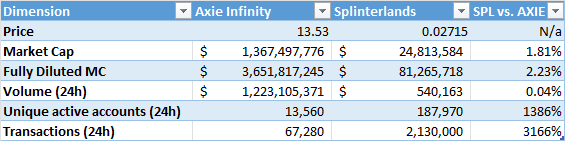

Quick analysis of high level market metrics for AXS vs SPS

Saw $AXS was pumping, wasn't sure why (and couldn't find out) and decided to just do a quick analysis of some fundamental metrics comparing $AXS and $SPS.

What I show here is a very basic comparison of MC, fully diluted MC, volume, and then some usage metrics (unique active accounts and transactions). Both of the usage data points coming from Dappradar; note that the figures you see here for Splinterlands are lower than what we can find on Peakmonsters, but still on the same order of magnitude and are sufficient to make my arguments. I wanted to use the same data source for both games to at least compare them apples to apples based on source.

Anyways the quick summary is as follows:

- SPS is just ~2% of AXS's market cap (current and fully diluted)

- SPS is 0.04% of AXS's volume, which is even more pronounced today due to the increased volume on AXS which is causing (and/or caused by) the current AXS pump

- In terms of daily active accounts, Splinterlands is 14x larger than Axie Infinity

- In terms of transactions, Splinterlands is 32x larger than Axie Infinity; this is probably a testament to Hive, which enables free transactions via the resource system

I'm not an expert on Axie, but looking at these metrics really makes me feel there's something fundamentally wrong with that valuation. What do you think?

I think when people see way more transactions/users but dont see the volume that should be associated with it they think somethings up. It often feels like SPL would rather have 4 people running a million accounts rather than 50k people running 50k accounts which TBH makes no sense to me. If you scream you cant do anything about fair play and bots because of decentralization but then are okay when only a few people owning the majority of your assets/tokens then what part of that is decentralized.

Wow need to stack and stake some more SPS!