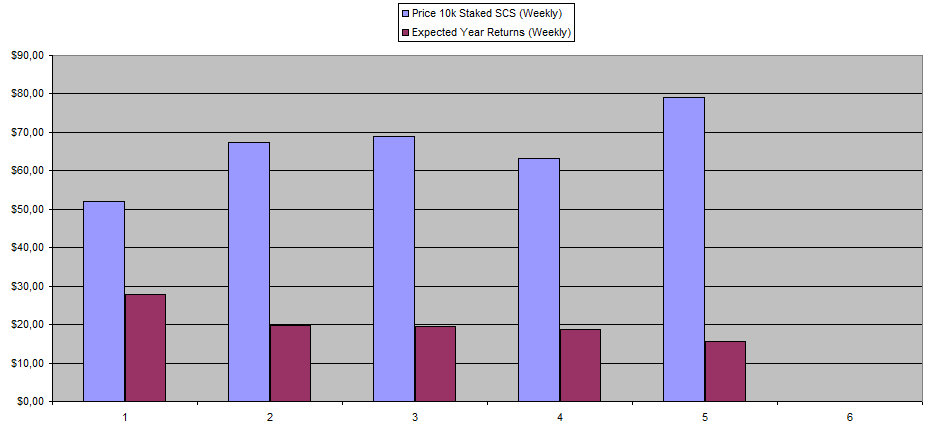

Solcasino.io (SCS)

There is somewhat op an opposite move as the price of SCS has gone up while more of it (+4.5%) got staked which lowered the dividend expectation. So I do expect the price to go down more as the return needs to be in line with the risk.

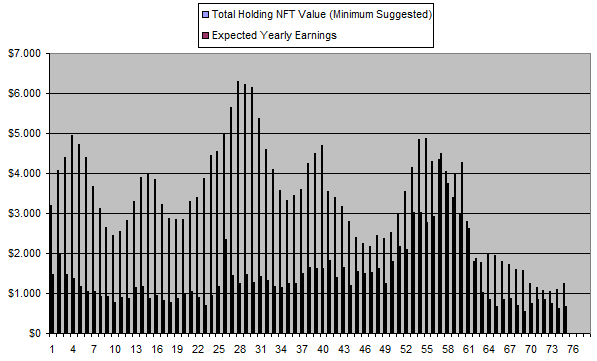

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

The price of RLB went up along with the market but it wasn't combined with an increase in earnings so the burn was lower last week. It's still 20% of the current supply on a yearly basis at the moment

Sx.Bet (SX)

As expected, there were no dividends this week as last weeks were doubled. It also looks like overall volume was also down a bit and it remains a real challenge to get things really going. The price of SX is also lagging behind and going down slowly but surely.

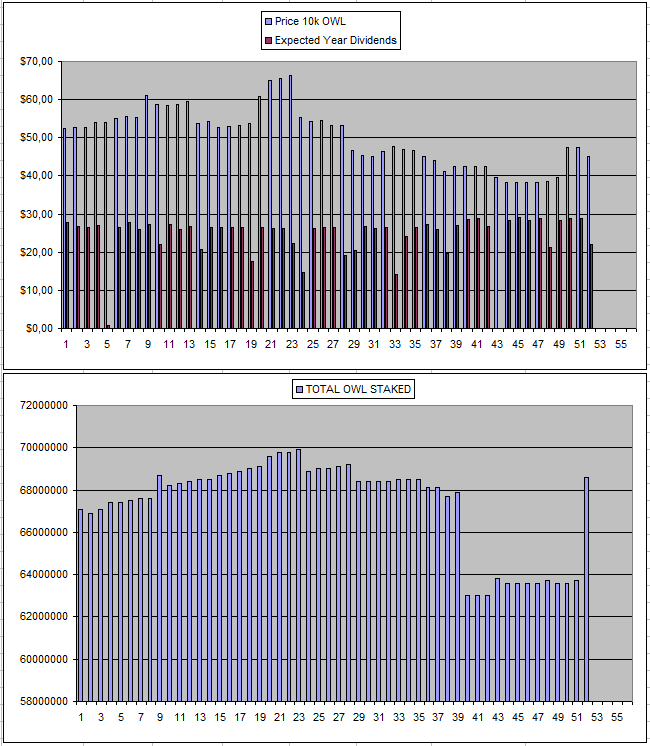

Owl.Games (OWL)

I guess the one who pushed the price up a couple weeks back now staked the coins (+9.69% increase in staked supply) which will put a little bit of pressure on the dividends unless they increase the pool. This was also the pool renewal week and as always there was a delay which lowers the overall expectation for holders.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

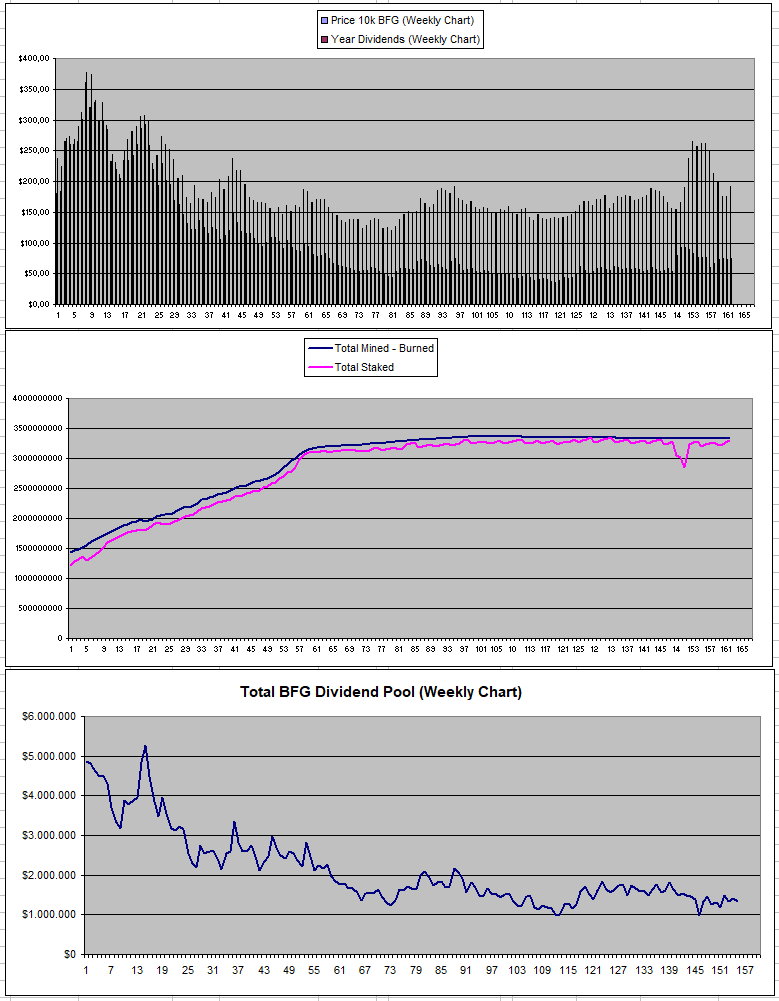

Betfury.io (BFG)

Stanble and quite flat at a good APY is where BFG is mostly at for quite some time now which is just fine I guess. This is what a 500k Staked BFG got me last week

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +35% APY |

| Betfury.io (BFG) | +39% APY |

| Rollbit.com (NFTs) | +54% APY* |

| Owl.Games (OWL) | +48% APY |

| Sx.Bet (SX) | +0% APY |

| WINR Protocol (WINR) | +2% APY |

| Solcasino (SCS) | +20% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

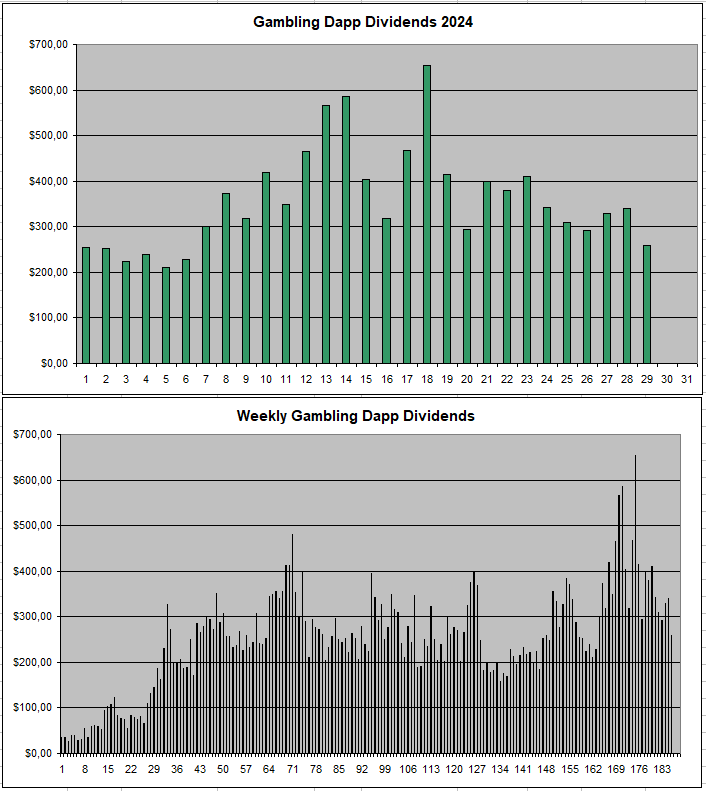

Personal Gambling Dapp Portfolio

I was down below 300$ again in passive returns last week for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 20k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Congratulations @costanza! You received a personal badge!

You can view your badges on your board and compare yourself to others in the Ranking