Exchanges Are Running Dry

We are now half of the way towards the next halving, in around 700 days bitcoin block rewards will be cut from 6.25 to 3.125 and with that supply squeese, we normally see a price run-up that triggers the next bull run. While very few consider this and focus on short-term pricing as a result, those who see what's coming are starting to consolidate their positions as the price trades sideways.

I expect the sideways and range-bound trading to continue for the next two years and there might be several capitulations as people grow impatient and sell or try to leverage trade these ranges.

The 2500 - 3000 satoshis to a dollar range will look like a bargain once 2024/25 roles are around and you probably won't bag 1000 sats for a dollar by then.

Bitcoin on exchanges

To look for proof that consolidations are taking place, you only have to look at what exchanges are doing. Bitcoin on exchanges has nose-dived from a peak of nearly 3.3 million coins to close to 2.4 million coins a rate lower than 2018 and when you consider that in the last 4 years 1.3 million new bitcoin was minted it just goes to show that the price is not reflecting the reduction in the float.

Consider the fact that most normies don't cold storage or self custody and you can track that as people who are likely to sell.

As more people realise the safety of self custody and the risk of exchange rehypothecation, we will only see more supply pulled offline and exchanges will start to run dry.

Available #Bitcoin on exchanges keeps on nose diving! pic.twitter.com/2lnqWLRRsp

— Crypto Rover (@rovercrc) May 5, 2022

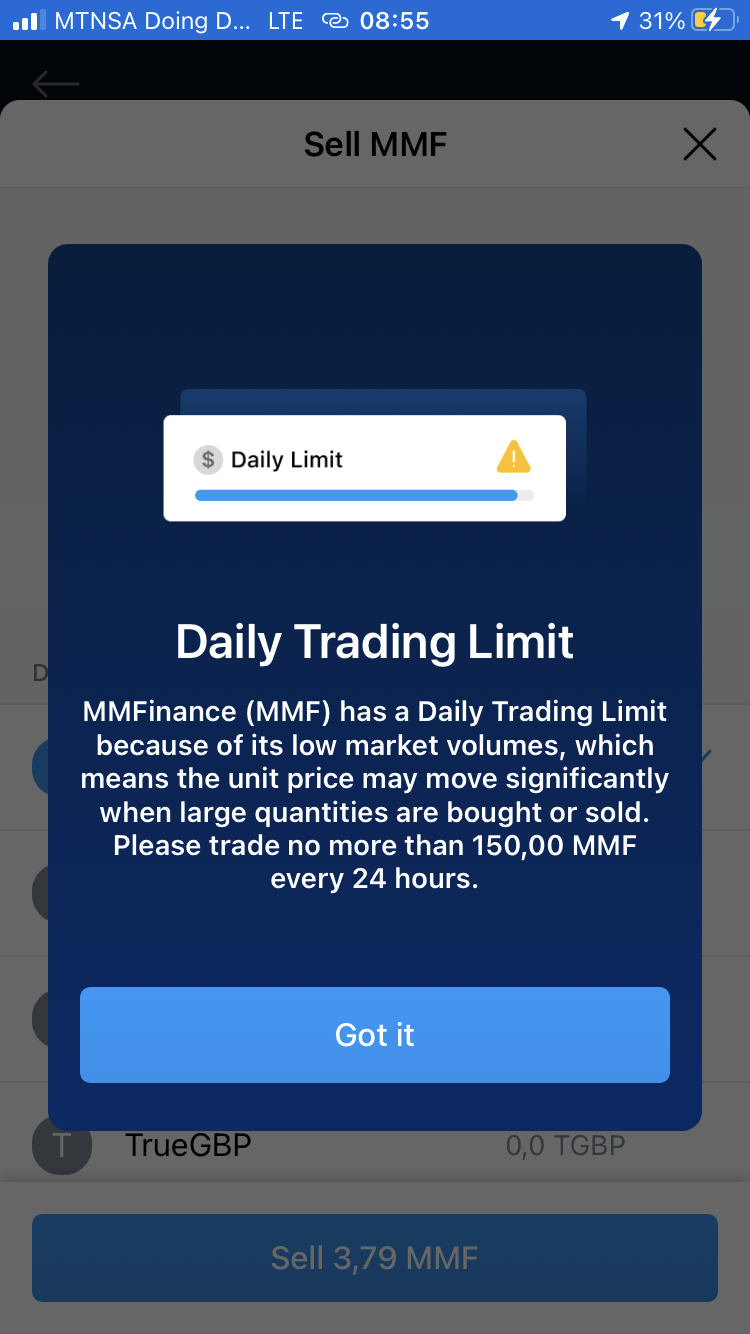

Crypto.com limiting dumping

Look at notifications on crypto.com these days trading a shitcoin for bitcoin, they're actively notifying you that this is a low liquidity trade and limiting trade volumes as not to freak out the market if their order book should implode from 1 or 2 big sales.

Coinbase taking out bitcoin loans

As for coinbase the grand daddy of shitcoin casinos, they've already started to backstop their BTC shortcomings by taking out a bitcoin loan. Coinbase is obviously in need of bitcoin liquidity for some reason, probably to mark make and backstop all their shitcoin pairs, hoping they can make fees to build up their treasurey over time.

Coinbase And Goldman Sachs Join Forces On First Bitcoin-Backed Loan https://t.co/9y2eKaKzzz

— Michael (@val5linx) May 6, 2022

Yields on bitcoin have dropped

Another sign of bitcoin is hard to come by is the rates on bitcoin interest accounts. We've seen BlockFi, Luno, and LEDN reduce their interest rates on bitcoin as they can't clip the GBTC premium anymore or use futures to pocket that contango trade.

Leverage trading has also slowed down which is a huge income stream for exchanges, which they use to pay back their interest obligations along with fees they earn through their market making.

Over the last few months, changing market conditions have led to interest rates for savings accounts in both Bitcoin and USDC going lower across the industry.

— Mauricio (@cryptonomista) May 4, 2022

At @hodlwithLedn we always like to be transparent about these changes and how they impact the interest rates for Savers

The way I see it is those listening to the noise will be distracted by the price while those looking at the signal will be buying while the liquidity is still there to acquire at these prices. Eventually, as supply tightens, and the float dries up, prices are forced upward.

Have your say

What do you good people of HIVE think?

So have at it my Jessies! If you don't have something to comment, "I am a Jessie."

Let's connect

If you liked this post, sprinkle it with an upvote or esteem and if you don't already, consider following me @chekohler and subscribe to my fanbase

| Safely Store Your Crypto | Deposit $100 & Earn $10 | Earn Interest On Crypto |

|---|---|---|

|  |  |

Posted Using LeoFinance Beta

I'm buying all the way down. 😁

Posted Using LeoFinance Beta

Lol catching the falling knife, me too, watching all the shitcoins break apart is also a sweet sweet release. I enjoy watching scams unravel

Same here

those exchanges with hypothecated BTC are going to be caught when the tide comes in...

You already cant withdraw UST or Luna.. which crypto is next..

absolutely, few people realise this, I wouldn't trust a single cent with an exchange

57c for a HIVE is a steal!!!

Lol, $31,147.05 for a bitcoin is bascially giving it away at this point

Yes, I really want to see its multiple growth and tripling, but there are still many waves, ups and downs of the BTC to be seen.

Posted Using LeoFinance Beta

Absolutely, bitcoin will keep moving a long, how people value it and how they deploy capital to it is their business plenty of people who will think they are smarter than the system will be humbled

Yes sometimes. it looks like what you said ... humiliation)

Posted Using LeoFinance Beta

Yay! 🤗

Your content has been boosted with Ecency Points, by @chekohler.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more