Random Spiel, Screw the GDP

a lack of incentive for dumbing financial news and what it means to a lay person because these types of news have a target audience. The problem I have with understanding Gross Domestic Product (GDP) and all things related to make it make sense to how things are going for the Philippines is the amount of extra reading it requires to get the context right. It's not that information is hidden behind a pay wall because one can just Google the answers, it's more like how the information is presented that the meaning is obscured in the financial jargon even if the information affects the economic reality of the reader the most.

When I made this post, I made it with the intention that readers could follow the train of thought with ease for the concepts to be applied to whichever country they live in. I don't think my analysis is always right as I'm just hobby reading the subject and applying what I learned. I prefer them being proven wrong as I have a general negative outlook for the economy right now.

I say screw the GDP as an expression and with growing conviction that it doesn't really matter for the average person. If the media says economic recovery and growth happening, then why does the average person feel like their living standards got worse? There is a disconnect between how much these numbers are reported and what really happens in reality, in my opinion.

Gross domestic product (GDP) is the total monetary or market value of all the finished goods and services produced within a country’s borders in a specific time period. As a broad measure of overall domestic production, it functions as a comprehensive scorecard of a given country’s economic health. - Investopedia

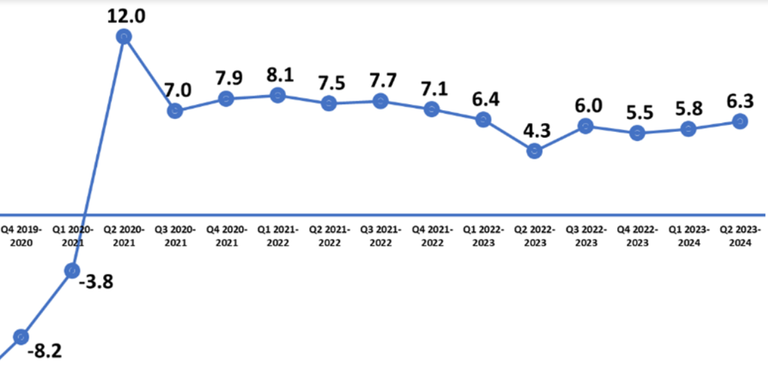

The flex is how there is consistent rise in GDP the Philippines has been experiencing.

GDP

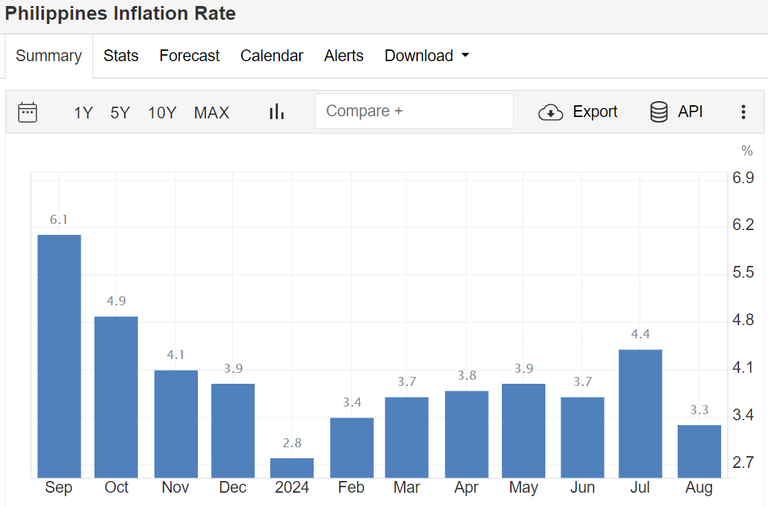

The latest inflation rate in August shows a drop to 3.3% from 4.4% of July 2024. The BSP lowered its interest rate to 6.25 from 6.5 to support the economic growth. Both are good numbers because you want the inflation rate to go down to below 2% while still propping up the economy. The decrease in interest rate would motivate businesses to loan and expand their business and create more jobs. This is on paper, a nice thing to have.

Inflation Rate

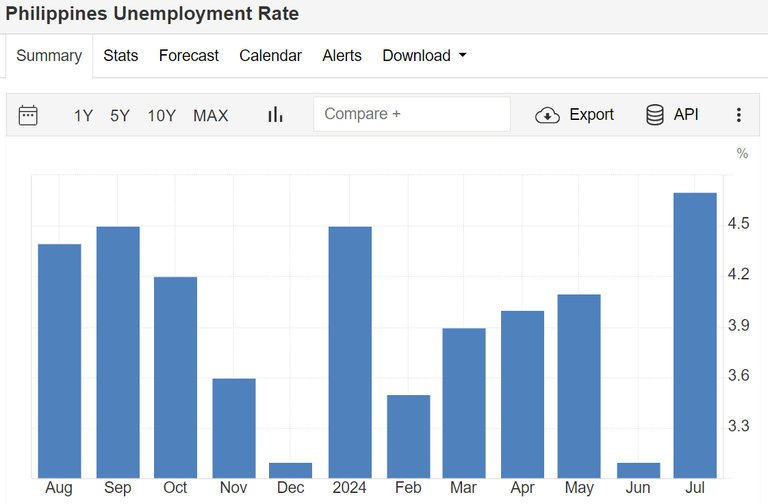

Now in comes the latest report on the unemployment rate where it rose from 3.3% to 4.7% with highlights from the Labor Force Survey.

Unemployment Rate Graph

According to this article Worked for only an hour in a week? To PH gov’t, you’re already considered ‘employed’

But how do we measure employment? It’s based on a definition from the International Labor Organization (ILO): if the person surveyed at the time has worked for at least one hour within the reference period. In the PSA’s case, it’s a week or seven days. The PSA conducts the survey monthly and quarterly.

That's why you shouldn't just take the numbers reported at face value because statistics can be misleading. On the general charts, it just looks like a rise in percent of people employed and these are estimated to be millions from a survey sample. There are a lot of highlights mentioned in the labor force survey that made me speculate stuff about what is really happening:

On average, employed persons worked 41.1 hours per week. This was lower than the average hours worked in a week in July 2023 at 42.4 hours, but higher than the average hours worked in a week in April 2024 at 40.5 hours.

I think it's a combination of employers not incentivizing their employees to work more hours because they can't afford the adding the costs to wages and the recent wage rate hike.

The underemployment rate in July 2024 decreased to 12.1 percent, from 15.9 percent in July 2023 and 14.6 percent in April 2024.

Every year, the country produces more young graduates into the work force without enough jobs waiting for them so fresh graduates will just accept jobs they are overqualified in to survive. Yes, the trend shows that underemployment is decreasing and that's a good thing but not enough.

What contributed to the decrease in inflation? my guess is the increase of unemployed individuals who opted to tighten their wallets. Inflation rises because there is demand for goods and services, there's no shortage of people that are in demand for the same goods and services but there is a shortage of means to purchase these goods and services. While interest rate cuts in theory do help stimulate the economy, the effects can take months before it becomes noticeable. Businesses starting out or expanding will have to spend more on infrastructure before creating job openings.

If we breakdown the forces that drive the rise in GDP, it's the industrial, and financial services sector that contributes the most for the economy. And if you check the consumer credit graph, it supports the idea that people are taking in more debt and this keeps inflation up. The economy needs more people to spend money to keep it working and inflation, while not hitting the 2% and below target line, is fine as long as GDP remains higher. But the kicker is that people don't really feel any better than they were before covid-19 and it just got worse. The US already shows signs of impending recession as indicators like Sahm's rule were triggered. PH economy relies a lot on the Business Process Outsourcing industry and a lot of the accounts are from the US along with the remittances. If the US economy goes into a recession, the consequences to the PH economy will be felt as the US is one of the major countries PH exports its manufactured goods.

So screw GDP, it's not really reflecting the average person's woes. The economy didn't get any better even if the stats showed some recovery. Wealth inequality is rising, the middle class is shrinking, and I got a lot of ideas to unpack on the subject but that's it for now.

Thanks for your time.

Congratulations @adamada! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts:

Nominal GDP is nonsense by itself anyway. This is especially true for "larger economies" like the US that print money since "government spending" is part of that equation.

Pass a retarded $2T bill? GDP!

The average person (I don't claim to understand them all) cannot understand or be bothered to look at all the possible indicators and craft a picture. In the end, you have internet fights where people spew numbers without context.

I believe a lot of it is already priced in the market before the news ever comes out. For instance, if inflation year over year is comparing what's the rate 12 months ago and if last year was the known worst year for inflation in the country and things got better over the course of months leading to the latest report, it's a no brainer to see the number going down and economist will say things are better now compared to last year.

But the numbers may not be looking good month over month and showing it's progressively worsening, just not yet as bad as last year's record. It's really just how one words it in the news but traders already priced in their bets knowing how this linggo talk and that's my belief why the markets may not be reacting as expected because they already did way ahead.

Reports pushed out online hardly truthfully expresses all it's meant to.

In the case of GDP there's a huge load of estimations taken.

In my country...

There's hardly no middle class

The hike in the price of petrol amd foodstuffs is touching all classes, those with money are feeling the money going.. those without money are dead.... Or almost dead.

GDP means shit to me atm😂😂😂

Pretty much what is expected with hyperinflation. Some of these summarized reports don't really have value for some traders but they do for fiscal policies.

GDP is sadly such a poor metric for the health of an economy. It only signals the big companies who get the most subsidies and money from the government versus the working class propping them up. The stocks and things that factor into GDP are so heavily manipulated it’s insane. Sadly it’s one of the weapons that governments use to say everything is fine when in reality it’s a shit show.

These are the numbers that the government uses to flex on the public but for people in the know about investing, these don't really hold as much weight in real time since it lags and people already adjust the market prices on the next announcement. None of these feel good reports matter if the cost of living screws everyone.