Extreme Greed In Sight — Spot Is The Safest Bet Now

Bitcoin touched $103,900.47 yesterday and a bunch of gambling addicts thought it best to open long positions, expecting a ride up.

I recall doing some financial documentation the night before and basically predicted the pump in my records. Usually when I put my finances on paper, being all-in on crypto, I often analyse the market to the best of my knowledge and make price estimates and set specific targets that align with whatever it is I was documenting for.

And this specific night, my estimation was that Bitcoin should be above $100,000, so my cost inputs were all made on that assumption.

Couples hours later, into the next morning, being yesterday, surprise(or not?) bitcoin is above 100k and sitting at 103k.

If I were a long-seller, I would have made money on that pump, but I'm not. The last time I traded long was 4 years ago, and I frankly had zero risk knowledge of what I was doing.

Since said time, I've only ever traded small short positions, often in slow market days to avoid surprises.

The Market Is At Extreme Greed

Greed level is currently at 81, based on CoinMarketCap data and we've practically been here for the last 7 days.

Like every bull market, people are about to lose a shit ton of money before it even starts. The ecosystem's market capitalization is up 47.33% in the last 30 days.

We are practically riding to $4trillion — currently $3.59t.

Our volume is also up, over $310 billion, placing us at 71% increase in the last 30days.

CMC index believes we are in an alt season. We sure are or could, but, that's essentially the problem, we are at peak greed, almost every market participant is on the lookout for pumps to ride without understanding that pumps are initiated for specific reasons.

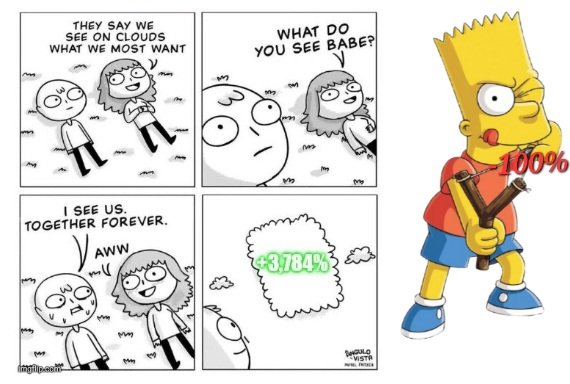

Get this, 139,255 traders were liquidated in the last 24hrs, and 9,938 were on Bitcoin trades.

This is data from CoinAnk. In USD value, $841.31M were liquidated, and longs dominated the liquidation - $698.20M.

With bitcoin specifically, $413.44M in long positions were liquidated against just $51.09M in shorts, but one would think that shorts should suffer the most following a pump.

Certainly, there are times they suffer the most, but that's not the point. When it comes to trading the bull market, the best bet is always to trade Spot and do not for any reason buy the top.

There are a couple of things I look out for but I mostly focus on volume.

Is the pump volume bigger than the average volume throughout the week? This usually feels like there's room for growth.

That said, if the volume is larger than the marketcap of said asset, it's usually an indicator of a top. Market participants are mostly exhausted physically and financially at this point.

Certainly, you won't find such an indicator for assets like Bitcoin and its trillion dollar marketcap, but it's very useful for random alts whose pumps are mostly engineered by trading firms to milk unsuspecting pump hunters.

At the end of the day, gamblers will gamble, leverage is but a member of the three Ls that will always send degenerates back to the trenches.