What is the purpose of Bitcoin: Speculation or dollarization?

The U.S. dollar has made its mark across the globe, with various countries integrating the United States currency alongside their own. So, what is dollarization? The dollarization definition incorporates the U.S. dollar alongside a local, fiat currency, and often occurs when the currency in place has lost its value.

But technology has advanced and with Bitcoin and other cryptocurrencies, we’re faced with a more futuristic form of money. Experts debate whether the purpose of Bitcoin is that of a speculative asset, meaning Bitcoin is riskier than most other investments.

However, a speculative investment isn’t what Bitcoin’s creator, Satoshi Nakamoto, had in mind when he presented the Bitcoin project. Nakamoto envisioned Bitcoin as an alternative to traditional fiat currencies.

Twelve years after its inception, the world is still deciding what Bitcoin does as well as how it should be classified. What are Bitcoin’s purpose and function? Could the world’s first cryptocurrency be considered a speculative asset due to its volatility, or will Bitcoin be a new form of dollarization?

Moreover, why do people think Bitcoin is only about speculation? Will cryptocurrencies begin to exist alongside traditional fiat or replace certain currencies entirely?

This article will explore the current state of Bitcoin and whether the cryptocurrency has what it takes to replace the dollar or should simply remain in the background as a more speculative investment.

The original purpose of Bitcoin

As all cryptocurrency enthusiasts know, Bitcoin’s white paper was released in 2009 by the pseudonymous Satoshi Nakamoto. What does Bitcoin do? According to the document, Nakamoto intended Bitcoin to be a “purely peer-to-peer” version of electronic cash. The paper detailed that Bitcoin was to be an anonymous alternative payment system, removing the need for third-party involvement.

However, over a decade after Bitcoin’s inception, whether Bitcoin achieved Nakamoto’s initial, bold vision is arguable. After all, the Bitcoin network suffers from scalability issues and high transaction fees, leading many to believe that Bitcoin is more of a store of value than an alternative form of cash.

Undoubtedly, Bitcoin has risen in value to succeed competitors like gold (a commodity) in terms of price. But when it comes to Bitcoin’s use as alternative cash, Satoshi’s vision might not have been fulfilled. Bitcoin struggles to process more than seven transactions per second (TPS) and still suffers from high fees during times of network congestion.

As of March 2021, Visa was processing an average of 84 million transactions per day. In that same time frame, Bitcoin has only been processing an average of 350,000. For an attempt to create a global alternative to fiat, 350,000 daily transactions is a significantly low threshold to reach.

With over 12 years in existence, Bitcoin’s lack of substantial daily transaction value leads many to argue that the world’s first cryptocurrency is meant to be a store of value rather than an alternative currency. While Bitcoin indeed contains some features relevant to a currency status — such as its use as a medium of exchange — scalability issues, among other problems, appear to prevent Bitcoin from reaching new heights as a global alternative currency.

What useful purpose can Bitcoin serve in the long term?

A reliable store of value is an asset that slowly appreciates as time goes on. Gold, for example, is probably the most popular store of value. Many consider Bitcoin to be a form of “digital gold.” But, what is the aim of Bitcoin or for what purpose Bitcoin is used?

Looking at Bitcoin’s overall price history, one could argue that the world’s first cryptocurrency is a fairly reliable store of value. Bitcoin started at less than a dollar and has slowly risen in value every year since its inception. In 2010, Bitcoin couldn’t break through to even one dollar. In 2013, Bitcoin soared to $220 before falling back down below $100. By 2017, Nakamoto’s assets broke $20,000 before soaring above $64,000 in 2021.

Part of Bitcoin’s price success is due to long-time holders, or HODLers. HODLers are Bitcoin investors with no intention of trading their Bitcoin. HODLers who hold millions in Bitcoin are called whales and can single-handedly shift the asset’s market with one sell-off. But, dedicated whales understand they keep Bitcoin’s price high and appear to have no intention of selling for a long time. Similar to gold investors and others who put money into a store of value assets, HODLers view Bitcoin as an ever-appreciating form of money.

When the COVID-19 pandemic struck in early 2020, nearly every financial asset saw a price crash as investors withdrew their money out of fear. That said, over the years, investors poured money into Bitcoin and gold at an alarmingly similar rate.

While a positive correlation between Bitcoin and gold could lead one to believe in the cryptocurrency as a store of value and a haven asset, the two assets saw an inverse correlation the very next year.

A positive correlation exists when two variables move in lockstep; that is, in the same direction. A safe-haven asset is a financial instrument that is expected to keep or even increase in value during an economic crisis. Because these assets are uncorrelated or negatively linked with the overall economy, they may appreciate in the case of a market crash.

Institutionally, a fair number of corporations believe that Bitcoin’s purpose is to be the next potential global reserve asset. Both the JPMorgan Chase and Blackrock financial groups believe the first cryptocurrency is digging into gold’s market share, for example.

Conversely, the chief economist and global strategist of Europac, Peter Schiff, claims Bitcoin is just a “giant pump and dump.” In mid-2021, Schiff publicly debated with Anthony Scaramucci, the founder of the SkyBridge investment firm. The former stated that gold has a use case even 1,000 years from now, due to its physicality, implying that another asset could easily replace Bitcoin in the short term.

Scaramucci defended Bitcoin, arguing that the digital asset’s scarcity is more than enough reason for it to hold value in the long term. Unfortunately for Bitcoin, Schiff skewed the audience toward a 51% belief in gold, with only 32% favoring Bitcoin.

Schiff’s argument has a fair point. Historically, all stores of value, such as property, gemstones, and art, have all been physical items that stand the test of time. The digital nature of Bitcoin could mean that if everyone moves on from the first cryptocurrency, it serves virtually no purpose and might as well no longer exist. Meanwhile, physical assets have other use cases, which are part of their value.

As the world moves into a more digital future, however, Bitcoin believers argue that a digital store of value is a progression of what came before. After all, Bitcoin is a globally accessible asset with over $1 trillion in liquidity. Bitcoin can’t erode over time, and the asset’s scarcity could be positive for Bitcoin price speculation or Bitcoin investment speculation as long as users invest in the cryptocurrency.

The case for Bitcoin as a currency

Despite Bitcoin’s constant volatility, an argument could be made that Bitcoin exists as a currency in the way that it was originally presented by Nakamoto.

After all, on paper, Bitcoin is a relatively easy asset to acquire. Potential Bitcoin holders don’t need a bank account or to deal with a controlling third party to work with Bitcoin. On the global level, Bitcoin’s financial infrastructure is already in place. Merchants can simply choose to start accepting Bitcoin, assuming their local regulators abide by cryptocurrency, and anyone in the world can come and easily spend.

But the case for a currency is based on more than just the ability to spend it. When held against the three elements of traditional currency — store of value, medium of exchange, and unit of account — Bitcoin is not considered as an alternative form of cash by its opponents.

Bitcoin as a medium of exchange

Bitcoin fits somewhat well into the medium of exchange description. The world’s first cryptocurrency is already accepted for goods and services on various websites and even some local businesses in a swathe of countries.

Unfortunately, much of Bitcoin’s history as a perceived medium of exchange is in its dark web usage. Most notably, Bitcoin was the currency of choice for users acquiring illegal narcotics and engaging in dangerous activity on a website called Silk Road.

That said, the beliefs of bad actors as to the purpose of Bitcoin as an anonymous currency were flawed. Governments ended up taking Silk Road down after using various tracing methods within Bitcoin’s public ecosystem. Due to Bitcoin’s lack of anonymity, one could argue that Bitcoin was being utilized as a medium of exchange on Silk Road as goods and services had a certain set of values within the platform and Bitcoin was used to pay for said goods and services.

Even more so, Bitcoin is fungible, meaning every Bitcoin is interchangeable with another, similar to the U.S. dollar and other fiat currencies. Some countries are even beginning to adopt Bitcoin as a medium of exchange. In September 2021, El Salvador became the first country to adopt Bitcoin as a legal tender. President Nayib Bukele believes Bitcoin will assist the 70% of El Salvadorans who lack access to proper banking.

But even if El Salvador’s government believes Bitcoin is a great addition to their use of the United States fiat, 70% of its citizens are against the tenderization of Bitcoin. Many Salvadoran citizens don’t even know how to use Bitcoin, so the El Salvadorian government must educate the people to see if Bitcoin as legal tender alleviates their distress.

Standing in the way of Bitcoin adoption are the network’s scalability issues. Currently, the Bitcoin network can only process seven transactions per second (TPS), compared to Visa’s 24,000. Certain layer-two solutions, such as the Lightning Network, are working to solve Bitcoin’s scalability issues.

While Lightning Network is experiencing some level of adoption, it remains to be seen if the project can work at scale as the Bitcoin network cannot be considered a medium of exchange if Bitcoin can’t increase its average TPS.

Otherwise, it’s worth noting that Bitcoin is a deflationary asset due to its hard cap of 21 million coins. Considering Bitcoin is believed to go up in value as the asset gets rarer, the cryptocurrency could very well be used as a medium of exchange similar to the gold standard when it was in place.

But then again, if businesses fail to adopt Bitcoin as a daily form of payment, Bitcoin’s deflationary attribute would lend itself more to a store of value than an alternative currency.

Bitcoin as a unit of account

Bitcoin’s volatility makes it difficult to exist as a unit of account. After all, an asset that can fluctuate tens of thousands of dollars in one day can hardly be issued into a local economy, let alone be considered a reliable way to transact value.

A product might be worth $0.00034 in Bitcoin one day, only for the product’s worth to completely change in the next hour due to Bitcoin’s constant price swings.

It’s also hardly possible to determine Bitcoin’s actual value at any given point. Cryptocurrency exchanges list different prices for Bitcoin at any given moment, with price disparities as high as hundreds of dollars at a time. Retailers can’t be expected to keep up with Bitcoin’s price changes if the world can’t even agree on one price point.

Then, we have the average denomination of Bitcoin. Considering that the price of one Bitcoin is far above $10,000, let alone one dollar, how can retailers price their goods? If the price of a coffee is $0.00034 worth of Bitcoin on Tuesday and $0.000012 on Thursday, both customers and retailers would struggle to parse the coffee’s true value.

Both for accounting and convenience reasons, current financial systems around the world are presented in the simplest way possible. Asking merchants to adopt another form of confusing, fluctuating accounting in Bitcoin is unlikely to go well.

Bitcoin as a store of value

As mentioned previously, Bitcoin might be viewed best as a store of value even if there are some issues with this moniker. For one, Bitcoin speculation points toward Bitcoin’s volatility, leaving citizens hesitant to view Bitcoin as a reliable long-term storage method.

When people invest in gold, they do so expecting the precious metal to increase in value slowly from its time of purchase. At the very least, gold investors expect to be able to sell back the metal at a relatively similar starting price.

Bitcoin, on the other hand, can drop in price over 100% from its time of purchase. While Bitcoin’s volatility can lean positively as well, such a high level of risk does not bode well for Bitcoin’s future as a store of value.

We must also consider Bitcoin’s lack of physical representation. Gold, art and other stores of value can be hidden or securely stored for the time they’re held. Bitcoin can be securely stored in some ways, such as a hardware wallet, but the majority of investors hold Bitcoin on a cryptocurrency exchange or another internet-connected wallet. The constant connectivity of online wallets leaves Bitcoin at a constant risk of theft that’s completely out of the holder’s control.

Bitcoin insurance exists to some degree, but the level of accessible insurance depends entirely on where the user holds their cryptocurrency. Even if an investor finds the most secure way to store their Bitcoin, traders are still at the mercy of Bitcoin’s drastic volatility. All of this assumes that Bitcoin remains in demand. While the cryptocurrency’s limited supply is expected to create constant demand if a better crypto project comes into play, what does everyone do with their now useless Bitcoin?

The case for Bitcoin as a speculative asset

Regarding Bitcoin’s first 12 years in existence, the asset can be considered speculative. While that classification of Bitcoin can certainly change in the future, the cryptocurrency’s unpredictable nature makes it hard to describe as anything but speculative.

Rosa Rios, the former treasurer of the United States, has argued that most cryptocurrencies, including Bitcoin, are entirely speculative as the majority of cryptocurrencies don’t serve a primary purpose. Rios cited Ripple as less than speculative, considering the asset is meant to facilitate cross-border payments around the world.

Interestingly, the chair of the United States Securities and Exchange Commission, Gary Gensler, has claimed Bitcoin is primarily a speculative store of value. Gensler stated that Bitcoin and other cryptocurrencies fail to serve citizens in the same way as the dollar. Still, we should view Bitcoin as an unique asset class rather than an asset that can enact widespread dollarization.

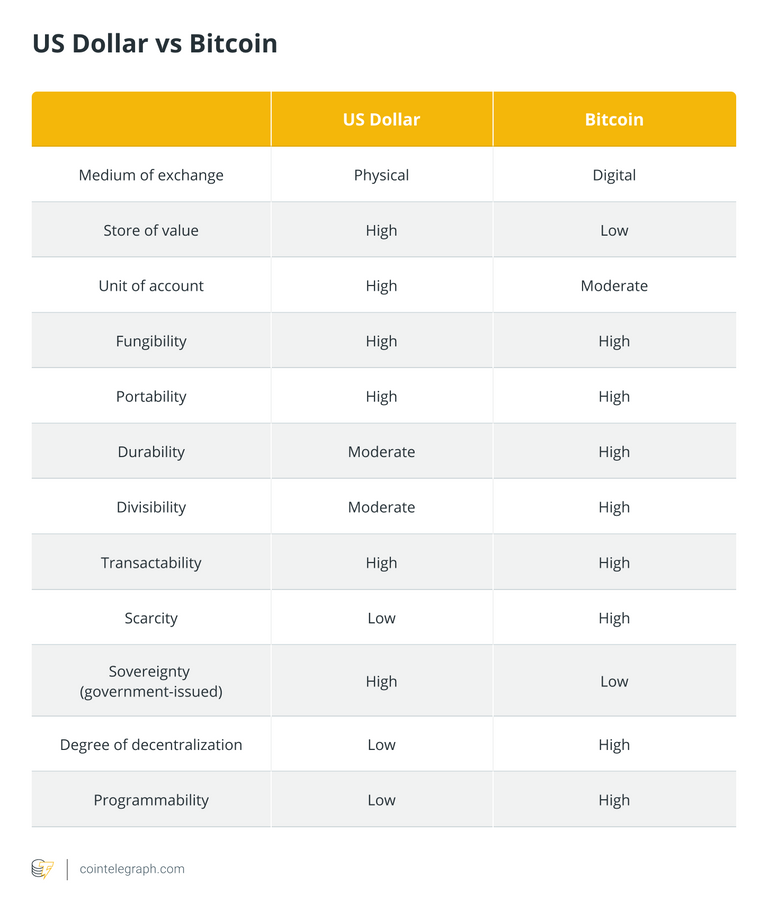

Bitcoin vs. the dollar

The promise of a digital alternative to traditional currency, uncontrolled by a government or central party, is polarizing for various reasons. For one, it’s easy to understand why a merchant may not want to accept Bitcoin vs their local fiat. If a merchant accepts Bitcoin for a good or service, the Bitcoin can suddenly tank in value the very next day. Should a business be struggling, they’re likely to want the stable income provided by the established dollar.

But Bitcoin proponents could argue that not accepting Bitcoin implies that Bitcoin will only go up in value as it becomes rarer, stating that Nakamoto’s cryptocurrency is a deflationary asset. On the contrary, the U.S. dollar is inflationary and will drop in value over time. Over the long term, assuming demand for Bitcoin continues to grow, Bitcoin may very well be the long-term asset to hold.

Let's understand the differences between the dollar-based monetary system and a global monetary system based on Bitcoin.

Of course, should Bitcoin become the asset to take over the U.S. dollar in other countries, there would have to be an overhaul of regulation. Bitcoin is a global cryptocurrency, after all, and monetary policy would have to change to abide by Bitcoin’s global reach. There would need to be tax changes, value adjustments based on different fiat currencies, and a unification of the current global financial system.

This isn’t to mention that a government can’t print more Bitcoin like they can a dollar. The limited amount of Bitcoin could mean that millions of people can’t even hold one single BTC. Could Bitcoin’s limitations cause financial strain similar to that of the gold standard? We can expect the same problems that applied to the gold standard to apply to Bitcoin. It’s because of these reasons, alongside Bitcoin’s scalability issues and the asset’s lack of convenience, that Bitcoin may never experience dollarization in the way the United States dollar has.

Posted Using LeoFinance Beta

They literally have attempeted my murder and are trying to kill me with V2K and RNM. Five years this has been happening to me, it started here, around people that are still here. Homeland security has done nothing at all, they are not here to protect us. Dont we pay them to stop shit like this? The NSA, CIA, FBI, Police and our Government has done nothing. Just like they did with the Havana Syndrome, nothing. Patriot Act my ass. The American government is completely incompetent. The NSA should be taken over by the military and contained Immediately for investigation. I bet we can get to the sources of V2K and RNM then. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism ..... https://ecency.com/gangstalking/@acousticpulses/electronic-terrorism-and-gaslighting--if-you-downvote-this-post-you-are-part-of-the-problem

They literally have attempeted my murder and are trying to kill me with V2K and RNM. Five years this has been happening to me, it started here, around people that are still here. Homeland security has done nothing at all, they are not here to protect us. Dont we pay them to stop shit like this? The NSA, CIA, FBI, Police and our Government has done nothing. Just like they did with the Havana Syndrome, nothing. Patriot Act my ass. The American government is completely incompetent. The NSA should be taken over by the military and contained Immediately for investigation. I bet we can get to the sources of V2K and RNM then. https://ecency.com/fyrstikken/@fairandbalanced/i-am-the-only-motherfucker-on-the-internet-pointing-to-a-direct-source-for-voice-to-skull-electronic-terrorism ..... https://ecency.com/gangstalking/@acousticpulses/electronic-terrorism-and-gaslighting--if-you-downvote-this-post-you-are-part-of-the-problem

Good paper.

I'd argue that Bitcoin (unlike HIVE or XRP) is not really fit to be retail currency as it is too slow and not capable of processing anywhere near sufficient number of transactions to support retail use.

Great article, only thing I would add is the Stock 2 Flow chart and only due to the fact of how on point it has been for several years now with a call of $1,000,000 Bitcoin by 2028! !1UP !PGM !CTP !PIZZA !Giphy bitcoin !meme !lolz

BUY AND STAKE THE PGM TO SEND A LOT OF TOKENS!

The tokens that the command sends are: 0.1 PGM-0.1 LVL-2.5 BUDS-0.01 MOTA-0.05 DEC-15 SBT-1 STARBITS-[0.00000001 BTC (SWAP.BTC) only if you have 2500 PGM in stake or more ]

5000 PGM IN STAKE = 2x rewards!

Discord

Support the curation account @ pgm-curator with a delegation 10 HP - 50 HP - 100 HP - 500 HP - 1000 HP

Get potential votes from @ pgm-curator by paying in PGM, here is a guide

I'm a bot, if you want a hand ask @ zottone444

Via Tenor

Credit: ianmcg

Earn Crypto for your Memes @ hiveme.me!

lolztoken.com

You ain't seen muffin yet.

Credit: reddit

@cesarcesarpoland, I sent you an $LOLZ on behalf of @dynamicrypto

Use the !LOL or !LOLZ command to share a joke and an $LOLZ

(1/2)

You have received a 1UP from @dynamicrypto!

@vyb-curator, @pob-curator, @neoxag-curator, @pal-curatorAnd they will bring !PIZZA 🍕

Learn more about our delegation service to earn daily rewards. Join the family on Discord.

PIZZA Holders sent $PIZZA tips in this post's comments:

@dynamicrypto(1/15) tipped @cesarcesarpoland (x1)

You can now send $PIZZA tips in Discord via tip.cc!

Congratulations @cesarcesarpoland! You have completed the following achievement on the Hive blockchain and have been rewarded with new badge(s):

Your next payout target is 50 HP.

The unit is Hive Power equivalent because post and comment rewards can be split into HP and HBD

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out the last post from @hivebuzz:

Support the HiveBuzz project. Vote for our proposal!