GambleFi Portfolio | Delayed Bull Run Started for Dividends!

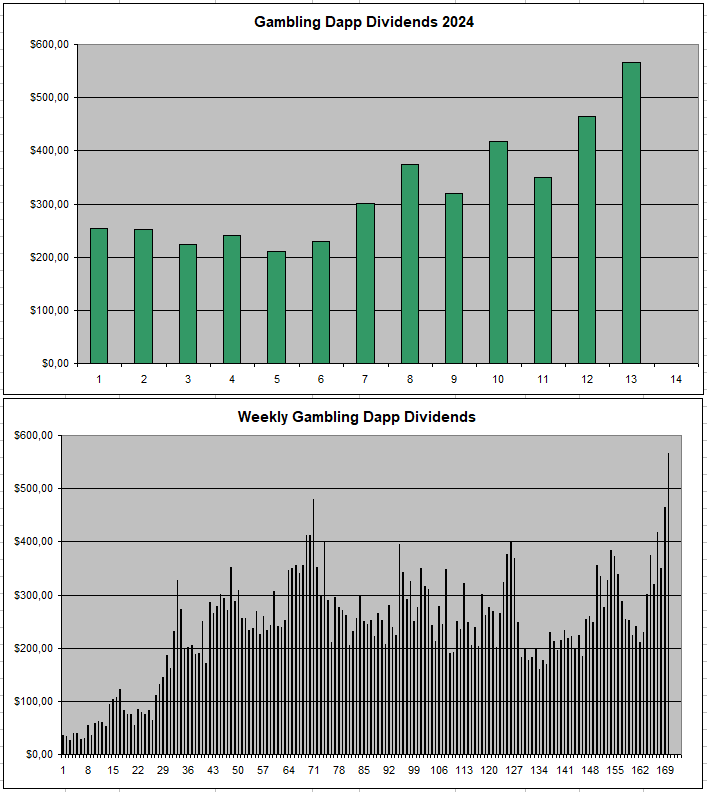

This was a great week breaking my previous record and also since a while doing a small extra investment to continue to grow it. It also looks like a delayed bull run has started for Dividends in the GambleFi Space. Basically, the Bitcoin price increase is getting in more people in the space who slowly started to find their way into web 3 gambling which now is starting to translate into higher revenue and dividends. All this while many of the prices of the coins and NFTs haven't actually increased that much. This gave me a 76% APY on my overall estimated Gamblefi Profolio value.

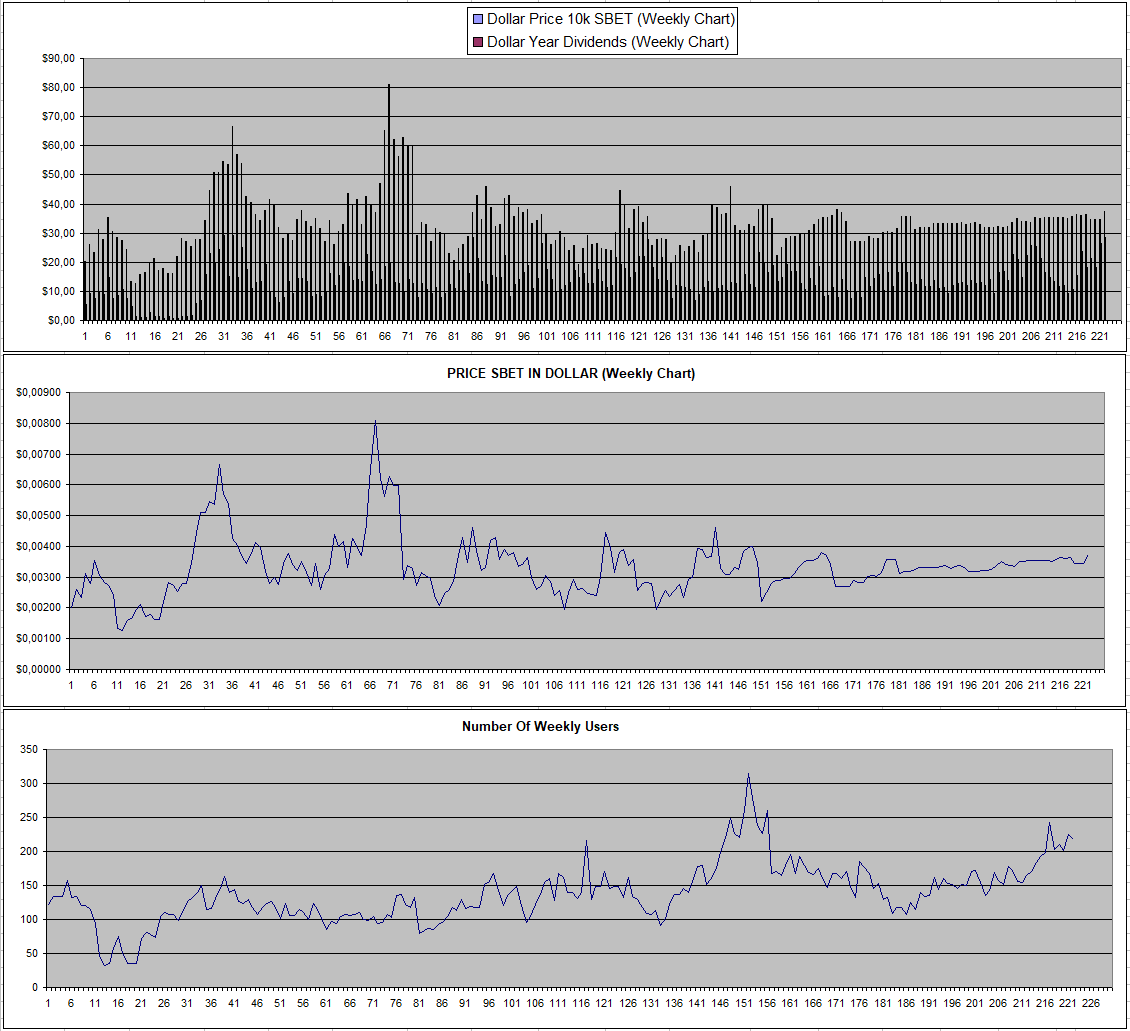

Sportbet.one (SBET)

SBET seems to be seeing an increased overall volume which made dividends in the past week (for holding 5M SBET) go from 174$, to 255$ and last week 275$ which equals and 1%, 1.48%, 1.47% weekly return. The price of the token barely moved (+8%) and if these return stay up, I do anticipate someone scooping this up at this price. I would do it myself but I'm already heavily invested. The expected dividends for the coming weeks are also on course of breaking the record 2.2 out of 7 days into it. At the moment I project it to be over 300$ for the next claim but it could fall short if some whale action drops down.

The number of weekly users also is ramping up and I hope it get at least back to where it was and beyond during the World Cup which so far was the peak.

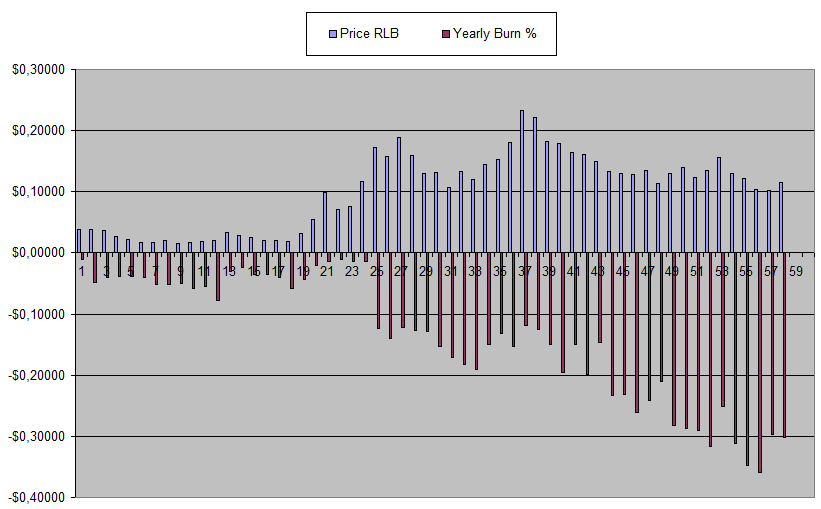

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

Rollbit seems to be in a pretty stable zone at least when it comes down to the price of RLB which ranges around 0.10$-0.11$. I bought a bag on the solana chain a while back but capitulated on it also because they soon will no longer be supported and got in the meme coin game with those funds which I'm glad I did as I managed to hit a big winner.

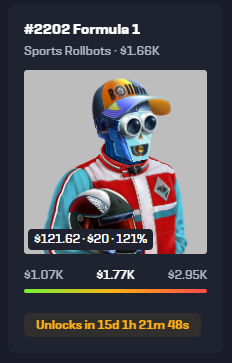

The value of the Sportsbot and the revenue claim continues to go down a bit but it does seem like the big whale (stakestinks) is still active. At the current minimum suggested value it does feel like a steal. Looking at the marketplace, there are a couple that I would pick up if if all was decentralized and if I could hold them in my own wallet.

| Last Week | This Week |

|---|---|

|  |

The returns on the NFTs continue to be very high at the moment even when calculating the prices at the Orange/Red zone.

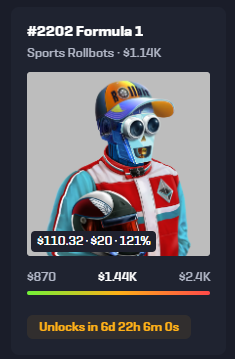

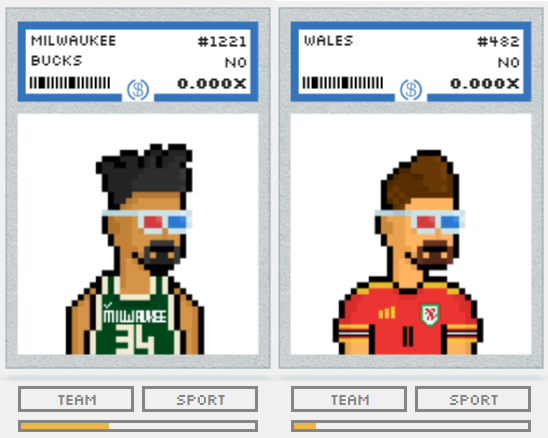

Defibookie (NFTs)

There was a bit of drama this week for Defibookie as the partnership with Bored Ape Solana Club (BASC) was distributed in a way too short time frame with the result that 10k BASC was dumped by some DefiBookie Whales dumping that price since there isn't really that much liquidity. This upset the BASC community and the tokendrop was cut short. From what I understand, things are friendly back now and the situation is cleared out.

I did receive 161.41 BASC from my 13 Bookies (currently 133$) which I claimed and so far I'm holding onto them still needing to do some research on if that is a high or low price as I honestly have no clue what exactly BASC does.

I did scoop 2 more NFT's off the market (Paying 140$ and 147$ for them) as I do like how this project has been run so far likely with more of these token drops coming. Their strategy is to do partnerships giving free bets to holders of the project they partner with which helps to onboard new players while DefiBookie NFT holders get dropped tokens. This over time should bring the real revenue share back. With ~2217 NFTs in total this brings the market cap at only 400k so lots of room to go up.

Tomorrow likely the revenue share report for March will come which I'm not yet expecting much from it and assume there will be no revenue share the coming weeks.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 207$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 188$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 188$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

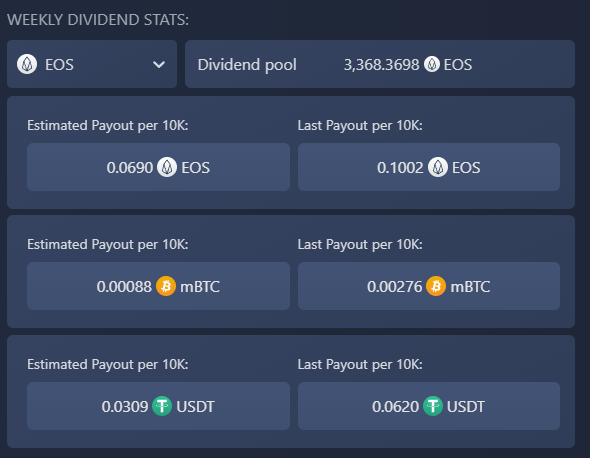

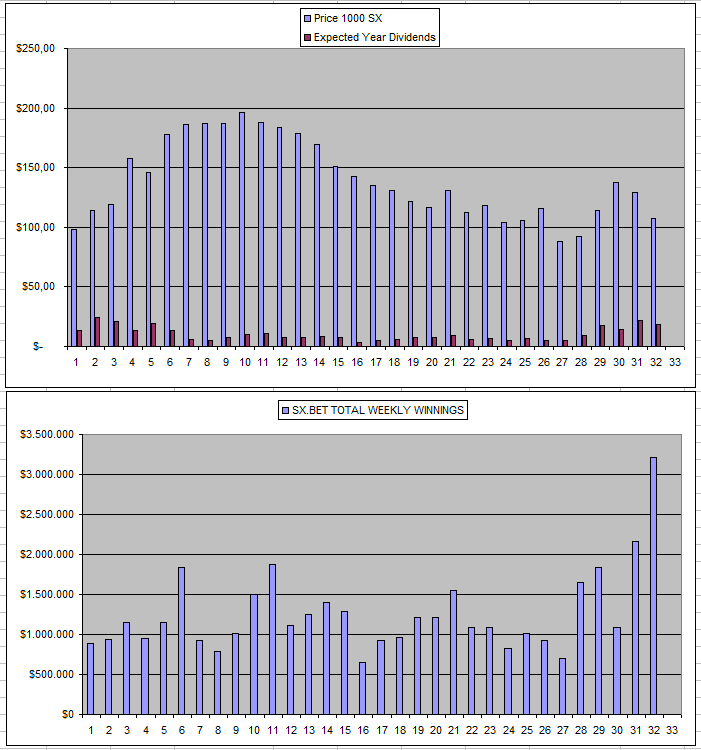

Sx.Bet (SX)

It looks like the strategy of getting more users and volume by temporary setting the fees to 0% is working as the overall winnings increased by 50% compared to last week.However, the fact that dividends is paid out in SX as inflation is putting pressure on the price. If anything right now, I see SX as one of the tokens I'm comfortable holding onto for the long run both in the bear and the bull in anticipation that they become the Crypto Betfair at some point with mass adoption. In that regard, I'm tempted to increase my holdings mainly because it all can be done in a decentralized way. So if I get a lucky break somewhere I might buy some more if the current price stays available.

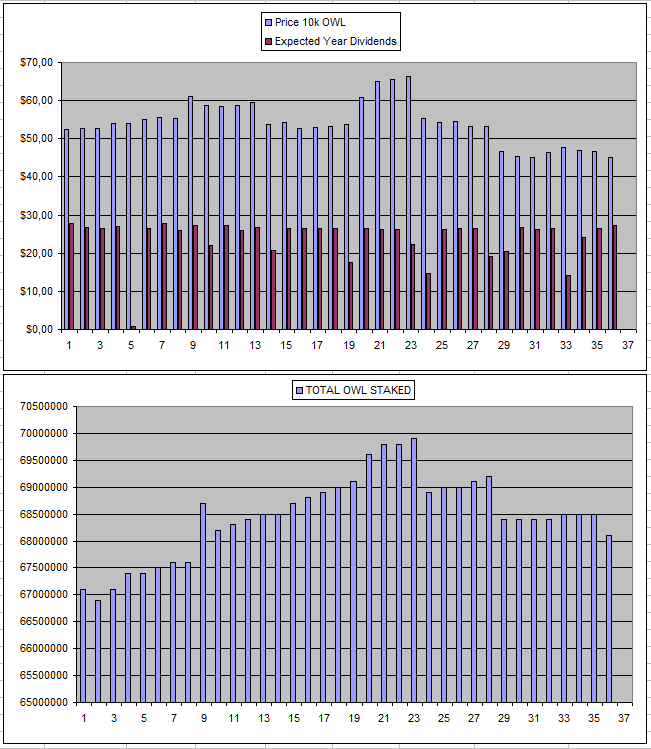

Owl.Games (OWL)

It was another week with ~30$ of earnings getting closer to recovering the investment that I put in. It also looks like someone unstaked and sold some OWL. Aside from this nothing seems to be happening whatsoever.

I did reduced the table a bit just showing the monthly results before 2024.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

Betfury.io (BFG)

BFG remains pretty flat with reliable dividends.

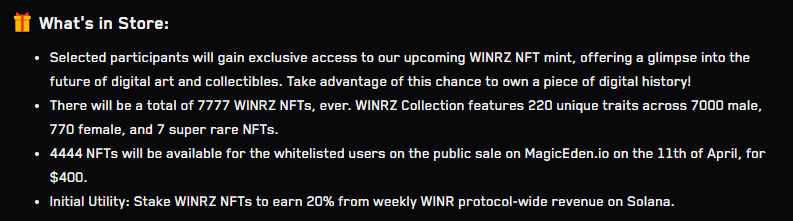

WINR Protocol

It looks like WINR will introduced WINRZ NFTs for the platform they will run out on the solana chain. As usually with this project, everything is just overly complicated and I have a ton of questions that pop up and not the time to do days of research to understand it. If you play on their site or have WINR staked you have a chance at a whitespot.

All I really see with winr is what having bought 10k WINR has given after staking it which just isn't that much so far while the price also has gone down since I bought it. I also have yet to put the effort in actually trying their products and there as lots of things that I don't understand about all of it.

Since staking my WINR 7 weeks ago I earned 3.66$ which isn't worth claiming and converting given the transaction fees that likely come with it and it would come down to 2.7% APY.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +76.59% APY |

| Betfury.io (BFG) | +31.85% APY |

| Rollbit.com (NFTs) | +117% APY* |

| Owl.Games (OWL) | +60.18% APY |

| Sx.Bet (SX) | +17.51% APY |

| Defibookie.io (NFTs) | +291% APY |

| WINR Protocol (WINR) | +5.39% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

With some delay, it looks like the bull market for GambleFi dividends got underway getting a record-high 565$ earnings in a week for holding 5M SBET | 500k BFG | 3 Rollbot NFTs | 600k OWL | 25k SX | 13 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|