Inverted Yield Curve: How does this affect crypto and metals?

For the record, I'm not an expert on macro, obviously. However, even I am aware that an inverted yield curve is something that precedes unfortunate market events.

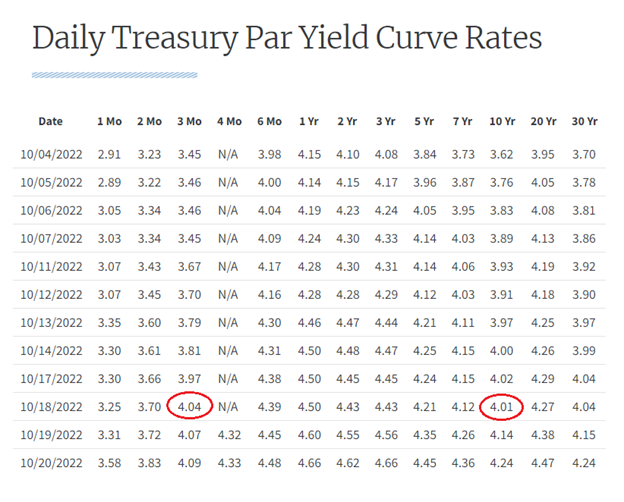

Economic 101: When the Fed raises the fed funds rate, what they are doing is essentially raising the short-term interest rate by selling a bunch of treasury bills with maturities of less than one year. The yield of a fixed-income or a government bond is inversely related to the price of the security. This basically means the higher the price of a bond, the lower the yield of the bond. Since JayPow and his team dumped so many bills, the price fell, leading to a rise in yield (short-term interest rate).

As the price of bills decreases and short-term interest rates increase, the long-term interest rates should also increase. Generally, this is the case. However, the free market allows the unusual flattening of the yield curve. Or worse, the inversion of the yield curve. This market phenomenon is caused by speculators selling short-term bills (further rise in short-term yield) and buying long-term bonds (fall in long-term yield). Don't quote me on this, but I think this is caused by the belief that the Fed is going to raise the short-term rate again and again, which causes the price of bills to dump. So the logical course of action is to dump the bills before the Fed and buy more secure long-term bonds.

What does this mean for the crypto and precious metals markets?

The inversion of the yield curve is an indicator of a recession or a more severe market slump, a depression. Although the likelihood of an economic depression is low, the possibility still exists, which is a topic for another day.

With the slight inversion of the yield curve, the U.S. is officially one step closer to a recession. In reference to my previous post: For the market participants, a recession is considered bullish (for everything that is short dollars). Crypto, precious metals, and even NASDAQ100 have a very high correlation due to the dominance of the dollar in this bear market. We're all waiting for the time when the Fed has no choice but to weaken the dollar by printing money or increasing the USD liquidity to save the fragile financial system from crashing. I guess you could argue we're one step closer to the bottom of this bear market since the Fed will likely pivot if the alternative is an economic depression.

(All ideas expressed above are only my opinions and should not be taken as financial advice. My knowledge of macroeconomics is limited, please correct me if I make any mistakes in this post.)

Yay! 🤗

Your content has been boosted with Ecency Points, by @blockbunnyorg.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

I agree with your saying. With the printing of more money or increased liquidity we may enter in stagflation as well. Although this depends on the policy and coming changes in rates. Economic structure is already on decline, quick turns can be catastrophic as well. This is the time, the policy makers must show their excellence.

I guess being a policymaker is not an easy job🤣

p.s. Well, the Fed was having a difficult time, but I guess not anymore, since the Q3 GDP report (+2.6%) just came out, and now they can raise interest rates further without fear of a recession.