GambleFi Portfolio | Having A Look At Kineko (KNK)

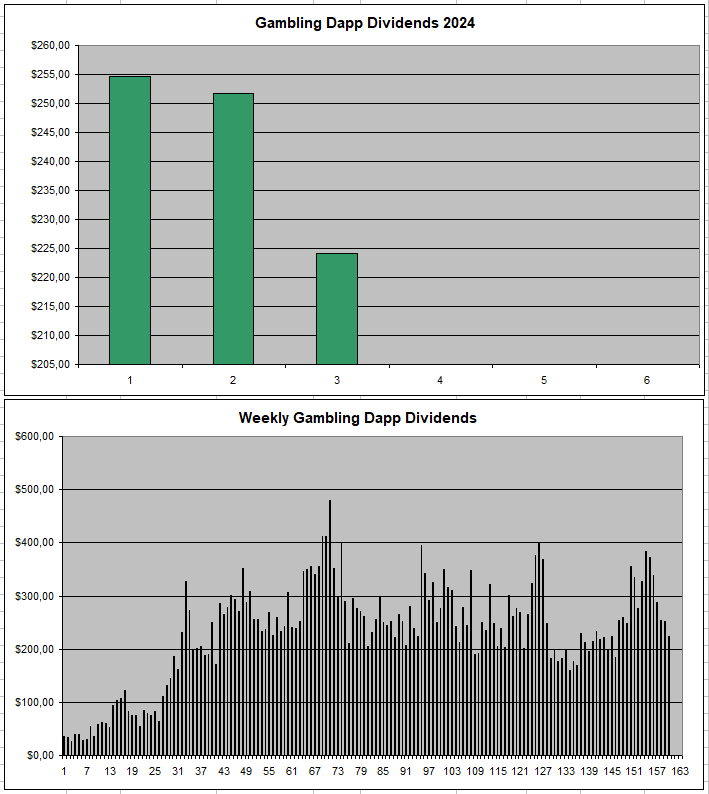

This week saw a bit of a drop in dividends and I hope to at least get 200$+ weekly going forward not dropping below that. I'm still exploring other projects to potentially add but the actual Dividends remain absolute key. I had a look at Kineko (KNK) to see if it's worth getting in as it's one of the coins that is shilled by some Youtubers. This is what I found out...

Kineko.io (KNK)

So Kineko (KNK) has a sportsbook & casino (kineko.io) similar to Rollbit and others but it doesn't share the exact same software which makes it so that they have different odds available. Purely as someone who wants to take bets, their sportsbook might be an option to actually use for me which on its own is a major plus.

In terms of the KNK token, it was hard to find some good info as I can't find a whitepaper and their discord link is broken. From what I understand, KNK is on the Solana Chain which is a good thing. There is a supply of 20 Million KNK of which half is in circulation and I assume half is held back by the team and will be released at some point. Frome that profit that is made, only 33% is used to support the token. 90% of that is used to buy back and burn while only 10% is given out as dividends to those who stake KNK on the site

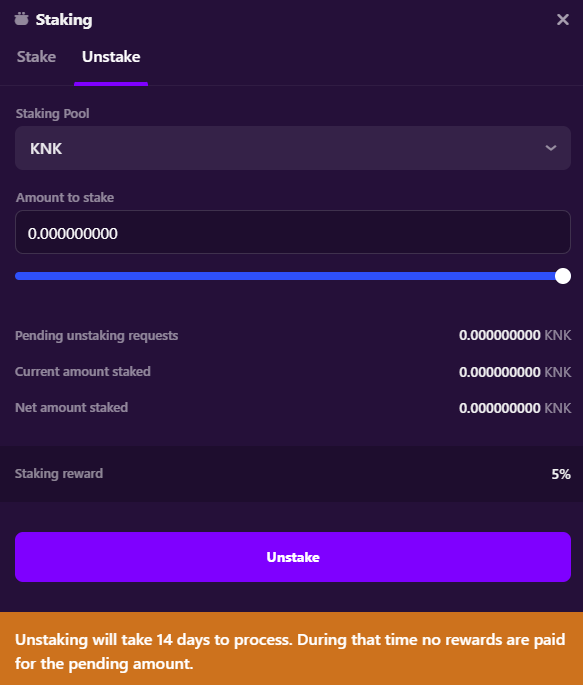

I don't think there is a tax for buying KNK in the liquidity pools on Raydium and Orca and it takes 14 days to unstake also without a cost which is a period where no dividends are paid out. Every month, the numbers are released and the buy back + dividend distribution is done. These numbers are shared on their twitter but there is no real way to know how much KNK is actually staked. The last 2 months, these were the revenue numbers.

So there was an increase in the last month but the overall burn still only equals 0.0227% of the total supply. For Rollbit this was 0.405% just this week and the revenue share is much bigger there. At a current price of give or take 1$, only 455$ out of 19629$ of profit was given out as earnings. So assuming 8 Million KNK is staked, 1000$ in KNK over the month would pay just 0.056$ in dividends.

At a total circulation market cap below 10 Million, there have been 2 'influencer' pumps followed by dumps.

Kineko Current Conclusion: I might look tto try the sportsbook since it has different odds than the others with what looks like ok offers even though I never like the centralized aspect. As an investment, the valuation is already based on big growth and I don't like the 90%-10% buy-back / Dividends not even to talk about this only being for 33% of the earnings. So for me right now this is not tempting at all to put in my gambling dapp portfolio and either crazy growth or big tokenomic changes are needed to make it attractive at the current price.

Sportbet.one (SBET)

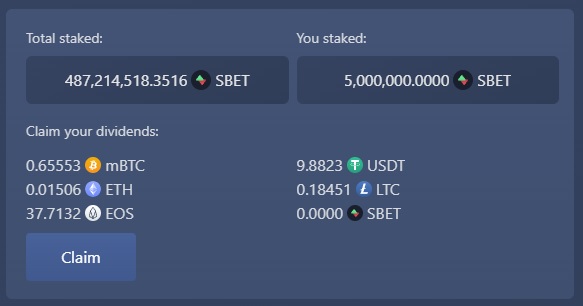

It was a low-profile week on SBET and the 7th consecutive week where dividends went a bit lower.

The APY despite this remains around 33% and the price remains the same as nobody is buying or selling.

I keep holding onto my bag and use what I earn to re-invest and cover some real-life expenses.

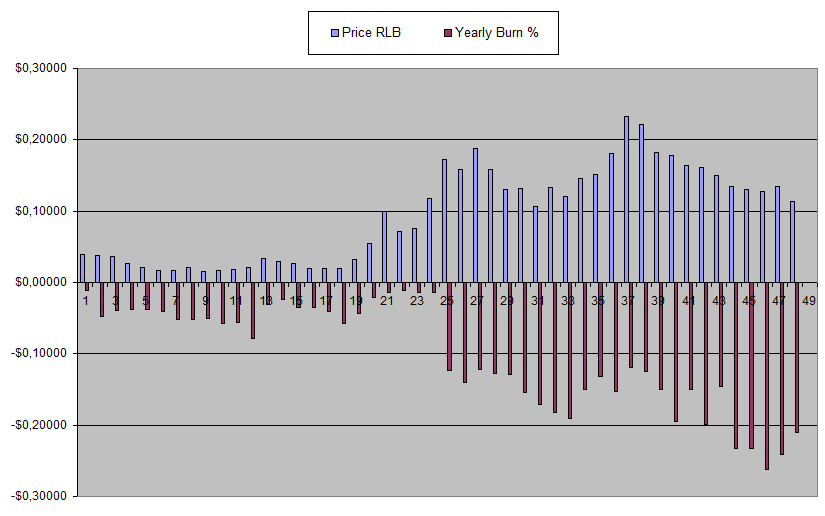

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB actually broke down but it has held up much better compared to the general crypto space. At this point, it's mostly a waiting game as revenue is still there and more RLB is getting burned quicker.

So I'm patiently waiting for an RLB pump collecting the Dividends alongs the way.

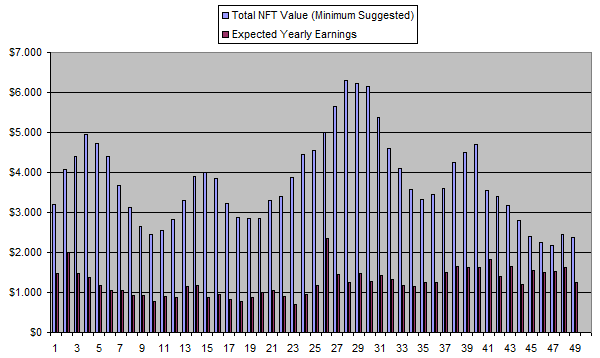

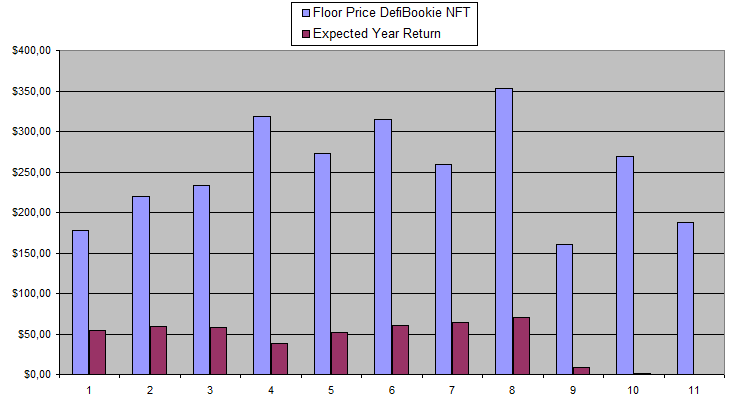

Defibookie (NFTs)

The month-to-month revenue share make the earning drop to zero now and it will take over a week to know if something will be there in Frebruay from Janyary revenue. However, based on what I see on their bookie, it's still way to easy to exploit.

The 140$ I deposited back in October has grown to 270$ by now just from taking 684$ in bets which only leaves me with 20$ in rollover to fully clear the 25% deposit bonus.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23$ | +1010$ |

Sx.Bet (SX)

I hoped for the Australian open to push the overall winnings and fee generation on the site a bit but this didn't really happen. So earnings are still very low but the platform itself remains one with the most potential since it's the most decentralized.

They continue to improve things and new projects that operate on the SX network are being introduced

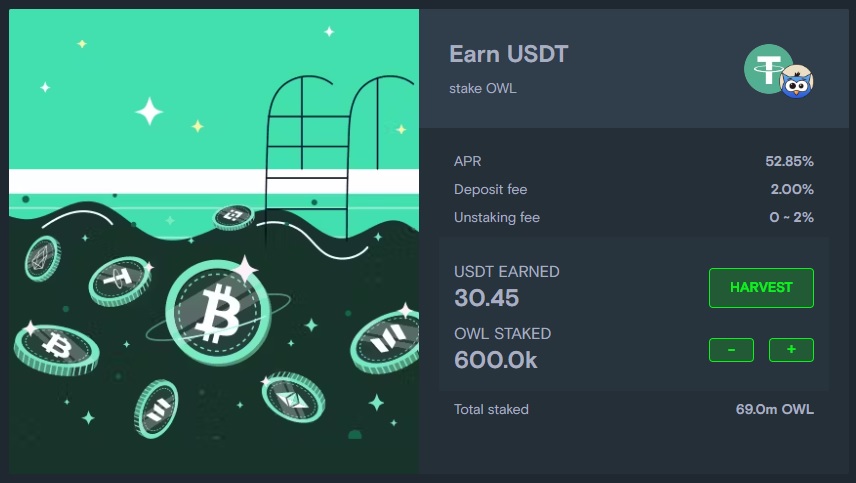

Owl.Games (OWL)

Owl continues to give good returns and I did another withdraw which went through instantly. 30$ a week is right now what I can expect with the weeks where they need to refill the pool being lower as they always have a delay. The price is also not moving and inch which is great when the market tanks.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -67$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +225$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +248$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +48$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42 |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +47$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +749$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

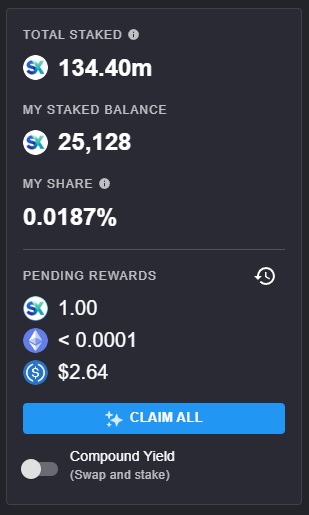

Betfury.io (BFG)

Befury also seems to be quite stable between 50$-60$ weekly for holding 500k RLB. Over the lifetime of the project I managed to claim over 10k in dividends by now.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +32.9% APY |

| Betfury.io (BFG) | +33.04% APY |

| Rollbit.com (NFTs) | +52.41% APY |

| Owl.Games (OWL) | +48.44% APY |

| Sx.Bet (SX) | +5.26% APY |

| Defibookie.io (NFTs) | +0.20% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

I'm hoping to get back above 300$ in weekly Dividends for holding 5M SBET | 500k BFG | ~3500$ worth of Rollbot NFTs | 600k OWL | 25k SX | 3000$ worth of DefiBookie NFTs. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|