The 63 Banks on the FDIC "Problem Bank List" and WTF does that even mean?

63 banks are now on the FDIC Problem Banking List

"OK, tf you even mean?" is a proper response to hearing that. That's what I thought too when I read the Business Insider article. 63 banks in crisis, $517B in unrealized losses is like a holy shit number, "Ahh the sky is falling" sorta feeling. I wanted to make sense of what this even means so I decided to do some digging and post my findings in a blog, cuz some of this shit is whack, and others puts things into perspective.

The FDIC released a first quarter 2024 report with some interesting metrics and datapoints. All the news articles are laser focused on this particular line from the article, so lets explore it:

The number of banks on the Problem Bank List, those with a CAMELS composite rating of “4” or “5,” increased from 52 in fourth quarter 2023 to 63 in first quarter 2024. The number of problem banks represented 1.4 percent of total banks, which was within the normal range for non-crisis periods of one to two percent of all banks. Total assets held by problem banks increased $15.8 billion to $82.1 billion during the quarter. - FDIC Q1 2024 report

First things first: Which banks are on this "FDIC Problem Bank List"?

Let's start with the most annoying part of my search first: getting a list of the 63 banks on the "Problem Bank List". Why was this annoying? The FDIC does not publish this list publicly.

When I began writing this blog alls I wanted to do was copy/paste the 63 "Problem Bank List" bank entries and talk about it, but when I learned this little factoid it actually pissed me off even more. So now this blog has turned into a full throated bitch-fest.

Since making this information public might start runs on banks, the names of the banks are withheld from the list. While the FDIC Problem Bank List is not available to the public, the FDIC does make public how many institutions are on the list as part of its wider banking survey. - Investopedia

Now ain't that some shit.

What benevolence, what kind and judicious arbiters of truth this "Federal Deposit Insurance Corporation" is. Mic check: is FDIC another one of those "Independent Agency of the Federal Government" sorta like the CIA and the Federal Reserve? Yep, they are. Shocker.

Great, so another case of the government stealing resources from us to use to protect us from us without any oversight that's worth a shit. I'd ramble about a dying empire but it feels redundant. It really astounds me how much this shit slides due to the mass of humanities utter ignorance about such crucial matters. It's another paradox: so many people absolutely worship money as their god with little regard to the actual creation and function of money, and even less regard to actual God. Such a faith based system for such an ignorant and retarded mass of humanity, willfully accepting their financial fate it seems.

OK enough about me bitching about it. Moving on.

FDIC CAMELS Rating System

In order to get on the "Suck List" a bank has to have a CAMELS rating of 4 or 5. Just to briefly touch on that, here's what their whacky little acronym stands for:

- Capital adequacy

- Asset quality

- Management

- Earnings

- Liquidity

- Sensitivity

I'm sure entire articles could be written over each topic, but we'll leave this as an overview. Basically, the CAMELS is a rating system to see how much a banks assets suck ass. A CAMELS rating of 4 is like "whoa you kinda suck, cool it." where-as a CAMELS rating of 5 is like "ya'll dead-ass need to fix your shit pronto."

But what I honestly can't understand is why even have a damn rating if the list is private. Who even cares at that point? Damn I'd love to give you some actual metrics and real data in this blog but the entire endeavor feels like a bloated bureaucratic waste of time.

Oh what else...oh yeah, Q1 2024 Banks suffered $517B in losses

Lets write that giant number out and really chew on it. Banks suffered $517,000,000,000 in unrealized losses. Yikes. An Unrealized Loss is a valuation loss on paper. It's when an asset dips in valuation, but you haven't sold it yet. Unrealized losses could be better than realized, or they could be worse. Depends on if you accrue more losses by holding, or lose value post sale if an asset goes back up in value.

$517 billion is quite a large amount of cash, and to lose it is pretty extraordinary. A good question would be "Why?" and it all boils down to interest rates and mortgage-backed securities. Oh, by the way, now might be a good time to mention the 2008 financial fuck-up was due to sub-prime mortgage crisis which was instigated by a drastic reduction of housing prices and a housing bubble collapse.

Uh-oh. That sounds familiar.

Onwards to datapoints, the good, the bad, the ugly

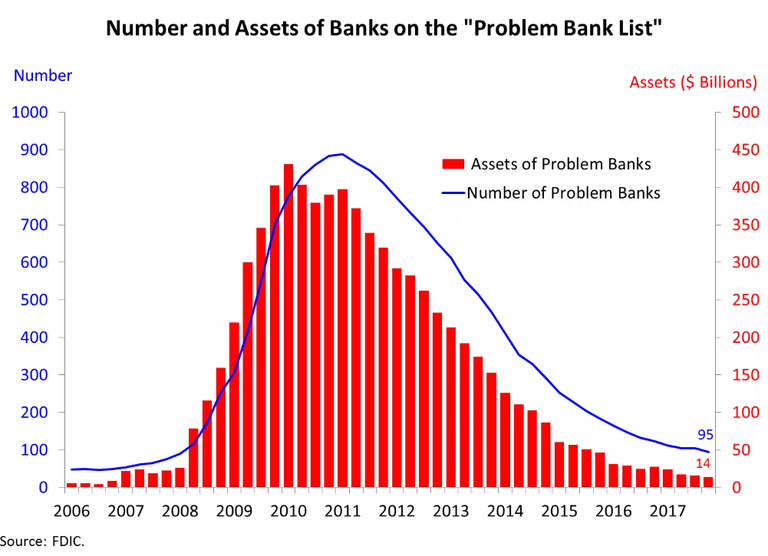

The Good: If we compare the "Problem Bank Suck List" from 2007-2010 to today, it doesn't look bad on paper. The height of the 2007-2011 crisis saw nearly 900 banks on the "Problem Bank List" which when compared to 63 of today that sounds wonderful! Right? 63 banks currently in risk of insolvency is only 1.4% of total FDIC insured banks, as reported above. That's nothing, smooth sailing.

The Bad: the rate at which it's increasing. Merely months ago, there were only 54 banks listed, and in 2018, there were 0. So the trend is trending upwards, and the trend is accelerating. With no end in the near future with the currently myopic boomer infested housing market sitting like a damn stick in the mud, and with interest rates remaining as they are, this is only going to get worse, which leads us to...

The Ugly: Remember that $517Billion? Compare that number, considered a loss, with the totals held in the problem banks listed in the chart above. $517b was more than they even held, let alone lost, in 2007-2011. The amount of digital bullshit fun-money that's being magically fucked with is insane lol, like, how is this even possible that we're allowing this as a society baffles me.

Congratulations @amphlux! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 62000 upvotes.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: