Don't Ignore The Troubles In China's Real Estate Sector

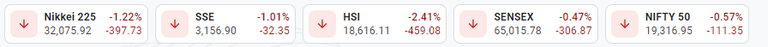

Stocks in Asia are down a lot after it looks like the downturn in China housing has begun to dampen the mood here a little bit.

All eyes are on Country Garden which was previously China's largest private-sector developer by sales. It faces default and the latest economic data for the country shows little promise of a recovery in growth. Not a good mix which is why their shares were down as much as 12% earlier today.

Is This China's 2008 moment?

The world was a very different place 15 years ago, before the financial crisis. Housing was the culprit back then as it appears to be now. Locking down the country for three years and then not providing much of a stimulus to re-invigorate animal spirits seems to be causing a lot of economic damage.

Couple that with the even increasing restrictions on exporting chips to China and diversifying supply chains to be less dependent on a single point of failure, it really is the perfect storm.

China is still too big to ignore

China is still home to about 1/6th of the world's population, making it too big to ignore. It was only a couple of years ago that everyone was pinning their hopes on the Chinese economy to lift the global economy, but now it is proving to be a drag instead.

If you're a contrarian, now might be time to do some bargain hunting in China. Just like no one wanted to touch Meta at the end of last year, only to see it go up more than 100% this year, the best times to buy are often when there's blood on the streets. Stay away from real estate, though.

Yay! 🤗

Your content has been boosted with Ecency Points, by @charcoalbuffet.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more