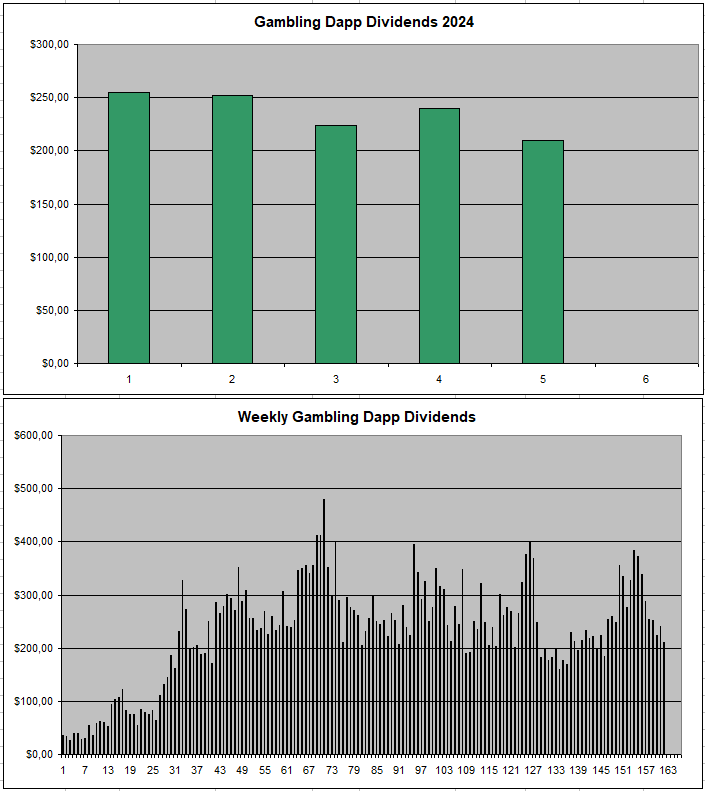

GambleFi Portfolio | Slow Dividend Decline

Combined Dividends so far this year have been in a slow decline from 254$->251$->224$->240$->210$ while ideally, I would like to be above 300$ weekly. I haven't done any more investments even though I am keeping my eyes out.

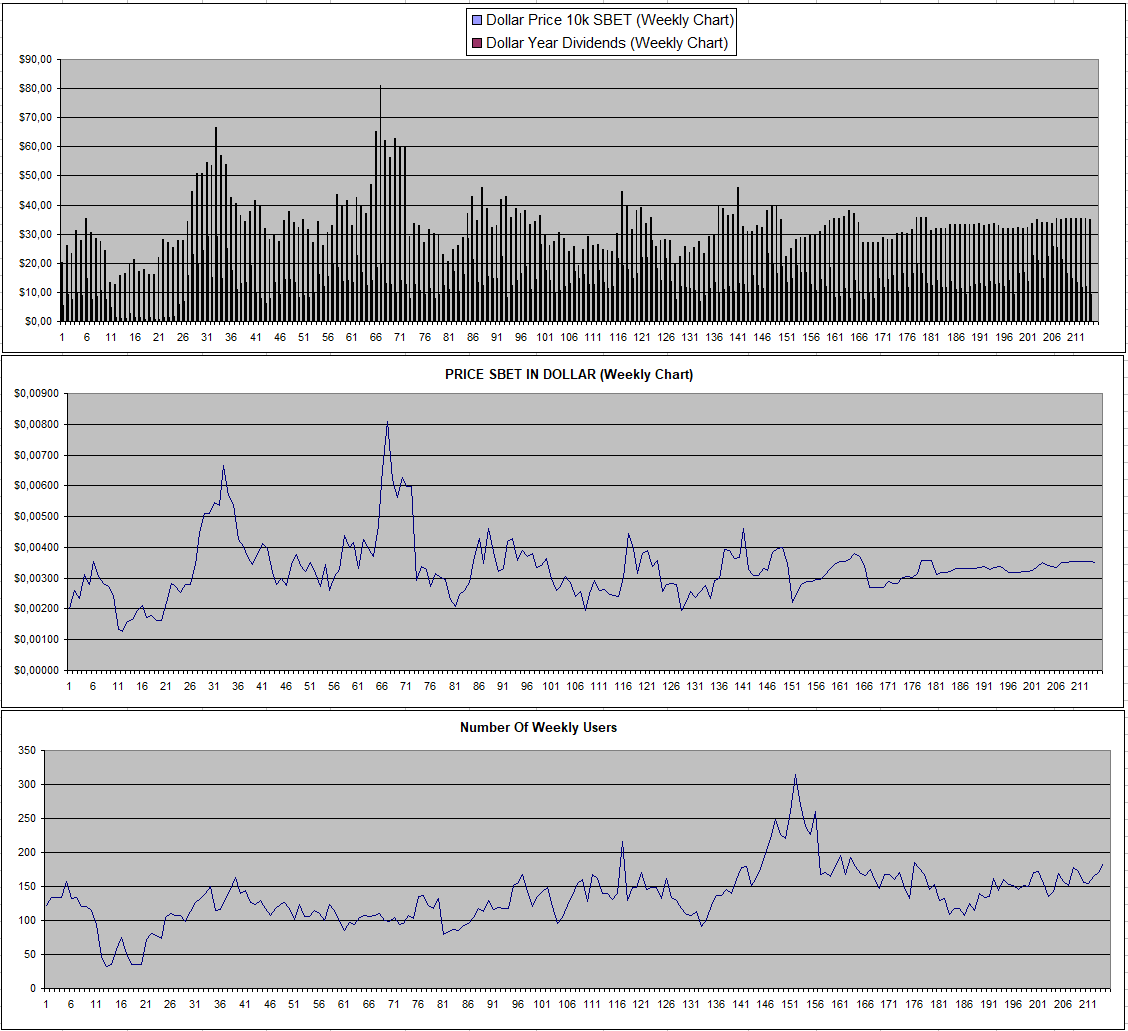

Sportbet.one (SBET)

The power of SBET is the stability (especially during the bear market) but the main weakness is the lack of growth. It has also gotten to a point where I don't really see where the adoption will come from as newer 2020+ investors often never even heard of EOS. I am thinking of reducing my holdings a bit because of this even though I don't really want to. The reality though is that growth likely will be bigger in other cryptos. The numbers of bettors is again going up a bit but I assume some whales decreased their losses as dividends have been going down.

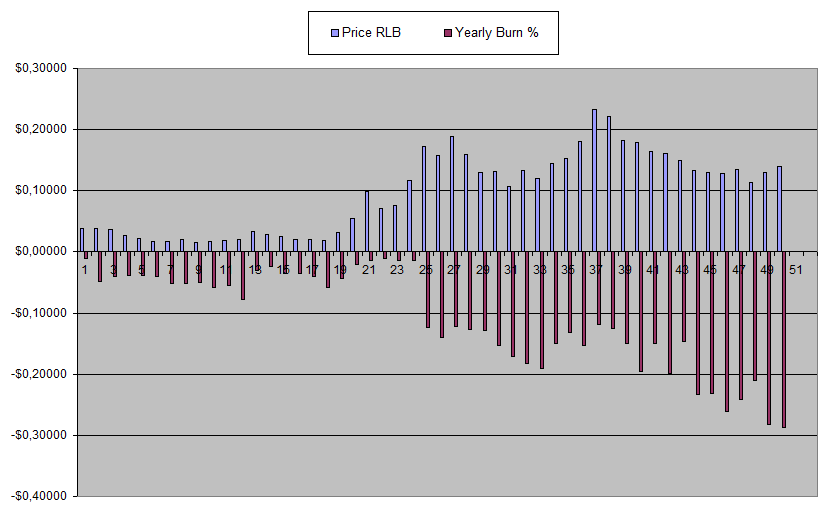

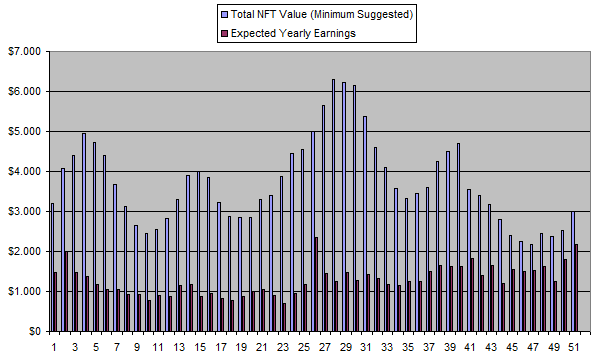

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

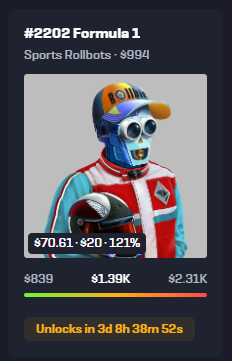

The burn of Rollbot continues to be insane at close to 30% of the entire supply in a year at current pace. It also looks like Sports Betting revenue has skyrocketed with my sportsbot going from under 10$ in revenue share (on top of a 20$ free bet) to over 70$. I still have no clue how the actual minimum suggested value is calculated.

| Previous Lock | Next Lock |

|---|---|

|  |

On the Technical chart side of things, RLB has set a hiher low at least on the daily chart. On the weekly it bounced where the week closed round the previous bottom. Since there is a lot of buy & burn pressure, I do still see this as a solid buy right now.

The yearly burn is reaching a level where the price pretty much must go up sooner rather than later.

The prices of the NFTs and the returns also are increasing and this isn't even counting in the upcoming lock of my Rollbot.

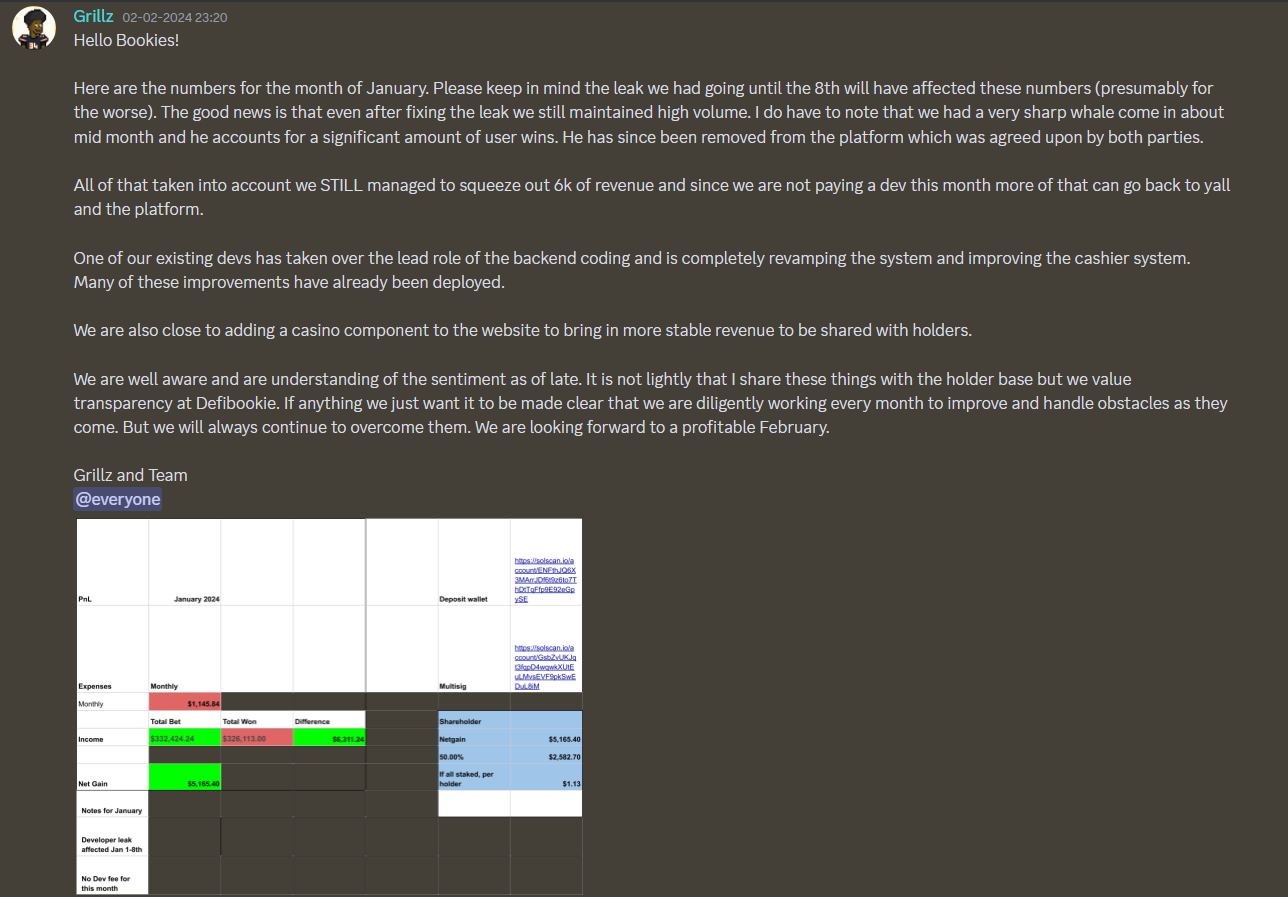

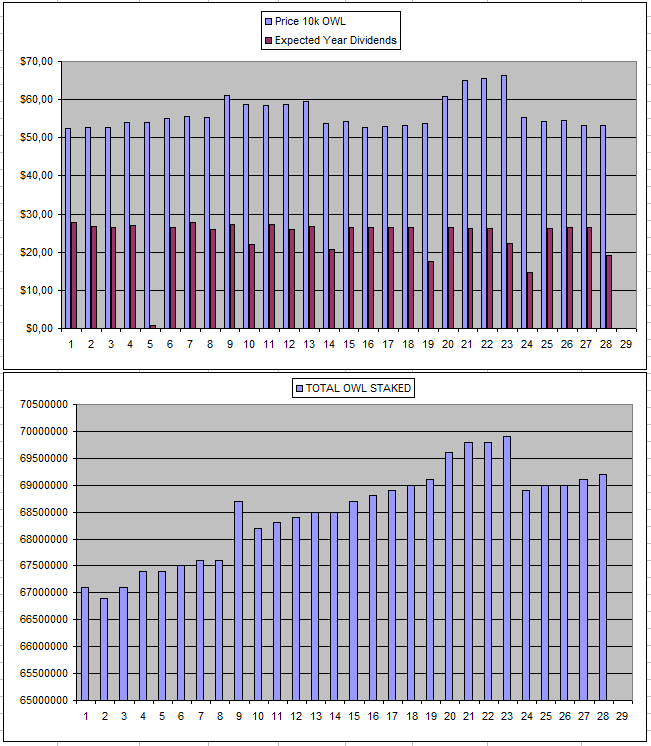

Defibookie (NFTs)

There was a monthly update on the revenue that was made which was slightly positive with an expected revenue share of 1.13$ per NFT. They also reported that a sharp whale came in who exploited their weak odds (which is my main worry). They say "He has since been removed from the platform which was agreed upon by both parties. " but the underlying problem is what needs to be fixed as it's just a matter of time before more of these whales come in to take some free money.

with around 2200 NFTs in existence and a current floor price of around 150$, the overall market cap is still just 330k which still makes it a very good risk-reward deal to me and I'm even tempted to buy some more defibookie NFTs.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.00$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.00$ | 117.16$ | 8.23% | +581$ |

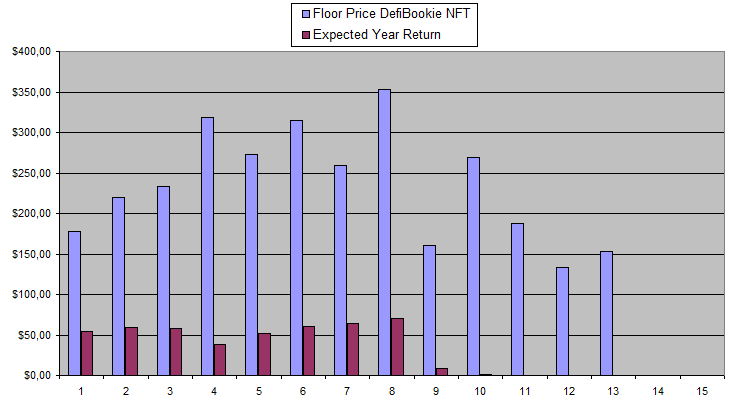

Sx.Bet (SX)

So far, growth is also not really happening for SX even though they continue to move forward. The price of the token has come down which means the value of the 70k SX given each week is lower bringing less incentives to 'bet-to-mine'. This is one of those spirals in cyrpto that can work for or against you. It's the superbowl week now and it will be interesting to see what the overall volume does. There are some returns still but they aren't the greatest.

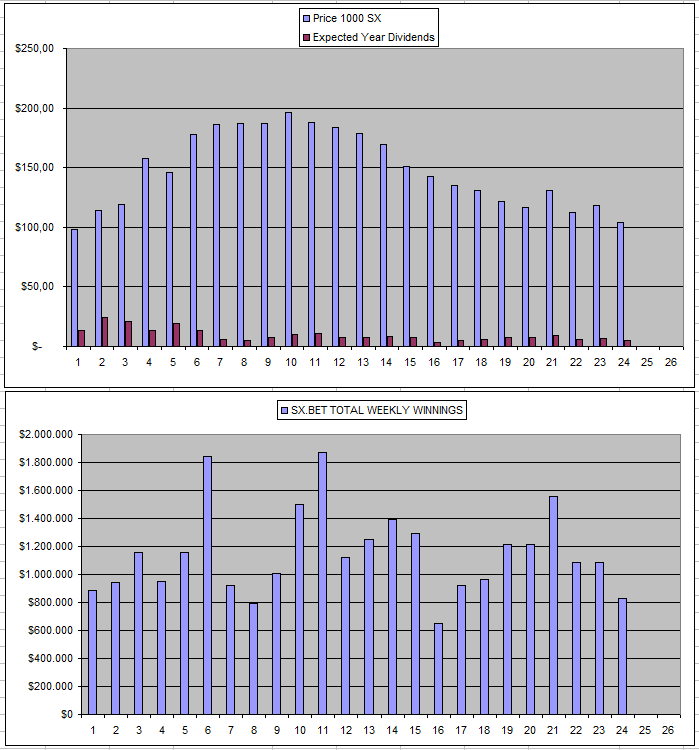

Owl.Games (OWL)

It's the same story for OWL with the reward pool drying up and the need for it to be replenished which takes many days cutting into the returns of holders.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -67$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +225$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +248$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +48$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42 |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +47$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +749$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

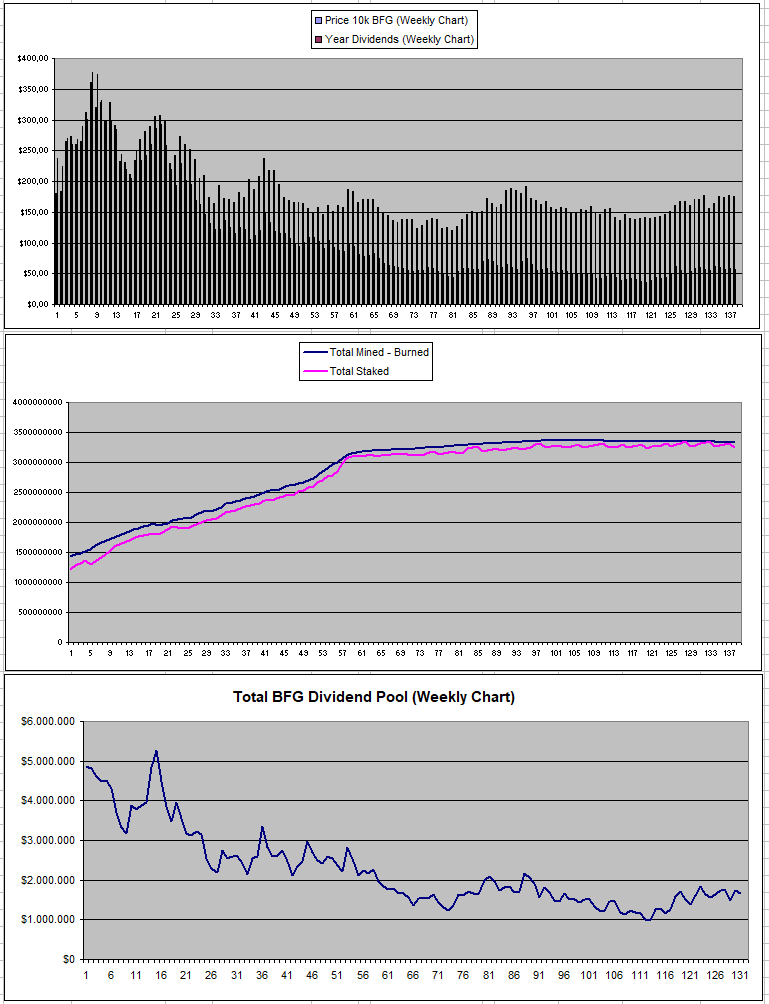

Betfury.io (BFG)

Betfury introduced Leverage trading to their platform similar to Rollbit who were the first to do this. This after already introducing crypto staking with high returns and I like the general direction they are taking. So far it's not yet fully reflected in an increase in returns but I'm hoping it will going forward. BFG for sure has the potential to so something like Rollbit did if the bull market progresses and if the public gets into cryto again.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +26.31% APY |

| Betfury.io (BFG) | +32.46% APY |

| Rollbit.com (NFTs) | +72.77% APY* |

| Owl.Games (OWL) | +36.25% APY |

| Sx.Bet (SX) | +4.67% APY |

| Defibookie.io (NFTs) | +0.00% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

I'm still hoping to get back above 300$ in weekly Dividends for holding 5M SBET | 500k BFG | ~4000$ worth of Rollbot NFTs | 600k OWL | 25k SX | 1800$ worth of DefiBookie NFTs. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|