My earnings from dCity game

It is still the first week of the new month and I'm not done with sharing my earning reports. dCity being one of the first few games on Hive Engine is still one of the best games to provide consistent income to investors. The game provides rewards to the holders based on their holdings. I have been holding my assets for a long time and have not sold anything. I have also been holding the SIM rewards I have been getting from the game.

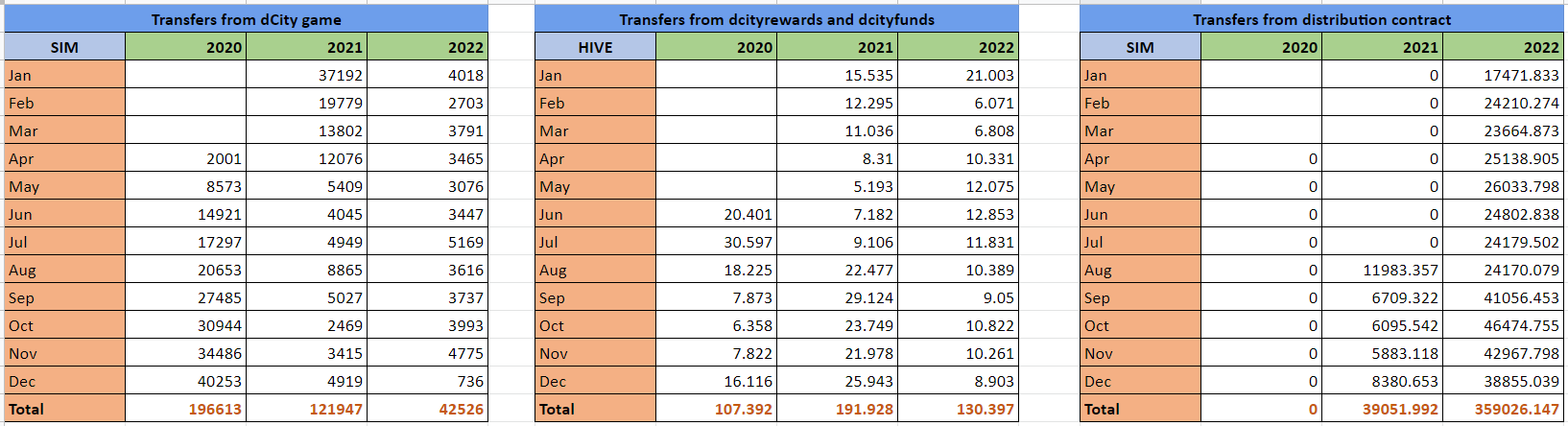

Right-click and open the image in a new tab to view it better

From what I noticed the rewards from the game have been reduced in the last month. Compared to the previous month the rewards in the month of December were very poor. I guess I should spend some time understanding the game mechanics. Otherwise, it is not going to be great next month too. I also did not invest anything into the game in the last year. Only during the initial days, do I continuously invest. Anything I'm earning after that is all just a bonus.

The rewards are also in the form of Hive tokens. The game transfers tokens in the form of Hive to SIM holders. It is said that the APR is very good for holding SIM but I'm not sure if the drop in the price of SIM is also considered for the calculation of APR. Most of these APR providers miss that. Here again, the rewards were a little less compared to last month. I guess the price of Hive should be the reason for that. As the price of Hive improves the price of SIM should also improve and there should be better rewards if I'm not wrong.

The third category of rewards is the distribution rewards for holding SIM in the liquidity pool. This again dropped because the quantity of SIM on the pool would have reduced because of the bad market conditions. I hope this all becomes good after the price improves. I'm also worried a little about the impermanent loss. If these rewards are not good then in addition to this if there is going to be an impermanent loss, then it is again not good. I'm also thinking about when I should book my profits from SIM. The price of SIM is not good right now. Maybe I should hold the SIM tight and sell them when the price improves.

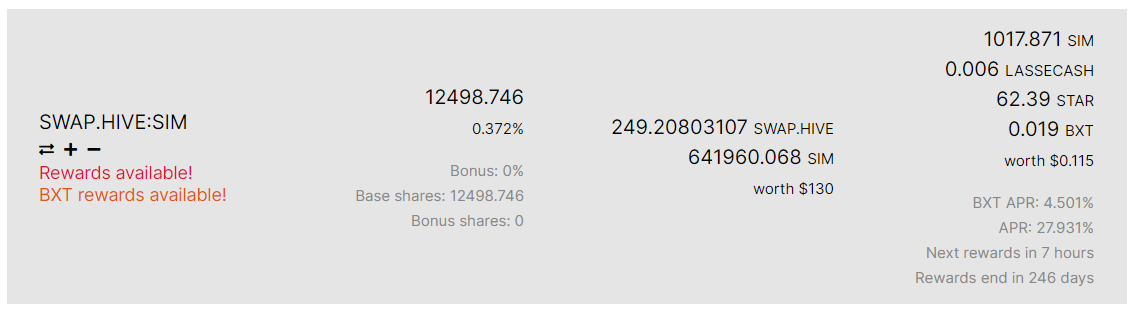

This is my current holdings in the liquidity pool. I was thinking if it would be a good idea to push my liquid SIM further to the liquidity pool itself instead of having them in my wallet. While writing this article I added my additional SIM to the pool itself. Hope the rewards would be better for adding more liquidity. Let's see.

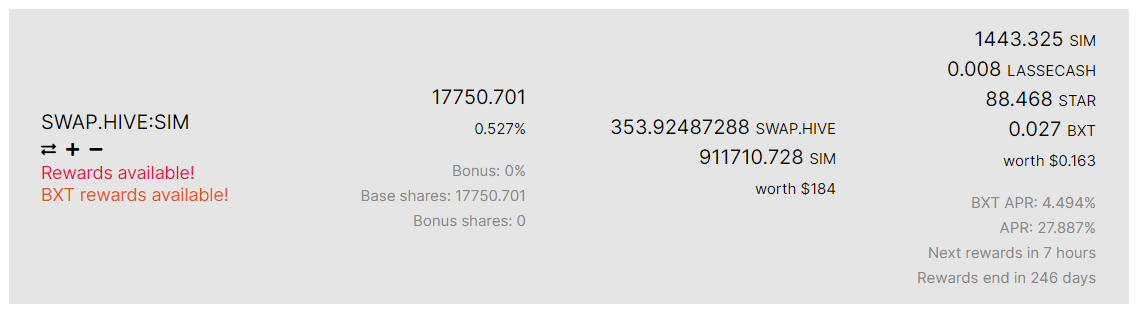

This is now my new position in the liquidity pool after adding the additional liquidity. Maybe I should push my SIM for one more month and reach 1 million SIM and later after that, I should start booking my profits.

If you like what I'm doing on Hive, you can vote me as a witness with the links below.

|

|

|

|

|

|

Of you’re not going to sell, then you might as well provide liquidity, because then you get rewards for the pool and for your sim power, as sim power also looks towards sim you have in liquidity pools.

If you think you would sell at lower prices, you should probably start selling some now, while keeping the majority in case the price recovers.

That way if the price does go down your at least sold some of your holdings at the current price point and if the price goes up then at least you still have some of your holdings left to take advantage of that.

The right thoughts!

!PIZZA

!LOL

lolztoken.com

Because they make up literally everything.

Credit: marshmellowman

@invest4free, I sent you an $LOLZ on behalf of @voltz-blag

Are You Ready for some $FUN? Learn about LOLZ's new FUN tribe!

(2/10)

Thanks!

This post has been manually curated by @steemflow from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating to @indiaunited. We share more than 100 % of the curation rewards with the delegators in the form of IUC tokens. HP delegators and IUC token holders also get upto 20% additional vote weight.

Here are some handy links for delegations: 100HP, 250HP, 500HP, 1000HP.

Please contribute to the community by upvoting this comment and posts made by @indiaunited..

This post received an extra 20.00% vote for delegating HP / holding IUC tokens.

The last year was disasters for the NFT games, the token value has been decreased massively, I have seen many games whose revenue was great in the first few months and then it started decreasing as the user base started to grow. I Don't know what is wrong, but the model is not doing well, WE have a clear Example of Axie infinity, drugwars, starsharks.

I gifted $PIZZA slices here:

@voltz-blag(2/10) tipped @invest4free (x1)

Send $PIZZA tips in Discord via tip.cc!

This post has been manually curated by @bhattg from Indiaunited community. Join us on our Discord Server.

Do you know that you can earn a passive income by delegating your Leo power to @india-leo account? We share 100 % of the curation rewards with the delegators.

Please contribute to the community by upvoting this comment and posts made by @indiaunited.

As far as I understand market conditions have little to do with the reward from the LP, not the direct reward at least as shown pm the right in your screenshots. This is merely a share of the reward pool and just takes into account your LP shares compared to the total.

Personally it's one of my favorite ways to get liquid hive, the APR just from the pool is pretty good and you get the fee rewards plus the hive rewards for sim power on top of it.

Pool rewards plus the fee rewards imo are very worth it. If you're afraid of impermanent loss though, increasing your LP position might not be the best play right? ;-)

Posted Using LeoFinance Beta

I think the liquidity pool gives you decent rewards because the SIM also counts towards your SIM power but I don't think that many people use the SIM pool.

Posted Using LeoFinance Beta