The Bull Market? The FED, Stocks and Crypto

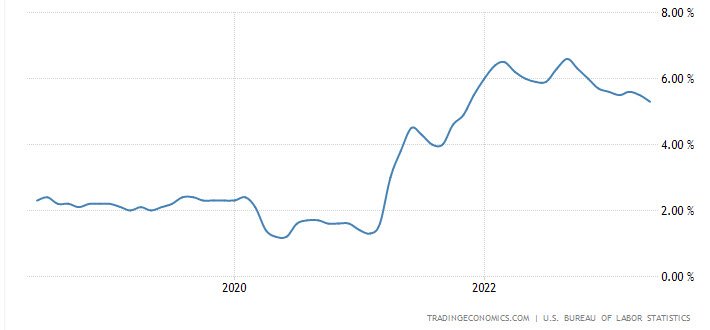

Today the big news out of the markets is the Fed pausing rate hikes. However the so called "threat" of raising rates is still on the table for the rest of this year.

CPI numbers came in at a 4% value which was less than expected however still 2x higher than what it should be of the target rate of 2% or less. This means inflation is still an issue and if we look back in history this is one of the most critical times for rate hikes and pain points.

History has show us as the inflation cools down the fed backs off and even lowers rates. Then 3-6 months later inflation kicks up and is devastating to all new levels then quickly falls as virtually stocks, houses and everything just implodes for a year and then takes 10 years to recover. Are we doomed to repeat this same cycle?

To note however the CPI report does not include things deemed "necessary" such as food and energy which is sill hovering at over 5% (5.3% last month) and really hasn't moved.

With this data we are starting to see a small move in the right direction. However it's honestly not much and is still high with the potential of reversing if anything at all shocks the markets again.

Stocks

If we look over the stock market the first thing of it all might seem like it's doing rather well. I mean...

The S&P 500 is up 15% in the last year

However if you start looking at all stocks and the general economy it shows another story. Only a very select few stocks on the S&P 500 are performing well which is helping this number look great. But overall across all stocks their values have for the most part declined over the last year.

The stocks driving the S&P 500 are

- Apple

- Microsoft

- Amazon

- NVIDIA

Makes you wonder if you should simply just invest in these few companies instead of the S&P 500 index fund itself!

This shows us that only a small amount of stocks actully produce any real revenue and growth over time while all the rest fall flat. Sure you might have a win here and there but overall the chances of that are slim and many fail.

This increase has triggered a "bull market" but I'll be honest it doesn't feel like a bull market or even really look like one. Does it to you?

Maybe those days of 100%+ gains across multiple assets in crypto has spoiled me on what I think a real bull run looks like.

Housing

Housing at least in America is a big telling sign of how things are doing. It makes up the largest amount of real income and also tax money to the government above anything else.

If we take a look at this some rather odd but understandable things are happening. The first is people simply are not selling and moving. That's because many are locked in a 2% rates while new rates are 7% it would be foolish to move and take on a 5% rate hike to what you owe including sky rocketing house prices.

A $250,000 mortgage would run you $1,041 a month at 2.9% while moving and taking on that same amount mortgage would land you at a whooping $1,752 a $700 a month increase or $8,400 a year coming out of your pocket every year just for moving.

This goes to show you why things have remained rather stagnate in the housing market and why home prices really haven't come down.

Rental incomes are also looking better now as well in terms of major construction opening up tons of new rental properties.

What we will most likely see is the FED increasing the rates by end of year around the 5.5%- 6% this is still sending shock waves into the stock market. It means the stock market is going to be a rough bet for the rest of the year. However that means next year we could actully start to see things starting to return to "normal"

What are you thoughts on all of this and the next bull run?

Posted Using LeoFinance Alpha

We're mostly banking on next year to return some normalcy. But normally, the whole economic System seems to be going through a lot. I don't know how it works in the US. The ripple effect has been really crazy

This thing put a negative effect on bitcoin and we are dipping since today's morning.

I still keep buying the SP500 even in the market condition, and I avoid just sticking to the top-performing stocks in the index.

Yay! 🤗

Your content has been boosted with Ecency Points, by @bitcoinflood.

Use Ecency daily to boost your growth on platform!

Support Ecency

Vote for new Proposal

Delegate HP and earn more

@tipu curate

Upvoted 👌 (Mana: 9/49) Liquid rewards.

Thank you!