Philippine Gold Reserves Dropped Q1

Just one of those posts where I babble about what I learned recently. I like reading news about macroeconomics in action as both leisure and a means to increase my financial smarts.

This post is inspired by this headline:

Gold Prices Dip Below $2500 as Markets Await Powell's Speech to Seek Clues on Fed Rate Cuts. Gold has been making all time highs since fears about an upcoming recession and can't really blame the speculations since indicators have been signaling it so:

Recession is closing in

— Game of Trades (@GameofTrades_) August 22, 2024

This won’t end well

Quick thread 🧵 pic.twitter.com/rpD5TOLCpP

Now I'm not really reliant the news as I treat the information as infused with opinions, politics, and speculations. Regardless of which platform this the news is published from, the source has an agenda so pick the source with the least amount of influence if possible. Do your own research and come up with your own conclusions.

source

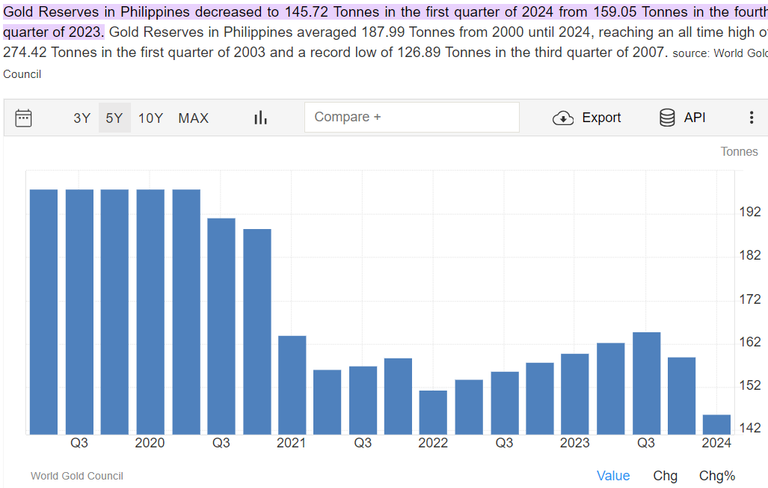

145.72 Tonnes report during the 1st quarter and just by eye balling at the graph, it shows you how much of that value dropped.

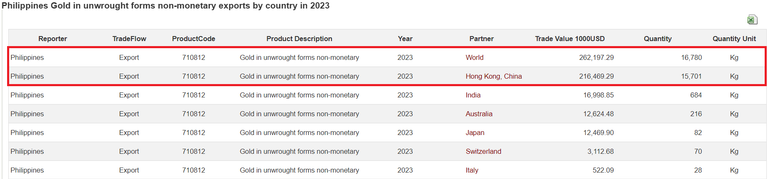

I didn't find any news regarding any major events about the sell off but I did find some pieces of the puzzle that might fit the picture from World Integrated Trade Solution report.

China has been buying up a lot of the gold and this maybe part of the efforts to steer away from the USD as the main reserve currency. Of course there are other countries that also buy gold from the Philippines but you can compare the trade value in USD. I said maybe as just my own educated guess here. The fact remains that according to the report, China bought up a lot of the shares since 2023.

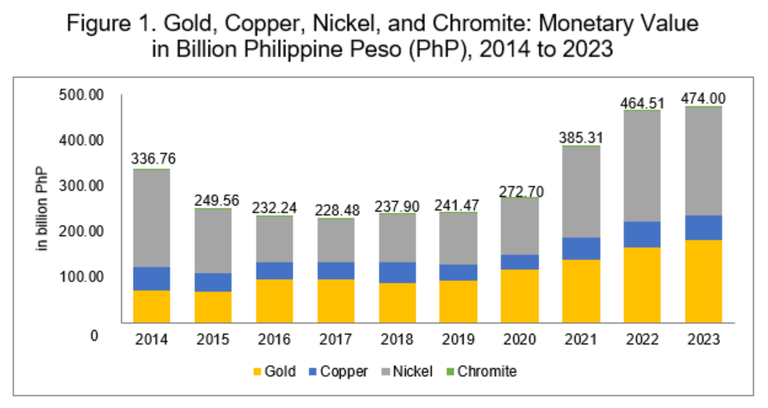

From the official Philippine Statistics Authority released last June 6. 2024.

The country’s stocks of Class A gold reserves declined to 401.70 thousand kilograms (kg) in 2023 or by 1.5 percent from 408.00 thousand kg in 2022. The production or extraction of gold, on the other hand, increased to 21.48 thousand kg in 2023 or by 0.4 percent from 21.40 thousand kg in 2022.

I didn't find this information as helpful as I initially thought since it only covers 2023 and below. I've already seen the estimated during the 1st quarter of the 2024 from Trading Economics and this piece of information is already near obsolete when trying to speculate what'll happen in the coming months especially speculations about Bangko Sentral ng Pilipinas (Philippine Central Bank) rate cuts.

While there is a drop in gold reserves, it's not like this country stopped mining operations to replenish its gold supplies. Philippines is still one of the top countries that trade gold.

I look at the information as part of my own self study watching theoretical economic concepts come into live action while at the same time play trade my way if I can practically use the information.

From my understand, since the 1st to 2nd quarter, the Philippine GDP rose while unemployment went down and inflation went up. BSP gave a rate cut of 0.25 to support economic growth recently and this signals a bullish momentum in the Philippine economy. But there's a catch, in the global market, the US economy is still that wild card that whatever happens to it sends ripples across other markets so if US recessions do happen, the impacts find their way into the PH stocks and recovery from the shocks have been slower than other ASEAN neighbors. How I arrived at the above conclusion came from other further readings which I encourage anyone to read up on further if they're interested.

Most of the data is already published out there on the internet and it only takes one inquisitive mind to ask the right questions to where to look. But institutional traders have the advantage of having insider information and a network to maximize their edge over the market.

A large gold reserve definitely adds some confidence that the Philippines can endure a recession because there are more asset backed to pay its debts and cushion the impacts of recession.

Thank you for your time.

Perhaps its simply profit taking? Golds bouncing around at all-time highs which cant go up forever. Perhaps its time liquidate and wait for the price to fall a little before buying back.

These huge numbers and trades on a national scale are simply mind blowing to me. I cant get my head around the vastness of the numbers or the fact, a bank account somewhere will have a transfer into it of billions of dollars. Selling a few hundred dollars of Hive and waiting to see it arrive in tact in my account stresses me out! Perhaps I need to develop a more natural abundant mindset lol

I hope you're well and wishing you a wonderful weekend :-)

That's possible too. China has been building up on their de dollarization plan with BRICS and they recently announced a gold backed currency so hoarding up some gold as a prerequisite makes sense.

Quite an interesting article.